The architect boards and finds their seat against the window just as they do nearly every day. The morning frost barely covers the glass anymore as the sun is rising earlier each day. He checks his wallet as the ticket collector comes round.

“Just enough for another weeks’ pass”, he thinks to himself.

The conductor exchanges a punched voucher for the crisp bill the architect hands him with a slight knowing nod to the man. He tucks the voucher into the billfold alongside the last few bucks he has and settles in for the bewitching clickety-clack on the ride into downtown.

As the chilly steel screeches to a halt, the architect snaps awake. “Excuse me” he utters while snaking around the legs of the passenger next to him. He pulls his lunch bag off the overhead rack, feeling the heft of it as he does so.

“Beans and rice again, no doubt. One more week…”

Exiting the station, he passes the same soup kitchen in the basement of a greystone that’s been there since he was a child. His memories of it are far too intimate as he pushes past a panhandler while being careful to leave her with a loud clink of heavy coin.

Ding. The doors spread open and the architect with a handful of his colleagues pour out into the maze of chairs and desks. He slides his brown bag into the bottom drawer, covering the nearly empty bottle of bourbon. Pulling up the diagram he paused work on yesterday, he begins making changes to the fenestration at the entryway. He falls into his usual trance as the day passes by.

Even this late in the evening, there’s still some sun now. The ride won’t be quite as dreary as it has been in recent months. The architect collects his things as his stomach grumbles with the feeling of the now empty lunch bag. On the way out, he remembers to stop by his mailbox as he spots the tail of a white envelope sticking out.

“Oh yes, nearly forgot—payday.” A tortured smile creeps across his face as he pulls the paystub from the sleeve.

He reads it with nonchalant expectation.

“Gross pay: $1,552.88.”

“Net pay: $0.00.”

He crumples it in his fist, dropping his paycheck into the trash where it’s valued precisely: as nothing.

Your Tax Payoff Day

There’s an old saying that you work for the government until the Spring of each year. Taxes need to be paid and the toll (at least in the US) is typically around a third of earnings for many folks on a path to financial independence.

By the time the thaw comes, you start earning money for yourself instead of working for Uncle Sam.

This notion is exemplified by my story of the architect above—in a bizzaro world where all taxes must be paid before you retain any earnings.

We’ll come back to the rest of The Architect’s story shortly.

This popular illustration of the weight of taxes as a proportion of the year’s workdays even has its own registered trademark.

It’s called “Tax Freedom Day” and was created by the Tax Foundation.

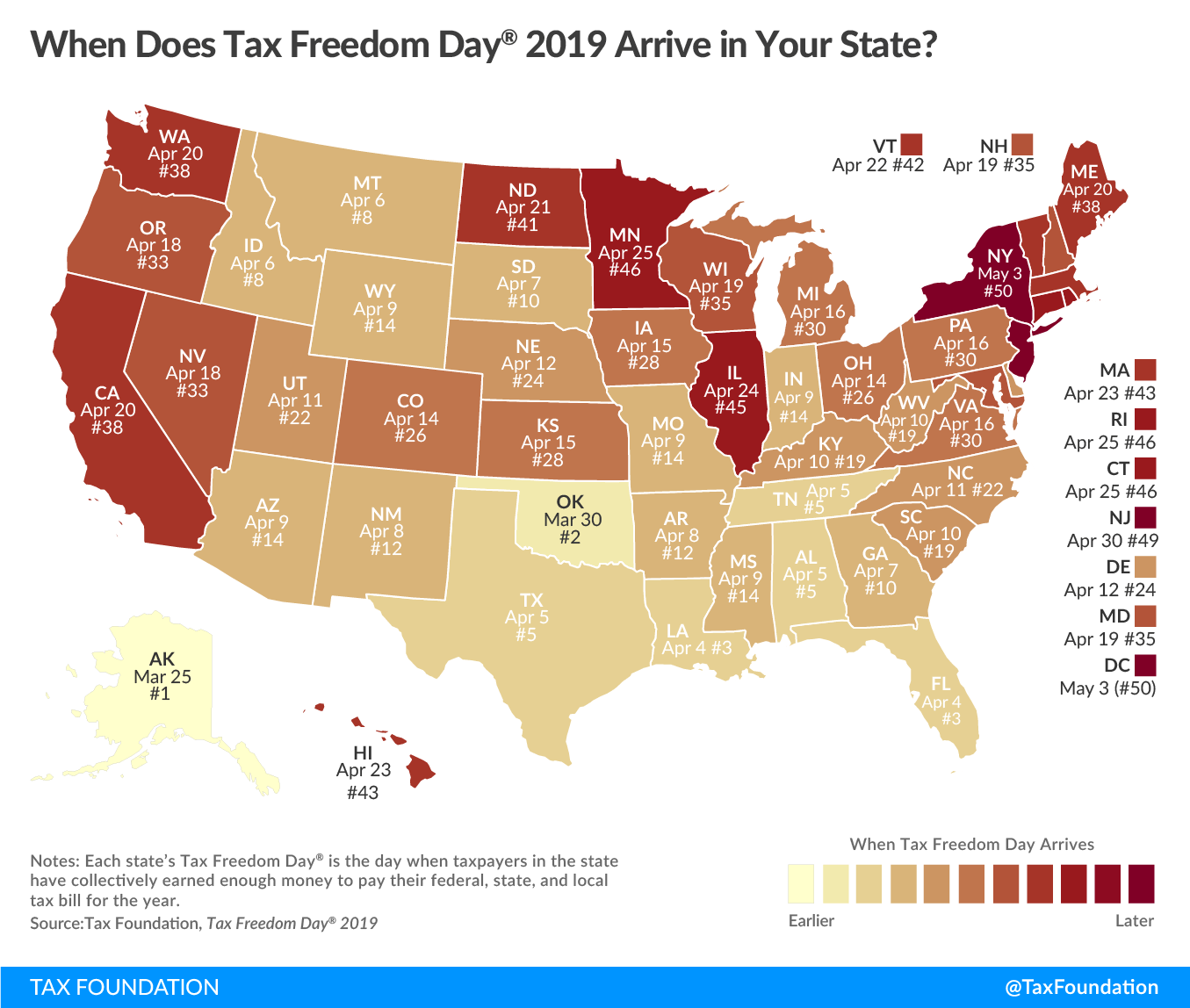

There’s even a data map of the US that shows your state’s day for when the average worker will finish paying off their tax burden.

Taxes vary pretty widely from state to state, we’ve got Alaska coming in the earliest on March 25 while New York ties for the latest on May 3.

I think there’s some value in understanding where your earnings go and just how much of it is taxed. However, I think the overall illustration—as fun as it was to write the story about the architect—misses on a couple of points.

- The median US income for full-time workers in 2020 was $51,688 [BLS]

- US federal income tax is progressive; you don’t pay your top marginal rate on your entire income

- The standard deduction for a single person is $12,400, offering a significant tax savings

If you were to look at a simple tax bracket table and see that our median worker’s income falls within the $40,126 to $85,525 range and presume they pay 22% in federal taxes, you’d be forgiven.

But you’d also be wrong. It’s a terribly common misconception.

Calculating your personal tax freedom day

This person would most likely earn the standard deduction, so they are only taxed on $39,288 of earnings—progressively. The first $9,875 at 10% ($987.50) plus 12% of the remaining $29,413.

Total federal tax: $4,517.06. Effective tax rate: 8.7%.

Their Federal tax freedom day would be the 32nd day of the year: February 1.

But of course, that doesn’t include all the taxes that Americans pay. In our median single worker example, they’ll owe nearly $4K in FICA contributions (Social Security, Medicare). It’s important to consider that these “taxes” are intended to be forced investments in your own future.

You should (could?) get value out of your FICA taxes once you retire.

State taxes vary greatly, but at least here in VA the worker would owe another $2.4K or so in taxes.

The worker’s total tax burden would be just under $11K. That’d bring their total tax burden freedom day to around March 17.

The Tax Foundation includes multiple consumption level taxes in their calculation. They also add corporate taxes. At the very least, this is less interesting to the individual when considering their personal tax burden. At the worst, it’s misleading.

While it’s true that you will pay some additional taxes for consumption (sales tax) or wealth (property tax), that’s going to depend heavily on the individual. It also has nothing to do with income.

Your Least Valuable Dollar

In reality, the first dollars you earn—say, in the month of January—are taxed the least because of the progressive tax system. Let’s go back to our median wage worker earning $994/week. If they actually quit work on their “freedom” day of March 17, they’d have only worked about 11 weeks of the year.

If they quit working that day and didn’t earn money for the rest of the year, they ultimately wouldn’t owe anything in federal taxes because their income would be below the standard deduction. They’d still owe about $1K of FICA plus state taxes from their $11K earnings, but that’s it.

They’d get a large refund check for their estimated taxes being incorrect.

Stress as the year ends and net earnings drop

The most valuable part of this exercise in taxes, I think, is actually toward the end of the year. As your income builds up, you travel through the higher marginal tax brackets.

Effectively, each additional dollar you earn toward the end of the year (say, around now, in December) is worth less than the dollars you earn in the beginning of the year.

Those first dollars in January come with a federal tax burden of zero. The last dollars in December are taxed down to as little as 63¢. As the holidays approach and deadlines for the end of the year are on the horizon, stress tends to skyrocket for many workers.

Fellow personal finance writer, XRAYVSN, writes about just such a phenomenon: The Least Valuable Dollar. As a doc with high earnings in a high tax state, their last dollars of the year left them with less than half in net earnings.

They used this lesson to see that decreasing their workload by 20% wouldn’t mean a loss of 20% of their income. That’s because they were cutting out their least valuable dollars. That’s another benefit of part-time work: maximizing your high-value dollars against the amount of time you spend working.

Your least valuable dollar is someone else’s most

Following the same logic, it’s also why donations can be significantly more valuable at high-income tax levels. You might lose 63¢ worth of income to give a non-profit $1 of value. By donating appreciated shares, you could take that even further since you’ll avoid taxes on the gains.

This same logic is what motivated Jenni and me to start funding our reader-directed donor-advised fund. We still have some income during semiretirement that would benefit from a lower tax burden.

Our charitable causes get more out of our dollars than they would in the future.

The Architect Who Remade Himself

Waiting for the final boarding call, the architect looks out the clear window. Slumped against the sill, he spots the beginnings of Bluebells in bloom. A wry smile creeps across his face as he’s reminded of what the week holds: a real paycheck.

He’ll finally be able to restock the kitchen with deep red raspberries and crisp collards once again. The family vacation he’s been planning will have the necessary deposit. He’s made it another year living just barely below his means.

With the stress of deadlines and the holidays at each year’s end, he spends too much money on convenience. Defeated at work, he uses money instead of muscle to free up time. His least valuable dollars are spent on indulgences and extravagance. He deserves the delicacies of life after all.

In the haze of the trundling commute and relief of months of subjugation, he turns over his problem in his mind—searching for a solution. By avoiding the connoisseur effect, he could cut significant spending from the family budget. With less spending to support, he could reduce his hours and stress. By donating some of his “least valuable dollars” and some of his newly freed time, he could have an outsized impact on that all too familiar soup kitchen in the basement of the greystone.

He puts his mind at rest, feeling strangely calm with his new internal directives.

He has a plan.

And now he’ll remake himself.

How do you think you could leverage your “least valuable dollars”?

Might part-time work be in your future? Perhaps you’ll donate to charitable causes while you still have high earnings?

6 replies on “The Architect Who Made Nothing”

Haha such a depressing thought that all of January (and part of February) is work for the government out here in California. Even the most patriotic among us have to be peeved at that. Really makes me envious of those low tax states. Interesting way to look at earnings vs. free time!

Seeing the disparity between states does make me think that attempting to be in a low tax state while you’re earning financial independence could make a pretty big difference in your FIRE timeline. That assumes you can still earn/spend the same ratio in a comparative state, or at least account for it. Months of work going to taxes (representing a large chunk of your income) could really decelerate that slope to FI.

That map is pretty cool. I never thought about taxes in the way you put it: the first few months are for uncle sam alone. Looks like CA is on 4/20. What a wonderful day and reason to celebrate being done with taxes if I say so myself. We’ve been playing around with ways to lower our tax bill this year. Ever since they reformed the tax law we’ve struggled to write things off we used to do be able to do all . This year I’m maxing out my high fee 401k for the sole benefit of reducing my taxable income. I’ve been reluctant to do this since my 401k offers no match and has a 2% fee after everything is added up. We’ll see how this goes.

I like the way you wove in the story. Thanks for the interesting perspective as always, Chris.

Hey Noel! Thanks for coming by and happy holidays.

Glad you enjoyed the different perspective on taxes, and yes, you’re pretty far into Spring there in CA before they’re paid. 🙂

Indeed, the $10K SALT limitation hits higher tax states and property owners particularly hard, often without the higher standard deduction making up the difference.

So far as the 401(k), that 2% fee is steep. Over time, it may outpace your initial ~30% deduction value for the contribution depending on how the market does. I think it makes sense to contribute, despite the fee, as long as you have a plan to get out of that high fee plan sometime in the (relatively) near future.

With tax changes and FIRE, it’s a little harder to predict what sort of tax advantaged accounts are worth it in current times. With our projected income needs (in early retirement) being far below the level of which we wouldn’t pay any federal tax, making the case for tax advantaged accounts like 401(k)s, IRAs, etc is increasingly difficult.

Cheers!

Really love your story telling, Chris. Such fun reads with lots of learning wrapped into it.

We are trying to find ways to lower our tax bill. When we look at the amount we take home vs what we make it’s annoying. Taxes are necessary and we want to do our part. But just don’t understand why we have to pay more than those who wouldn’t even miss it (the rich). 🙂 We were just having this conversation this morning with my brother and sis-in-law.

Guess we woke up with money on our minds. LOL.

MERRY CHRISTMAS!

Hey hey! Thanks for coming by during the holidays 🙂 Merry Christmas to your whole family. I hope you all have been able to enjoy it!

Glad you enjoyed the story, it was a different way of writing than what we normally do around here.

I think there will always be some friction amongst us, the populous, about how taxes are collected—how much, based on what—and it’s probably healthy to accept not everyone will be happy. That said, it’s rather American (for better or worse!) to ensure you pay no more than is necessary and appropriate according to the law. Wealthy people (including us!) have more means to ensure full advantage of the text is taken. That said, we’re happy to support the country and others, not to mention pay back into the services and infrastructure that enabled us to achieve what we have.

Happy holidays!