Should you pay off your mortgage or invest extra money? Besides the return on investment difference, sometimes you want to reduce your income.

Author: Chris

Chris began his financial independence pursuit in 2007 as he learned basic personal finance from Get Rich Slowly as an aspiring web designer and novice investor. After several missteps, he learned the secrets of financial independence and began his pursuit of freedom.

He reached financial independence in 2018 with $1.2M and two businesses. He began the process of transitioning to early retirement in 2020.

Learn more: Meet Chris.

What is the purpose of work? If the goal is money, why do people work after they have enough? Is it golden handcuffs or the desire to create?

A diversified portfolio isn’t enough: learn to be a disciplined investor to avoid the behavior gap. Behavioral finance teaches us about investment biases.

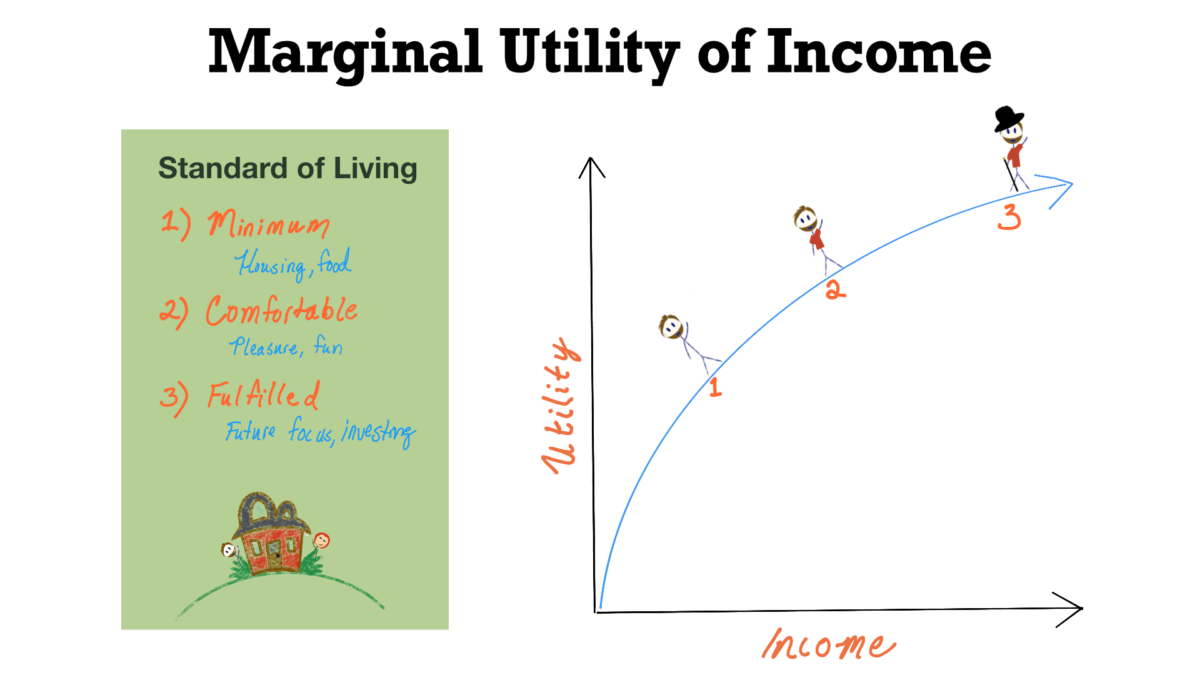

Understanding happiness as a function of income and the marginal utility of income will shortcut your path toward how to build wealth in your 20s and freedom.

VTSAX vs VTI: which should you choose for your portfolio? Learn the pros and cons of these Vanguard funds and discover 5 more options for diversification.

Turning a hobby into a business can bring you riches or leave you with a lost passion. Here’s how to decide if it’s worth switching from hobby to business.

How do you set the value of time? Would you not spend $2M in exchange for 60K hours to do as you please? A telling tale of Chris & Irsch.

Could real estate investing be the route for Mike’s family to reach financial independence with their $1.5M net worth goal?

Furthering our mission to give back, we’ve launched a donor-advised fund (DAF), funded with FIRE, where our readers choose the grant recipients.

Net Worth Revealed! (Jul. 2020 Update)

Our dividends tumbled but an Accountable Plan rescued our savings rate! We’ve revealed our net worth details for a little financial voyeurism.