If achieving financial independence is all about getting the most from the least, might nature unlock satisfaction and excitement along the way?

Author: Chris

Chris began his financial independence pursuit in 2007 as he learned basic personal finance from Get Rich Slowly as an aspiring web designer and novice investor. After several missteps, he learned the secrets of financial independence and began his pursuit of freedom.

He reached financial independence in 2018 with $1.2M and two businesses. He began the process of transitioning to early retirement in 2020.

Learn more: Meet Chris.

We join the Double Double Comma Club, reach our donation goal on our first year anniversary, review conservation nonprofits, and scrutinize our budget!

My career was costing me over $2,000/month! This is how I cut my “cost of working” and built a faster and more satisfying path to financial independence.

Your life’s wealth is derived from your choices and your social environment. While you can’t change how life begins, life is all about choices, which you control.

We review women’s (and girl’s) charities for our monthly donation, earn a huge cashback bonus, and review our March 2021 monthly FIRE budget!

Here’s how my good friend’s family could boost their net worth by $11K every 5 years through strategic giving!

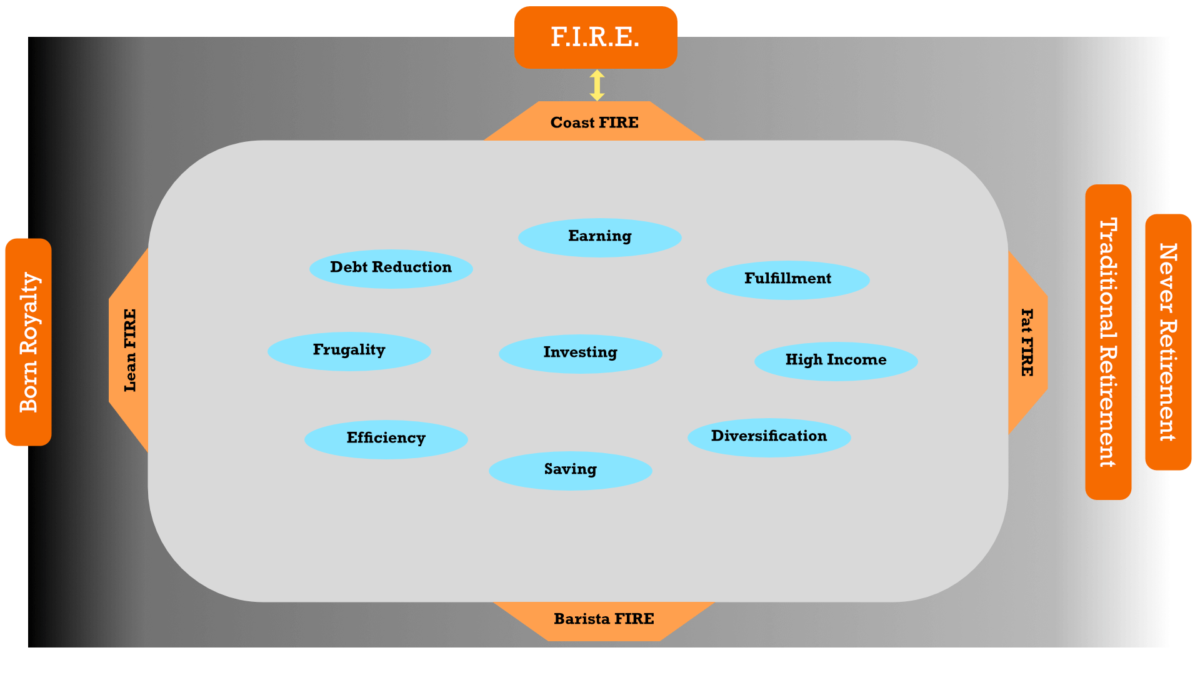

The FIRE movement has evolved into a mainstream interest, and with it, a diverse set of subgroups. But are we losing sight of what matters as we form silos?

We review three healthcare nonprofits for our monthly donation, get a surprise roof leak, sell some stock, and review our February 2021 monthly FIRE budget!

Gaining financial independence has no rule set. No one defines retirement but you. These are 7 ways the FIRE movement misses the personal part.

Imagine a thriving community of Black-owned businesses and residences in the era of Jim Crow. It happened in Oklahoma where Black Wall Street was born.

![The businesses of Black Wall Street in its heyday [Image source: America in Color: The 1920s, Smithsonian].](https://www.tictoclife.com/wp-content/uploads/2021/02/black-wall-street-tulsa-1200x675.jpg)