With spring in the air, we spent most of the month at home enjoying the weather, blooms, and our friends & family. We had an easy month of tax prep, some home projects, and plenty of fun. It’s amazing what you can get done while everyone else is at work! 🙂

With a new appreciation for the world in bloom as March was out like a lamb, we’re thinking how we can help our lovely world. We’re continuing our donation tradition by supporting one of three Earth conservation nonprofits this month. You can read more about them and vote for your favorite in the poll below!

Each month, we track our income, spending, and savings to stay on our FIRE path and share it with you. Please keep reading to see our monthly updates, tips, and charity reviews.

Budget Update

If you’d like a more detailed description of our typical monthly cash flow (like our jobs or housing situation), check out our previous budget updates.

In the Sankey diagram below, the income on the left matches our expenses on the right.

We’ll run through the income and expense sources for the month and remark on any interesting items.

Income Summary

With March and the first quarter of 2024 closed, spring is here! Jenni’s paycheck saw a huge bump, reflecting her increased pharmacy work lately.

Aside from our usual monthly income, here are some interesting anecdotes:

Dividends

We earned a nice dose of quarterly dividends! We anticipate significant dividend payments from our various stock holdings—most of it from Vanguard funds like VTSAX. More than half of our distributions were automatically reinvested in our tax-advantaged accounts.

We earned $3,533 in total distributions.

Accountable Plan

If you’re interested in the details of how an accountable plan for businesses works, check out this original post.

Chris’s business reimbursed him for the use of our house, utilities, health insurance, and other expenses. This reimbursement covers expenses for the first quarter of 2024.

Chris received $1,158 in reimbursements.

Credits

Several of our credit cards offer statement credits for purchasing with certain companies.

- Chris’s AMEX gold earned $10 back for Grubhub which he used on a local bakery pickup.

- Our Chase cards offer a quarterly credit $10-15 to use with Instacart, we use it on pickup grocery orders.

- We used multiple Chase Offer on Kroger Gift Cards that earned $22.50.

We received $107.50 in statement credits.

Consulting

Chris has been earning around $154/month from his ongoing consulting business. This marks a noticeable change in his income as his responsibilities decrease and the business assets dissipate.

Consulting earned $154.

Cashback

- Laurel Road no-fee checking accounts earn a $10 monthly bonus for making direct deposits of at least $2,500/month—we have two accounts.

- Chris cashed out his RetailMeNot balance (just over $60!).

We earned $80.85 in cash back.

Expense Summary

From our $9,672 monthly budget, we saved and invested about $6,312.

After subtracting our credits and savings, we spent about $3,253 on living expenses.

That’s 68% of our FIRE budget from 2022 ($4,787/month).

Let’s break down some of the more exciting details.

Food & Dining

All-in-all, this category continues to be a bit below average.

Groceries

Our grocery spending came to about $450. A big chunk of our expense was 11 pounds of whey protein isolate. That was about $83! It’ll last us a while, though. As we’re mostly vegetarian, we try to ensure we’re still consuming healthy levels of protein as active folks.

Restaurants, Fast food, Alcohol & bars

Restaurants and fast food came to about $183. This comes almost entirely from a few little restaurant adventures we took in search of catering sources for our wedding. We sampled a few dishes from two different local venues and took friends out to help us.

We spent $633 on food & dining this month.

Health & Fitness

This category saw an abnormal bump in costs this month.

Health & Dental Insurance

Our spending ($171) is inline on insurance this month. As a mini-update: we’re both continuing on Marketplace (ACA) health insurance plans. Because of our low income, we automatically receive lower rates for pretty good coverage levels. The one big downside is that coverage is regional—if we wind up sick out on the west coast for anything but a genuine emergency, it’ll cost us a pretty penny out of pocket. We pay full price for our dental insurance.

Sports

One of our larger expenses in this category, Sports. Chris refilled his punch pass at our local climbing gym. He bought two five punch passes since there was a promo this month where each set earned one free additional punch. So, 12 for the cost of 10 basically. That’s a little under $16 per rock climbing gym visit, which isn’t too bad!

Doctor

One health-related insurance type we don’t carry is vision. Jenni had a full vision exam and test. We try to do this every other year and price just keeps increasing—about $260 this time!—but the care is quite good.

We spent $621 on health & fitness this month.

Expense Conclusion

While that covers the big stuff, we still had a few random things small purchases to mention that might be of interest.

Home Improvement

The $55 or so we spent in this category went to some simple tools and supplies to refurbish a few furniture pieces. Jenni stripped and sprayed a black coat of paint on our patio furniture.

Next, she did the same with a small end table in our first floor bathroom—but finished it with brushed on white. Both came out great!

![This little [now white] table just barely fits in our first floor powder room. The white paint matches well, though!](https://www.tictoclife.com/wp-content/uploads/2024/04/ttl-bathroom-paint-side-table-white.jpg)

Furnishings

One of our hobbies is building with LEGO bricks. We like building sets, of course, but want to get more into making our own scenes and projects. To that extent, we purchased three multi-drawer storage containers to sort our bricks and pieces out. Total cost was about $82 after a $15 Target coupon. Hopefully we’ll more readily “play”!

Amusement

With a friend visiting, we did a virtual scavenger hunt around our city. For $49, an app directed us around various historical and cultural locations. At each stop, we were given a little puzzle involving the physical world around us. Once solved, we were lead to the next location. It was worth the price and we had fun, though a bit costly when looked at simply as an app.

We also went out with friends to a local putt putt place, but with a pretty wild spin to it. It was setup inside a historic building and decorated as if it was an old hotel. Lots of Art Deco and hidden gems throughout. We had a lot of fun! $72 purchased tickets and a sampler platter of food.

How Much We Work

We like to keep track of how much time we spend doing work that is paid.

Let’s add this month to the list…

| Month | Chris (Hours Worked) | Jenni (Hours Worked) |

|---|---|---|

| May 2020 | 41 | 108 |

| Jun 2020 | 38 | 96 |

| Jul 2020 | 36 | 120 |

| Aug 2020 | 39 | 48 |

| Sep 2020 | 27 | 76 |

| Oct 2020 | 26 | 104 |

| Nov 2020 | 27 | 57 |

| Dec 2020 | 28 | 57 |

| Jan 2021 | 25 | 102 |

| Feb 2021 | 24 | 104 |

| Mar 2021 | 24 | 106 |

| Apr 2021 | 23 | 85 |

| May 2021 | 17 | 29.75 |

| Jun 2021 | 19 | 66 |

| Jul 2021 | 21 | 30.25 |

| Aug 2021 | 23 | 16.5 |

| Sep 2021 | 26 | 28 |

| Oct 2021 | 22 | 49 |

| Nov 2021 | 21 | 51 |

| Dec 2021 | 64 | 27 |

| Jan 2022 | 32 | 80 |

| Feb 2022 | 29 | 63 |

| Mar 2022 | 14 | 70 |

| Apr 2022 | 15 | 21 |

| May 2022 | 14 | 36 |

| Jun 2022 | 6 | 12 |

| Jul 2022 | 13 | 45.5 |

| Aug 2022 | 15 | 96 |

| Sep 2022 | 12 | 54 |

| Oct 2022 | 14 | 34.5 |

| Nov 2022 | 12 | 72 |

| Dec 2022 | 11 | 16.5 |

| Jan 2023 | 10 | 88 |

| Feb 2023 | 11 | 81.5 |

| Mar 2023 | 12 | 47.5 |

| Apr 2023 | 8 | 1 |

| May 2023 | 16 | 100 |

| Jun 2023 | 10 | 109 |

| Jul 2023 | 12 | 48 |

| Aug 2023 | 16 | 54.5 |

| Sep 2023 | 9 | 20 |

| Oct 2023 | 14 | 22 |

| Nov 2023 | 15 | 22 |

| Dec 2023 | 16 | 12 |

| Jan 2024 | 12 | 61.25 |

| Feb 2024 | 14 | 28.5 |

| Mar 2024 | 16 | 61.5 |

Jenni worked a good bit more this past month. She was busy covering vacations, sickness, and needed to be present for accreditation at the pharmacy.

Net Worth Update

Net worth is not our primary measurement and can understand it can be discouraging if you’re working yourself out of debt. We also understand it’s difficult to be transparent with our readers without divulging this information so we continue to do so.

Account breakdown

The market keeps chugging along and so do our investments. From a high level, our assets and liabilities are shown in the data table below as of March 31, 2024.

| Description | Value (USD, $) |

|---|---|

| 401(k) | 942,070 |

| Brokerage | 845,691 |

| Roth IRA | 178,678 |

| Traditional IRA | 15,943 |

| HSA | 60,852 |

| Real Estate | 430,200 |

| Mortgage | (137,832) |

| Miscellaneous Assets | 51,642 |

| Checking & Savings | 47,425 |

| Net Worth | 2,434,250 |

- Miscellaneous assets include specific investments we’ve made in physical assets (think collectibles) and treasury bonds

- Amounts do not reflect the value of the businesses Chris owns or their assets, which should appear as income to us over future years

- Jenni’s Prius is omitted

The S&P 500 was up about 3.1% for the month.

We did about the same for the month with a 2.9% gain.

Overall, our net worth increased by around $69K this month (again!). This is also our highest recorded net worth.

Net Worth History

| Date | Amount | % Change |

|---|---|---|

| July 2020 | $1,555,289 | – |

| August 2020 | $1,597,334 | 2.7% |

| September 2020 | $1,566,393 | (2.0%) |

| October 2020 | $1,568,182 | 0.01% |

| November 2020 | $1,720,113 | 9.6% |

| December 2020 | $1,810,864 | 5.3% |

| January 2021 | $1,860,996 | 2.8% |

| February 2021 | $1,878,154 | 0.9% |

| March 2021 | $1,918,269 | 2.1% |

| April 2021 | $2,010,849 | 4.8% |

| May 2021 | $2,049,213 | 1.9% |

| June 2021 | $2,093,896 | 2.2% |

| July 2021 | $2,092,153 | (0.1%) |

| August 2021 | $2,130,761 | 1.8% |

| September 2021 | $2,070,730 | (2.8%) |

| October 2021 | $2,151,272 | 3.9% |

| November 2021 | $2,095,273 | (2.6%) |

| December 2021 | $2,160,235 | 3.1% |

| January 2022 | $2,055,292 | (4.9%) |

| February 2022 | $2,058,001 | 0.01% |

| March 2022 | $2,134,428 | 3.7% |

| April 2022 | $1,968,069 | (7.8%) |

| May 2022 | $1,975,569 | 0.04% |

| June 2022 | $1,868,397 | (5.4%) |

| July 2022 | $1,975,608 | 5.7% |

| August 2022 | $1,878,352 | (5.2%) |

| September 2022 | $1,735,997 | (7.6%) |

| October 2022 | $1,820,287 | 4.9% |

| November 2022 | $1,920,635 | 5.5% |

| December 2022 | $1,866,513 | (2.8%) |

| January 2023 | $1,953,691 | 4.7% |

| February 2023 | $1,882,656 | (3.6%) |

| March 2023 | $1,969,566 | 4.6% |

| April 2023 | $1,981,934 | 0.6% |

| May 2023 | $1,995,247 | 0.7% |

| June 2023 | $2,092,479 | 4.9% |

| July 2023 | $2,189,821 | 4.7% |

| August 2023 | $2,140,296 | (2.2%) |

| September 2023 | $2,042,865 | (4.6%) |

| October 2023 | $2,015,648 | (1.3%) |

| November 2023 | $2,157,404 | 7.0% |

| December 2023 | $2,261,458 | 4.8% |

| January 2024 | $2,296,269 | 1.5% |

| February 2024 | $2,365,110 | 3.0% |

| March 2024 | $2,434,250 | 2.9% |

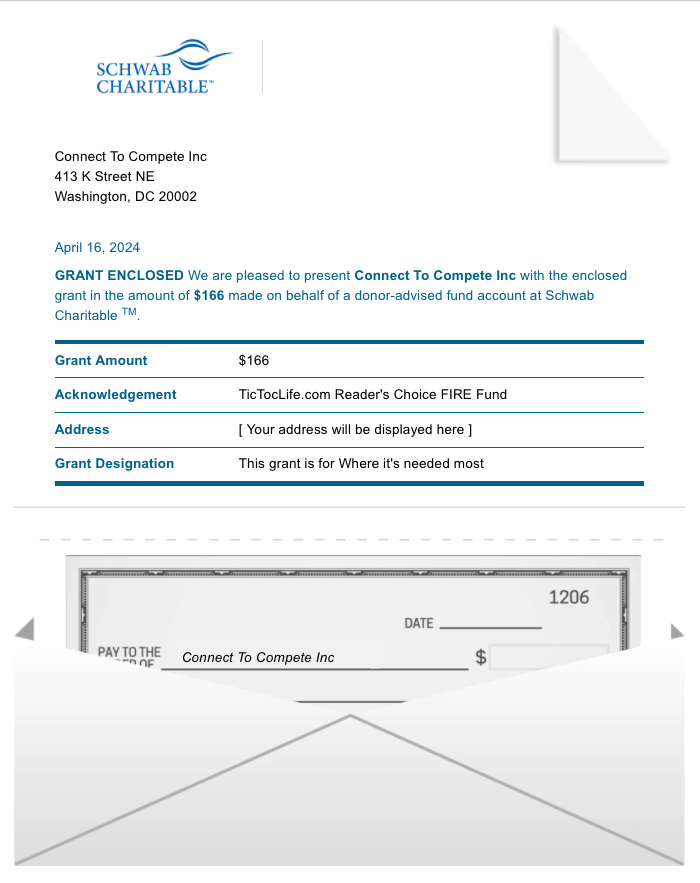

Previous Donation Winner

Congratulations to Connect to Compete Inc./EveryoneOn, as this month’s poll winner. The knowledge obtained from access to the internet can change lives and empower people to make a difference in themselves and the world.

Our Reader’s Fund seeks to leverage the principles of FIRE to build a lifetime of giving.

Thank you for your participation in our polls over the last 44 months. We’ve given over $5,500 to deserving charities with your help in deciding which organizations to donate to.

Polls are now open for our next round of candidates: Earth Conservation charities.

Charity Round-Up

April is a month we dedicate to celebrating our Earth and all of its beauty. It is our one and only home and we must protect it. In honor, we have chosen organizations whose mission is to reduce the impact we have on Earth. We encourage you to do the same this month.

These three charities work to preserve the beauty of our planet and minimize our carbon footprint. They have great charity ratings to ensure our donation will have the most significant impact. We invite you to learn more about them and join us in donating to one of them by casting your vote.

Summaries below include the impact metrics and a link to their Guidestar profile which details the nonprofit’s operations and transparency.

1) Sierra Club Foundation

Why? Speaking up against climate change can make a difference. Through the Beyond Coal campaign, over 300 coal plants were closed making an impact on reducing green house gases as well as improving the health and safety of the coal workers.

Where? The United States

Our Notes: Sierra Club Foundation is a nonprofit organization that helps to preserve our environments, protect our natural areas, and decrease our carbon footprint. They’ve invested millions in environmental projects worldwide to discourage the use of fossil fuels, preserve ecosystems, and restore the biodiversity of endangered plants and animals.

2) Coral Reef Alliance

Why? Our beautiful and protective coral reefs are dying. Global warming causes bleaching of our coral reefs by stressing the coral to expel their algae inhabitants. This leaves the coral white and fragile, usually leading to death of the reef. When reefs die, we loose their natural buffer to our shores protecting from floods and storms. Thousands of species of fish and marine life loose their homes as well.

Where? Hawaii, Fiji, Indonesia, Belize, Guatemala, Honduras, Philippines, and Mexico.

Our Notes: Coral Reef Alliance is a nonprofit foundation that studies the health of coral reefs to learn how to help reefs adapt to climate change. They fight for clean water and over fishing regulations. They have 30 years of coral conservation experience reducing the direct threats to reefs and promoting effective solutions for their protection.

3) Neighborhood Forest

Why? Kids across the country get free trees! With the help of volunteers 67,000 trees are shipped to schools, libraries, and youth groups to engage children in Earth Day.

Where? The United States and Canada.

Our Notes: Neighborhood Forest is a nonprofit organization that partners with youth organizations to get free saplings to children in urban areas. Children get to learn about the importance of planting trees and ways to reduce their carbon footprint. It’s a simple yet effective way to engage youth on Earth Day.

Nonprofit poll

After reviewing the list above, please take a moment to vote for which nonprofit you think will put funds to use in the best way.

4/17 Update: Sorry! We didn’t have the poll properly published, it’s fixed and ready for your votes now!

(Have trouble using or seeing the poll above? Some reader tools or apps may not display it. View this page in a browser or use this link to our Reader Fund page which has a copy of the poll!)

Thank you for taking the time to vote!

One of our primary goals with TicTocLife is building a stream of giving within the FIRE community and that starts with knowledge.

Want to hear about the results? Sign up for our free FIRE Insider newsletter! We send it out every few weeks and include the monthly poll results and donation winners. You can see an archive of the FIRE Insider and sign up here!

What’s Next

After kicking off spring with a light March, we’re expecting April to start ramping up our late spring plans, wedding prep, and big birthday prep. We’re each turning 40 pretty soon! We also have a 10k foot race in April—and plenty of training to do!

Chris is also attempting to get a post together on his inflation bond experience, our transition from Intuit’s Mint budgeting app to a different tool, and our annual FIRE budget post for 2023. Phew!

Stayed tuned, we’ve got a lot coming!

How’d the first quarter of 2024 close for you? Big spring plans ahead?

Let us know in the comments or on Threads and X (Twitter)!

2 replies on “In Like a Lion (Mar. 2024 Update)”

Very interesting that you only made $154 from your small business (sole proprietorship or LLC?) for the month yet you can get back $1,158 in reimbursements. I wonder how that works. That’s a great deal!

Given that you have a regional health insurance plan, do you buy travel insurance when you travel domestically or internationally? If so, any recommendations?

Why don’t you buy a separate vision insurance policy?

As always, enjoy reading your monthly summaries (and feedbacks)!!

Hey TK!

Appreciate your insightful comments, as always! 🙂

For more info on the accountable plan/business reimbursements, you can checkout the brief overview I wrote the first time it was mentioned. Basically, it’s reimbursements for a proportional cost of a home office and some other small expenses the businesses cover. This month’s reimbursement was for the whole first quarter, so divide by three to get a monthly reimbursement amount.

But more to your point, yes, my business assets continue to wind down and so my pay continues to decrease. It’s nice to have control over my W2 income as both an employee and owner in order to be as tax efficient as possible. By the way, both business are LLCs taxed as S Corps. One owns the other. I own 100% of the top level business.

We wrote up a good bit about the travel insurance we carry a while ago, too! You’ll see our breakdown in this post under the “travel insurance” section. Our coverage is through Nationwide. We’ve not had to use this insurance, but have been happy with the service and fee rates relative to the expected reimbursements.

For vision, when we ran the numbers, it made more sense to “self insure” (basically just pay out of pocket). Glasses are dirt cheap through Zenni or Goggles4u, so our only real expense has been an eye exam for each of us every other year.

Again, thanks for coming by!