With summer in full swing, we escaped Virginia’s toasty temps with a trip to Northern Europe! Biking along The Netherlands’ “Waterland” with a short jaunt over to Copenhagen sure took the sting out of high temps for us. Read on to see our trip budget breakdown and some frugal travel tips.

Of course, we also celebrated Independence Day with traditional American booms:

For our monthly donation, our theme is back to school nonprofits. You can read more about them and vote for your favorite in the poll below!

We track our monthly income, spending, and savings to stay on our FIRE path and share it with you. Please keep reading to see our monthly updates, tips, and charity reviews.

Budget Update

In the Sankey diagram below, the income on the left matches our expenses on the right.

We’ll run through the income and expense sources for the month and remark on any interesting items.

Income Summary

Our part-time work isn’t covering much of our expenses these days. Instead, we earned a big cash back bonus, brought in some miscellaneous income, and moved some cash out of checking to keep us afloat.

Aside from our usual monthly income, here are some interesting anecdotes:

Credits

Several of our credit cards offer statement credits for purchasing with certain companies. This month we used:

- Our Chase cards earn back $10/15 per quarter from Instacart which we use on local grocery pickups. Total: $75. Last month of this benefit!

- Chris’s AMEX Gold offers a $10 dining credit which he uses on grocery pick up.

- Chris’s AMEX Platinum offered a CLEAR credit ($189 value) which he used because it also came with a $100 travel voucher (which we used for our Europe trip this month) briefly. He also canceled this card this month!

- Chris’s Chase card offered a $15 credit when spending $100+ on utilities—we just overpaid our bill.

- Both of us racked up Doordash gift cards—to be used on grocery pick up—to earn $10 Chase credits per $25 gift card. Total: $50 ($125 in GCs).

We received $250 in statement credits.

eBay

We sold a few small things around the house for tiny earnings, but the real winner this month for us was… a keyboard! You read that right, a regular old computer keyboard. This particular keyboard was in Chris’ office supply, still sealed, from over a decade ago. It’s no longer made and has a very strong fanbase. Chris sold it on eBay for over $300! WOW.

It’s the “Microsoft Natural Ergonomic 4000 Keyboard” if you have one floating around yourself!

We earned $294 from eBay after fees and costs.

Cashback

We use various online referral platforms, bonuses, etc. to earn cashback on purchases on certain activities. Some of our favorites are Rakuten and Swagbucks.

- Chris earned $30 from a few Bank of America cash back deals (groceries and other typical purchases)

- In a complicated process involving a partially refunded flight, Chris managed to cash out a large number of credit card rewards we’ve built up at a higher than 1:1 rate. In total, we received a $2,642 check! This drained a lot of our points.

We earned $2,672 in cashback.

Local Sales

We’re still finding occasional success upgrading our old gear or selling off household items via our local Facebook Marketplace/Craigslist.

- Jenni sold her 2x LCD monitors and desk mount for them from her previous computer for $95.

- Jenni sold her Apple Watch Series 5 for $90 (and upgraded to a Series 6 for $80!).

We earned $185 from local sales.

Expense Summary

From our $5,536 monthly budget, we saved and invested about $294.

After subtracting our credits and savings—we spent about $4,372 on living expenses.

That’s 91% of our FIRE budget from 2022 ($4,787/month).

Most of our spending came with our trip to Europe this month. But, we still had fun at home—for example, we saw a local performance of “9 to 5: The Musical”. It can’t be all travel aboard—we still love home!

Let’s break down some of the more exciting details.

Food & Dining

Food saw a bump in costs this month primarily due to recent grocery expenses being a bit low—we had some restocking we needed to do.

Groceries

At $490, our grocery spending this month took a little breather from the recent rise. We’d have seen a larger drop if not for more convenience foods while traveling.

Restaurants, Fast food, Alcohol & bars

Dining out was up for us while we were traveling. Minus a few bucks, nearly all of our restaurants ($230), fast food ($58), and bar tabs ($24) were spent while in The Netherlands and Denmark.

Here is a small sample of the tasty treats we had, starting with the Danish open-faced sandwich “Smørrebrød”:

We spent $802 on food & dining this month.

Utilities

We’ve got a few funny things happening here that are worth mentioning aside from our high summer-AC-induced electric bill:

- Our home internet is now just $10/month with Xfinity—we downgraded from 300Mbit to 50Mbit.

- We put a $100 deposit on our city utility account (gas, water) on a credit card that earned a $15 credit for $100+ on utility spending; the city charged us a small $2 fee to do so—we’ll drain the balance over the next 4 months.

- We’re now both on Tello cell service after Jenni switched ($10/month, 5GB) from Mint; Chris’s $6/month 2GB plan is free for the next few months due to referral bonuses! Thanks for signing up, readers!

We spent $180 on bills & utilities this month.

Shopping

Just one shopping (electronics & software) item to highlight: keep an eye on your gadgets and timing upgrades! If you can find a good deal on a minor upgrade, it can make sense to offload an older gadget before it’s obsolete.

Case in point: Jenni had a Series 5 Apple Watch that still worked great, but it won’t get the latest Watch OS update this fall. She found a Series 6—which will be supported—from a local seller for $80, a great deal. She grabbed it, transferred it from her old one, cleaned it up, then sold it locally for $90. A small $10 profit and an upgrade!

It helps to be able to snap up good deals when they appear as a FIRE person with a flexible schedule!

The remaining balance of our shopping spending was for some summer clothes for Jenni.

We spent $131 on shopping this month.

The Netherlands & Denmark Travel Summary

We took an 11-day trip to Europe’s Netherlands and Denmark from July 9 to 19. It was intended as a lovely little break from Virginia’s summer and something of a honeymoon. We had a great time! Let’s break down our trip budget.

We’ll include all expenses we incurred for the trip—even groceries, restaurants, and amusement. But we’ll skip expenses that we incurred during the trip that were not part of the trip (for example, our utility bill back home in Virginia).

Trip cost table

Let’s take a look at our total trip cost. In the table below, you’ll find four columns:

- Description: a summary of what the expense was for. We’ve included some basic geographical information for things like flights or hotels.

- Cost: our incurred expense in US dollars for the described line item. In some cases, this appears as zero. If a travel currency like hotel points, airline miles, or a credit card reward certificate covers the total expense, we record a zero here. Sometimes, there’s a minor fee in addition to using points/miles for surcharges or taxes.

- Rewards Pts/Miles: we maximize our credit card rewards and frequent traveler currencies to cover the costs of our travel wherever possible. You’ll see a short description of the type of certificate or currency that we used.

- Estimated Value: when using a reward from the previous column to cover an expense, we record what we would have otherwise paid for the line item. This gives us a sense of our savings.

The table is generally in chronological order.

We still incurred expenses at home (mortgage, utilities, etc.)—but these do not appear as part of our trip costs.

| Description | Cost (USD, $) | Rewards Pts/Miles | Est. Value (USD, $) |

|---|---|---|---|

| Flight—IAD→AMS (2x, Economy) | 160.10 | 27,205 AMEX MR | 744.00 |

| Hotel: Waterland B&Bs—4 nights | 565.37 | ||

| Hotel: Rotterdam Hilton, Executive Club; 1 night | 146.23 | ||

| Hotel: The Hague/Parliament Suite—IHG free night certificates (2x) (annual fees) | 148.00 | ||

| Hotel: Copenhagen 2 nights | 332.11 | ||

| Alcohol & bars | 24.01 | ||

| Dining: restaurants, fast food, coffee shops | 232.01 | ||

| Groceries | 95.98 | ||

| Amusement: Stoomtram, Steamboat, Museums | 124.68 | ||

| Public Transport | 89.26 | ||

| Air Travel—Chase Ink Preferred (annual fee) | 95.00 | ||

| Flight—AMS→CPH (2x, Basic Economy) | 281.99 | ||

| Flight—CPH→IAD (2x, Economy) | 160.10 | 30,283 AMEX MR | 616.00 |

| Total | 2,454.84 | 57,488 AMEX MR | 1,360.00 |

Trip cost discussion

Phew! Certainly one of our more costly trips recently. But, that’s to be expected during high season in one of the more costly areas of Europe. Overall, we think it’s less than we expected.

A significant chunk of our costs went to boarding across the nine nights. $1,192 or $132/night on average. That’s despite knocking out the two most expensive nights—across from Parliament at The Hague in a Presidential Suite—with hotel certificates. We applied the credit card costs we received those certificates from as part of our hotel cost ($148 for 2x). The alternative cash rate for our room was about $500/night!

Here’s a little sampling of our rooms if you’re curious about what this cost buys. B&Bs in Waterland:

Rotterdam’s Hilton (Executive Club upgrade):

And our upgraded suite across from Parliament in The Hague:

A few small tactics helped keep our costs from spiraling on this trip:

- Breakfast was included in nearly all of our stays—several of them B&Bs with hearty starts to the day

- We rented bikes and trekked between B&Bs in Waterland which also acted as our local transit—instead of a car rental

We flew using credit card points to cover the majority of the flight cost for both of us. That said, we still had about $697 in flight costs. A majority, $320, was for taxes/fees on the reward flights. Another $282 chunk was to fly between Amsterdam and Copenhagen. Lastly, we attributed a $95 credit card annual fee as a flight cost since we use the points from that card for flights.

It certainly didn’t hurt to get that Presidential Suite upgrade in The Hague for free (honeymoon bonus!) and an upgrade in Copenhagen to include a rooftop steam sauna.

Summary—

For an 11-day, 9-hotel night trip, we spent $2,455. That’s about $112/person per day. We used credit card points to avoid the $1,360 flight cost—although, as mentioned above, these aren’t always “free”!

ⓘ Are you curious about some of the other expenses that we didn’t address? We’ve written about every expense in this month’s diagram either in this post or in the past. Check out our previous budget updates for more detail or ask in the comments below!

How Much We Work

We like to keep track of how much time we spend doing work that is paid.

Let’s add this month to the list…

| Month | Chris (Hours Worked) | Jenni (Hours Worked) |

|---|---|---|

| May 2020 | 41 | 108 |

| Jun 2020 | 38 | 96 |

| Jul 2020 | 36 | 120 |

| Aug 2020 | 39 | 48 |

| Sep 2020 | 27 | 76 |

| Oct 2020 | 26 | 104 |

| Nov 2020 | 27 | 57 |

| Dec 2020 | 28 | 57 |

| Jan 2021 | 25 | 102 |

| Feb 2021 | 24 | 104 |

| Mar 2021 | 24 | 106 |

| Apr 2021 | 23 | 85 |

| May 2021 | 17 | 29.75 |

| Jun 2021 | 19 | 66 |

| Jul 2021 | 21 | 30.25 |

| Aug 2021 | 23 | 16.5 |

| Sep 2021 | 26 | 28 |

| Oct 2021 | 22 | 49 |

| Nov 2021 | 21 | 51 |

| Dec 2021 | 64 | 27 |

| Jan 2022 | 32 | 80 |

| Feb 2022 | 29 | 63 |

| Mar 2022 | 14 | 70 |

| Apr 2022 | 15 | 21 |

| May 2022 | 14 | 36 |

| Jun 2022 | 6 | 12 |

| Jul 2022 | 13 | 45.5 |

| Aug 2022 | 15 | 96 |

| Sep 2022 | 12 | 54 |

| Oct 2022 | 14 | 34.5 |

| Nov 2022 | 12 | 72 |

| Dec 2022 | 11 | 16.5 |

| Jan 2023 | 10 | 88 |

| Feb 2023 | 11 | 81.5 |

| Mar 2023 | 12 | 47.5 |

| Apr 2023 | 8 | 1 |

| May 2023 | 16 | 100 |

| Jun 2023 | 10 | 109 |

| Jul 2023 | 12 | 48 |

| Aug 2023 | 16 | 54.5 |

| Sep 2023 | 9 | 20 |

| Oct 2023 | 14 | 22 |

| Nov 2023 | 15 | 22 |

| Dec 2023 | 16 | 12 |

| Jan 2024 | 12 | 61.25 |

| Feb 2024 | 14 | 28.5 |

| Mar 2024 | 16 | 61.5 |

| Apr 2024 | 12 | 22 |

| May 2024 | 8 | 19.5 |

| Jun 2024 | 18 | 19.5 |

| Jul 2024 | 14 | 44 |

Jenni’s slightly increased workload represents prep for certification at her pharmacy and a colleague’s maternity leave prep.

Net Worth Update

Net worth is not our primary measurement and can understand it can be discouraging if you’re working yourself out of debt. We also understand it’s difficult to be transparent with our readers without divulging this information so we continue to do so.

Account breakdown

The market keeps chugging along and so do our investments. From a high level, our assets and liabilities are shown in the data table below as of July 31, 2024.

| Description | Value (USD, $) |

|---|---|

| 401(k) | 978,507 |

| Brokerage | 888,166 |

| Roth IRA | 195,868 |

| Traditional IRA | 23,245 |

| HSA | 59,739 |

| Real Estate | 440,050 |

| Mortgage | (136,566) |

| Miscellaneous Assets | 25,000 |

| Checking & Savings | 42,583 |

| Net Worth | 2,513,877 |

- Miscellaneous assets include specific investments we’ve made in physical assets (think collectibles) and treasury bonds

- Amounts do not reflect the value of the businesses Chris owns or their assets, which should appear as income to us over future years

- Jenni’s Prius is omitted

The S&P 500 was up about 1.1% for the month.

We were a little ahead of that with a 1.7% gain.

Overall, our net worth increased by around $42K this month.

Net Worth History

| Date | Amount | % Change |

|---|---|---|

| July 2020 | $1,555,289 | – |

| August 2020 | $1,597,334 | 2.7% |

| September 2020 | $1,566,393 | (2.0%) |

| October 2020 | $1,568,182 | 0.01% |

| November 2020 | $1,720,113 | 9.6% |

| December 2020 | $1,810,864 | 5.3% |

| January 2021 | $1,860,996 | 2.8% |

| February 2021 | $1,878,154 | 0.9% |

| March 2021 | $1,918,269 | 2.1% |

| April 2021 | $2,010,849 | 4.8% |

| May 2021 | $2,049,213 | 1.9% |

| June 2021 | $2,093,896 | 2.2% |

| July 2021 | $2,092,153 | (0.1%) |

| August 2021 | $2,130,761 | 1.8% |

| September 2021 | $2,070,730 | (2.8%) |

| October 2021 | $2,151,272 | 3.9% |

| November 2021 | $2,095,273 | (2.6%) |

| December 2021 | $2,160,235 | 3.1% |

| January 2022 | $2,055,292 | (4.9%) |

| February 2022 | $2,058,001 | 0.01% |

| March 2022 | $2,134,428 | 3.7% |

| April 2022 | $1,968,069 | (7.8%) |

| May 2022 | $1,975,569 | 0.04% |

| June 2022 | $1,868,397 | (5.4%) |

| July 2022 | $1,975,608 | 5.7% |

| August 2022 | $1,878,352 | (5.2%) |

| September 2022 | $1,735,997 | (7.6%) |

| October 2022 | $1,820,287 | 4.9% |

| November 2022 | $1,920,635 | 5.5% |

| December 2022 | $1,866,513 | (2.8%) |

| January 2023 | $1,953,691 | 4.7% |

| February 2023 | $1,882,656 | (3.6%) |

| March 2023 | $1,969,566 | 4.6% |

| April 2023 | $1,981,934 | 0.6% |

| May 2023 | $1,995,247 | 0.7% |

| June 2023 | $2,092,479 | 4.9% |

| July 2023 | $2,189,821 | 4.7% |

| August 2023 | $2,140,296 | (2.2%) |

| September 2023 | $2,042,865 | (4.6%) |

| October 2023 | $2,015,648 | (1.3%) |

| November 2023 | $2,157,404 | 7.0% |

| December 2023 | $2,261,458 | 4.8% |

| January 2024 | $2,296,269 | 1.5% |

| February 2024 | $2,365,110 | 3.0% |

| March 2024 | $2,434,250 | 2.9% |

| April 2024 | $2,371,284 | (2.6%) |

| May 2024 | $2,423,205 | 2.2% |

| June 2024 | $2,472,353 | 2.0% |

| July 2024 | $2,513,877 | 1.7% |

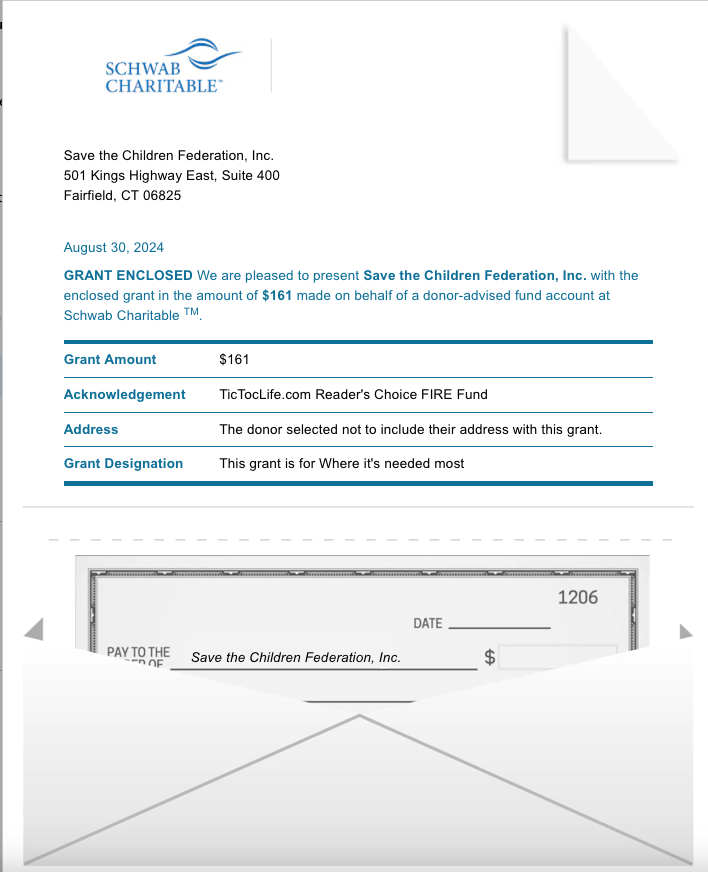

Previous Donation Winner

When you think it is hot outside, just remember the children in northern India where temperatures have reached 122°F. We are happy to award this month’s donation to Save the Children Federation Inc. who is supplying emergency aid and food for those affected by heatwaves and the droughts that develop. Their continued efforts will help communities prepare for future heatwaves and adapt to the impacts of climate change.

Our Reader’s Fund seeks to leverage the principles of FIRE to build a lifetime of giving.

Thank you for your participation in our polls over the last 48 months. We’ve given $6,000 to deserving charities with your help in deciding which organizations to donate to.

Polls are now open for our next round of candidates: Back to School Education Charities.

Charity Round-Up

Back to school season in the United States can bring mixed emotions. On one hand, summer is coming to an end but on the other, kids are returned to the learning and social environment of school. Schools offer more than just education. Afterschool programs and sports have a positive impact on children but also can be a financial burden. The same thing goes for buying school supplies. We’ve chosen three organizations that assist in different areas of getting kids back to school with what they need to thrive.

As always, each organization has excellent charity ratings to ensure our donation will have the most significant impact. We invite you to learn more about them and join us in donating to one of them by casting your vote.

Summaries below include the impact metrics and a link to their Guidestar profile which details the nonprofit’s operations and transparency.

1) Children International

Why? When schools aren’t equipped with the right supplies and support, they fail. They fail the future of our world, our children. By narrowing in on schools that are understaffed and underfunded around the globe, this organization connects people to provide the support needed to achieve academic success of the students.

Where? Guatemala, Honduras, Philippines, India, Dominican Republic, Little Rock, Arkansas, Ecuador, Zambia, Colombia, Mexico

What? Children International, a global nonprofit organization founded in 1936, works to help children overcome the effects of poverty, support their education, and prepare youth to contribute to society. Their educational support programs provide children with the back to school essentials such as school supplies, school fees, uniforms, textbooks, transportation fees and financial aid for any school-related expenses. They also offer tutoring in reading, math and science to computing and learning foreign languages. Finally, they strive to keep children engaged in their education by preventing kids from dropping out of school early by developing life skills in early education and providing parental support.

2) Kids in Need Foundation

Why? Roughly 15 million children in the United States live in poverty. When the choice is food or pencils, parent are going to choose food. Teachers, being the good souled people they are, often feel it’s their duty to fill in these gaps from their own pockets, which can be extremely hard on a teachers salary.

Where? United States

What? Kids in Need Foundation is a nonprofit organization focused on the success of children in the classroom. Throughout their network of organizations across the country, school supplies are donated to a central ‘store’. Then teachers can ‘shop’ these core essentials without spending a dime. Their Supply A Teacher and Supply A Student programs provide a standard box of supplies each year for teachers and students based on the grade level. Each sponsored backpack costs $25 and includes an uplifting note to each recipient.

3) NextUp RVA

Why? Education doesn’t have to stop when the school bell rings. Youth’s time out-of-school can be structured and continue to provide our youth with the educational direction to become successful adults. With access to out-of-school time (OST) programs (after school, weekends, and Summer breaks), youth can continue to have learning opportunities beyond the classroom in a positive environment.

Where? Richmond, Virginia

Our Notes: NextUp RVA was founded in 2013 with the goal to keep children engaged and learning when not in school. Their data driven and results focused programs build positive relationships and skills that improve the outcomes for youth in both school and life. Their network of partners in the community allow kids to discover their talents and continue to practice them. NextUp RVA is also a resource for parents to find suitable out-of-school time resources that are convenient for youth and their families.

Nonprofit poll

After reviewing the list above, please take a moment to vote for which nonprofit you think will put funds to use in the best way.

(Have trouble using or seeing the poll above? Some reader tools or apps may not display it. View this page in a browser or use this link to our Reader Fund page which has a copy of the poll!)

Thank you for taking the time to vote!

One of our primary goals with TicTocLife is building a stream of giving within the FIRE community and that starts with knowledge.

Want to hear about the results? Sign up for our free FIRE Insider newsletter! We send it out every few weeks and include the monthly poll results and donation winners. You can see an archive of the FIRE Insider and sign up here!

What’s Next

Chris is still working on other posts:

- Inflation bond (I Bond) experience

- Our transition from Intuit’s Mint budgeting app to a different tool

- The big annual FIRE budget post for 2023

And we finished our wedding expense breakdown a week ago.

August will be a more sedate update as we try to catch up on chores, errands, life, and friends. That’s before a big trip to Germany with family in late September!

It’s always a pleasure to have you along with us on our FIRE adventure!

How are your summer trips shaking out?

Let us know in the comments or on Threads and X (Twitter)!

2 replies on “A Honeymoon Adventure to Waterland (July 2024 Update)”

Congrats on another good month!

It looks like you use quite a large number of points for all your travels over the years.

Let’s say for the last 5 years, on average, how many new credit cards do you sign up for per year? How many points do you earn through sign-up bonuses per year?

(It would be great if you can dedicate a post just on that topic, with a breakdown of points earned and on which cards, etc.)

Hey TK! Thanks for the comment and—the suggestion!

Yep, we built up quite a few credit card, hotel, and airline points/miles in previous years. We continue to try to “restock” them as well.

Estimating—we tend to butt up against the Chase maximum of 5 new cards every 24 months (known as “5/24”). So that’d be 10 cards per year between the two of us at the most. Jenni recently dipped below that Chase limit and so she just signed up for her second “Reserve” card which is fueling our upcoming trip to Germany (with its 50% bonus redemption point value).

If we ballpark 10 new cards per year for us, with an average of perhaps 60,000 miles/points per card, that’s about 600k miles/points per year. The value of them varies greatly, but overall, it’s probably pretty close to a penny per point or about $6,000 of value/year for travel. That at least seems to be in the ballpark. That said, we’re consuming more points than we’re gaining so our “stock” will eventually zero. I’d guess we have about 1.0-1.5 million between all the programs and the two of us right now.

A lot of that comes from signup bonuses…but a good chunk comes from actual spending. We aim to get most of our spending in 5x categories. If we’re spending $50k/year and get $30k/year in 5x categories, that’s another 150k in points. It adds up. It’s definitely a little side hobby.

You make a good suggestion to have a post about this. Once we catchup on our variety of current drafts and topics, I think we’ll write that one up.

Cheers!