The new year started off pretty quiet for us as we were still recovering from the flu over Christmas. But, by the end of the month, we were already back to something we love—travel! Read on for a taste of our winter escape to Barbados!

With 2024 in full bloom, we continued our donation tradition to one of three nonprofits that provide aid in Ukraine. You can read more about them and vote for your favorite in the poll below!

Each month, we track our income, spending, and savings to stay on our FIRE path and share it with you. Please keep reading to see our monthly updates, tips, and charity reviews.

Budget Update

If you’d like a more detailed description of our typical monthly cash flow (like our jobs or housing situation), check out our previous budget updates.

In the Sankey diagram below, the income on the left matches our expenses on the right.

We’ll run through the income and expense sources for the month and remark on any interesting items.

Income Summary

After months of travel in 2023 and a December that ended the year with a bang, January is looking downright sedate! Our $4.8K is rather typical of our longterm average.

Dividends

Chris earned a small dividend from an old individual stock he purchased and still retains many years ago. It was automatically reinvested.

We earned $241 in total distributions.

Credits

Several of our credit cards offer statement credits for purchasing with certain companies. Chris’s AMEX gold earned $10 back for Grubhub which he used on a local bakery pickup.

We received $10 in statement credits.

Interest Income

We thought it was worth mentioning our increasing interest earnings over the last several months. The $10-$20 cashback/month we’ve been earning via $2,500+ Laurel Road direct deposits has been building up in that account. It earns interest at about a 5% rate and so the income has started to become pretty noticeable. Not a bad place to stick your emergency fund and/or cash buffer for spending.

We earned $124 from interest.

Consulting

Chris has been earning around $470/month from his ongoing consulting business. In reality, this is slowly drawing down assets and funds within the business.

Consulting earned $462.

Local Sales

We routinely sell our old stuff around the house on via Facebook Marketplace, Craigslist, etc. This month, Chris sold two refurbished Dell laptops for $180/per. He originally purchased them with a 50% promo code and a $200 AMEX credit, so he made a nice little profit.

We earned $360 from local sales.

Cashback

Laurel Road no-fee checking accounts earn a $10 monthly bonus for making direct deposits of at least $2,500/month. Jenni also earned about $36 from Ibotta for groceries.

We earned $38 in cash back.

Expense Summary

From our $4,835 monthly budget, we saved and invested about $1,605.

After subtracting our credits and savings, we spent about $3,220 on living expenses.

That’s 67% of our FIRE budget from 2022 ($4,787/month).

Let’s break down some of the more exciting details.

Food & Dining

All-in-all, this category seems to be a bit below average.

Groceries

Our grocery spending came to about $288. We’ve been working through some older foodstuffs in our freezer and cabinets. This includes the first grocery trip we made in Barbados to stock up an Airbnb.

Check out one of our better grocery hauls posted to Instagram (it’s a huge difference from the yogurt prices in Barbados—another post on our Instagram account you can find):

Restaurants, Fast food, Alcohol & bars

Restaurants came to about $176. Our dining out expenses reflect Jenni’s wedding planning. As you might imagine, she’s been out trying on dresses, interviewing venues, and much more. That often means springing for a meal here or there with friends who are joining her. We’ll certainly see more of this in the coming months!

We spent $465 on food & dining this month.

Travel

Our trip to Barbados began on January 30. We’ll be back on February 9. We’re escaping the worst of Virginia’s winter—trading it for sun, ocean, and swimmable temperatures.

Air Travel

We flew American Airlines on a rewards redemption. Considering each roundtrip ticket would have been about $860, at just 22K AA miles/ticket, that’s an excellent deal! Our cash cost is for taxes and fees on the redemption which was about $131 per ticket.

Hotel

We spent the last two days of January in our first Airbnb on Barbados. The wonderfully plantation-like cottage ran about $128/night. The full kitchen let us cook for ourselves and focus on what we were there for: beautiful weather and a quiet beach together.

The short walk to the oceanfront, boardwalk, and plenty of stores nearby made for a lovely stay.

Additionally, Jenni spent a week with some girlfriends for some wedding planning and catching up. Her portion of the Airbnb cost was about $82.

Car Rental & Taxi

We opted for Uber to take us to and from our local airport for this trip. The dates happened to fall so that Chris could use his monthly $10 Uber credit from his AMEX twice. The $20 savings helped make Uber the better choice over paying to park for the trip duration.

In Barbados, we used local taxis to get to/from our stays. The run from Bridgetown’s airport to our first stay was the most expensive—$35 for a pretty short ride.

We spent $658 on travel this month.

We’ll have a complete summary cost of our Barbados trip in next month’s update!

Expense Conclusion

While that covers the big stuff, we still had a few random things small purchases to mention that might be of interest.

Health Insurance

It’s a new year and that means we went through ACA renewal for our insurance. Chris maintained his tax credits for the most part. Jenni’s changed a bit with some income adjustments. Overall, our cost is up about $40/month. The underlying coverage itself remains excellent with relatively low deductibles and copays.

Electronics & Software

As mentioned in the Local Sales income section, Chris purchased a pair of refurbished Dell laptops to use up his biannual $200 Dell credit before it expired. Stacked with a 50% off coupon, the two laptops cost him about $26 out of pocket. He then sold each locally for $180/per! Now that’s a great way to use a credit card benefit.

How Much We Work

We like to keep track of how much time we spend doing work that is paid.

Let’s add this month to the list…

| Month | Chris (Hours Worked) | Jenni (Hours Worked) |

|---|---|---|

| May 2020 | 41 | 108 |

| Jun 2020 | 38 | 96 |

| Jul 2020 | 36 | 120 |

| Aug 2020 | 39 | 48 |

| Sep 2020 | 27 | 76 |

| Oct 2020 | 26 | 104 |

| Nov 2020 | 27 | 57 |

| Dec 2020 | 28 | 57 |

| Jan 2021 | 25 | 102 |

| Feb 2021 | 24 | 104 |

| Mar 2021 | 24 | 106 |

| Apr 2021 | 23 | 85 |

| May 2021 | 17 | 29.75 |

| Jun 2021 | 19 | 66 |

| Jul 2021 | 21 | 30.25 |

| Aug 2021 | 23 | 16.5 |

| Sep 2021 | 26 | 28 |

| Oct 2021 | 22 | 49 |

| Nov 2021 | 21 | 51 |

| Dec 2021 | 64 | 27 |

| Jan 2022 | 32 | 80 |

| Feb 2022 | 29 | 63 |

| Mar 2022 | 14 | 70 |

| Apr 2022 | 15 | 21 |

| May 2022 | 14 | 36 |

| Jun 2022 | 6 | 12 |

| Jul 2022 | 13 | 45.5 |

| Aug 2022 | 15 | 96 |

| Sep 2022 | 12 | 54 |

| Oct 2022 | 14 | 34.5 |

| Nov 2022 | 12 | 72 |

| Dec 2022 | 11 | 16.5 |

| Jan 2023 | 10 | 88 |

| Feb 2023 | 11 | 81.5 |

| Mar 2023 | 12 | 47.5 |

| Apr 2023 | 8 | 1 |

| May 2023 | 16 | 100 |

| Jun 2023 | 10 | 109 |

| Jul 2023 | 12 | 48 |

| Aug 2023 | 16 | 54.5 |

| Sep 2023 | 9 | 20 |

| Oct 2023 | 14 | 22 |

| Nov 2023 | 15 | 22 |

| Dec 2023 | 16 | 12 |

| Jan 2024 | 12 | 61.25 |

Jenni worked a little more with the new year kicking off and supporting a coworker who was on paternity leave.

Net Worth Update

Net worth is not our primary measurement and can understand it can be discouraging if you’re working yourself out of debt. We also understand it’s difficult to be transparent with our readers without divulging this information so we continue to do so.

Account breakdown

The market keeps chugging along and so do our investments. From a high level, our assets and liabilities are shown in the data table below as of January 31, 2024.

| Description | Value (USD, $) |

|---|---|

| 401(k) | 868,740 |

| Brokerage | 810,692 |

| Roth IRA | 168,537 |

| Traditional IRA | 15,264 |

| HSA | 59,022 |

| Real Estate | 416,870 |

| Mortgage | (138,670) |

| Miscellaneous Assets | 46,642 |

| Checking & Savings | 49,172 |

| Net Worth | 2,296,269 |

- Miscellaneous assets include specific investments we’ve made in physical assets (think collectibles) and treasury bonds

- Amounts do not reflect the value of the businesses Chris owns or their assets, which should appear as income to us over future years

- Jenni’s Prius is omitted

The S&P 500 was up about 1.6% for the month.

We did just slightly worse for the month with a 1.5% gain.

Overall, our net worth increased by around $35K this month. This is also our highest recorded net worth.

Net Worth History

| Date | Amount | % Change |

|---|---|---|

| July 2020 | $1,555,289 | – |

| August 2020 | $1,597,334 | 2.7% |

| September 2020 | $1,566,393 | (2.0%) |

| October 2020 | $1,568,182 | 0.01% |

| November 2020 | $1,720,113 | 9.6% |

| December 2020 | $1,810,864 | 5.3% |

| January 2021 | $1,860,996 | 2.8% |

| February 2021 | $1,878,154 | 0.9% |

| March 2021 | $1,918,269 | 2.1% |

| April 2021 | $2,010,849 | 4.8% |

| May 2021 | $2,049,213 | 1.9% |

| June 2021 | $2,093,896 | 2.2% |

| July 2021 | $2,092,153 | (0.1%) |

| August 2021 | $2,130,761 | 1.8% |

| September 2021 | $2,070,730 | (2.8%) |

| October 2021 | $2,151,272 | 3.9% |

| November 2021 | $2,095,273 | (2.6%) |

| December 2021 | $2,160,235 | 3.1% |

| January 2022 | $2,055,292 | (4.9%) |

| February 2022 | $2,058,001 | 0.01% |

| March 2022 | $2,134,428 | 3.7% |

| April 2022 | $1,968,069 | (7.8%) |

| May 2022 | $1,975,569 | 0.04% |

| June 2022 | $1,868,397 | (5.4%) |

| July 2022 | $1,975,608 | 5.7% |

| August 2022 | $1,878,352 | (5.2%) |

| September 2022 | $1,735,997 | (7.6%) |

| October 2022 | $1,820,287 | 4.9% |

| November 2022 | $1,920,635 | 5.5% |

| December 2022 | $1,866,513 | (2.8%) |

| January 2023 | $1,953,691 | 4.7% |

| February 2023 | $1,882,656 | (3.6%) |

| March 2023 | $1,969,566 | 4.6% |

| April 2023 | $1,981,934 | 0.6% |

| May 2023 | $1,995,247 | 0.7% |

| June 2023 | $2,092,479 | 4.9% |

| July 2023 | $2,189,821 | 4.7% |

| August 2023 | $2,140,296 | (2.2%) |

| September 2023 | $2,042,865 | (4.6%) |

| October 2023 | $2,015,648 | (1.3%) |

| November 2023 | $2,157,404 | 7.0% |

| December 2023 | $2,261,458 | 4.8% |

| January 2024 | $2,296,269 | 1.5% |

Previous Donation Winner

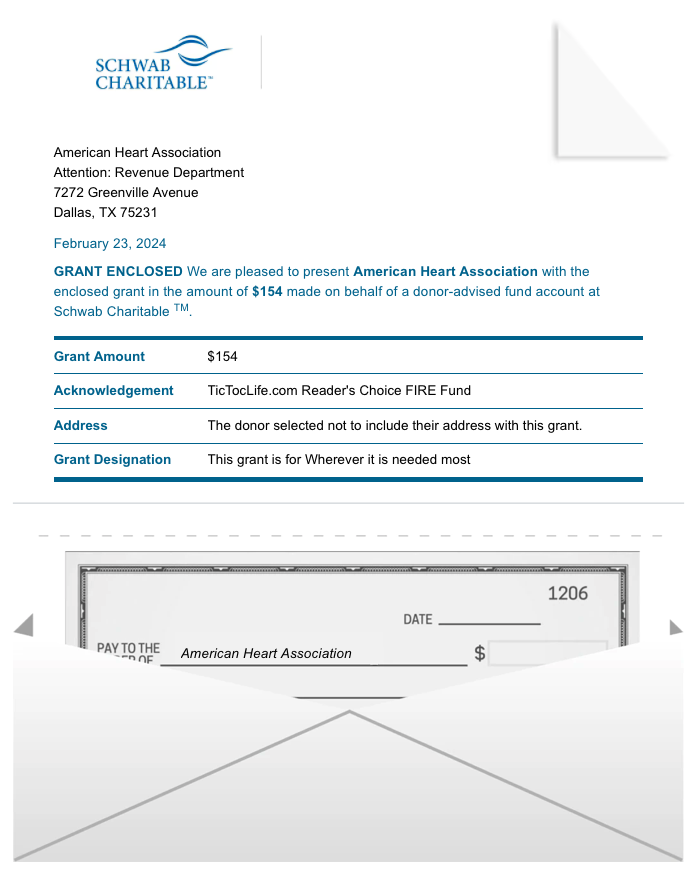

Congratulations to the American Heart Association, as this month’s poll winner. This organization helps increase awareness for heart disease and strokes through research and education.

Our Reader’s Fund seeks to leverage the principles of FIRE to build a lifetime of giving.

Thank you for your participation in our polls over the last 42 months. We’ve given $5,000 to deserving charities with your help in deciding which organizations to donate to.

Polls are now open for our next round of candidates: Aid for Ukraine.

Charity Round-Up

As we surpass the two year anniversary of Russia’s invasion into Ukraine, we are again looking for ways to support the tremendous needs of the Ukrainian people. From the daily essentials, such as warm shelter, food and water, to life saving and rescue missions, these organizations continue to provide ongoing support in Ukraine.

These three organizations have excellent charity ratings to ensure our donation will have the most significant impact. We invite you to learn more about them and join us in donating to one of them by casting your vote.

Summaries below include the impact metrics and a link to their Guidestar profile which details the nonprofit’s operations and transparency.

1) ActionAid USA

Why? Sometimes emergencies can bring out the best in a person but can also bring out the worst, specifically, gender-based violence. Communities are weakened during conflicts and disasters, making it hard to protect women and girls. A focus of this organization is to implement measures to protect the most vulnerable from the short term and long term effects of these actions.

Where? Africa, Asia, Europe, South America, and North America.

Our Notes: ActionAid USA is a nonprofit organization that helps to end poverty, exclusion, and gender inequality. Their ongoing efforts in Ukraine include emergency support and protection for refugees, providing safe spaces and psychological support for women and children facing violence and exploitation, and working with local organizations offering humanitarian relief. They have a strong focus on strengthening the leadership of women and preventing gender-based violence.

2) World Vision

Why? The uncertainty of where your next meal will come from is frightening enough to a young person. But imagine also having the uncertainty of whether or not the building will even be there in the morning. Many children in Ukraine have to wake up every day living in fear. This organization is one that is helping to provide what these kids need now and for their future.

Where? Africa, The United States, Europe, Asia, and South America.

Our Notes: World Vision is a global Christian humanitarian organization. Their efforts in Ukraine help deliver essential items, meals, and shelter assistance to children and their families. They working to address the long term psychosocial and emotional impacts may have on those living amongst of the violence of the Ukraine Crisis.

3) American Jewish Joint Distribution Committee

Why? Ukraine is home to the fourth largest Jewish community in Europe. With such a concentrated population, the need for humanitarian aid, disaster relief and relocation support is high.

Where? Israel, Argentina, Ethiopia, North America, Nepal, Turkey, India, Ukraine, Haiti, Ecuador, Philippines, Russia, and Hungary.

Our Notes: American Jewish Joint Distribution Committee is a nonprofit charity that provides to relief to the most vulnerable citizens of the world, both Jewish and non-Jewish. Their disaster relief efforts in Ukraine have provided medical support, temporary housing during the harsh winters, and financial help for heating bills and cooking stoves. They also assist with medical evacuations for those to injured to travel in a regular vehicle.

Nonprofit poll

After reviewing the list above, please take a moment to vote for which nonprofit you think will put funds to use in the best way.

(Have trouble using or seeing the poll above? Some reader tools or apps may not display it. View this page in a browser or use this link to our Reader Fund page which has a copy of the poll!)

Thank you for taking the time to vote!

One of our primary goals with TicTocLife is building a stream of giving within the FIRE community and that starts with knowledge.

Want to hear about the results? Sign up for our free FIRE Insider newsletter! We send it out every few weeks and include the monthly poll results and donation winners. You can see an archive of the FIRE Insider and sign up here!

What’s Next

With the new year in full swing, we’re looking ahead to our plans over the year. Our big task is planning our wedding—and we’re shooting for mid-May! We’re both very excited, but there’s lots of planning to complete.

More immediately, we’ll finish up our winter escape in Barbados. Our peaceful respite from the cold has already been wonderful. We’ll explore more of the island and learn some of the history.

Stay tuned to see how the trip expenses stack up and see how we put together a FIRE wedding!

How has 2024 started for you and your finances?

Let us know in the comments or on Threads and X (Twitter)!

One reply on “Barbados & Wedding Planning Begins (Jan. 2024 Update)”

Great update, thanks guys! And congratulations on your upcoming wedding, lots of exciting things to plan!