Here’s how to analyze your own buy vs rent and invest scenario, deciding to invest in either needs to be part of your financial independence plan!

Category: Finance

FIRE often involves mathematical analysis of your personal finances and holistic strategic approaches to your financial goals. Our Finance articles address this.

This category includes content about financial topics. This may relate to personal finance, investing, financial independence, and early retirement.

Should you pay off your mortgage or invest extra money? Besides the return on investment difference, sometimes you want to reduce your income.

A diversified portfolio isn’t enough: learn to be a disciplined investor to avoid the behavior gap. Behavioral finance teaches us about investment biases.

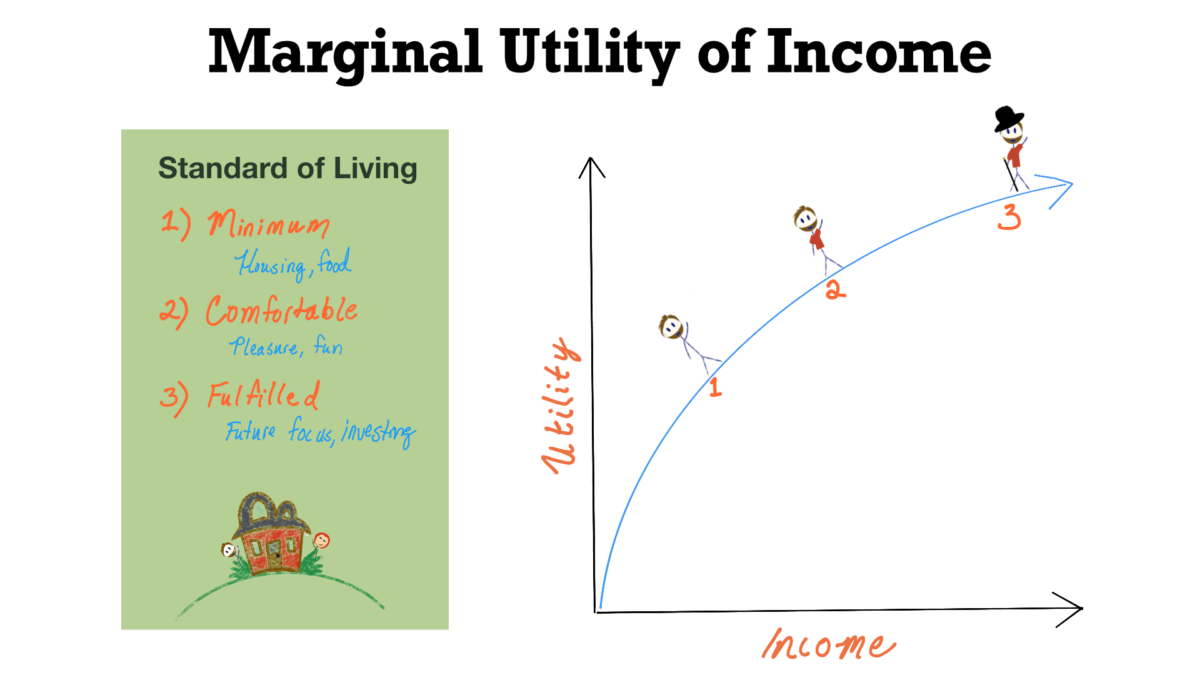

Understanding happiness as a function of income and the marginal utility of income will shortcut your path toward how to build wealth in your 20s and freedom.

VTSAX vs VTI: which should you choose for your portfolio? Learn the pros and cons of these Vanguard funds and discover 5 more options for diversification.

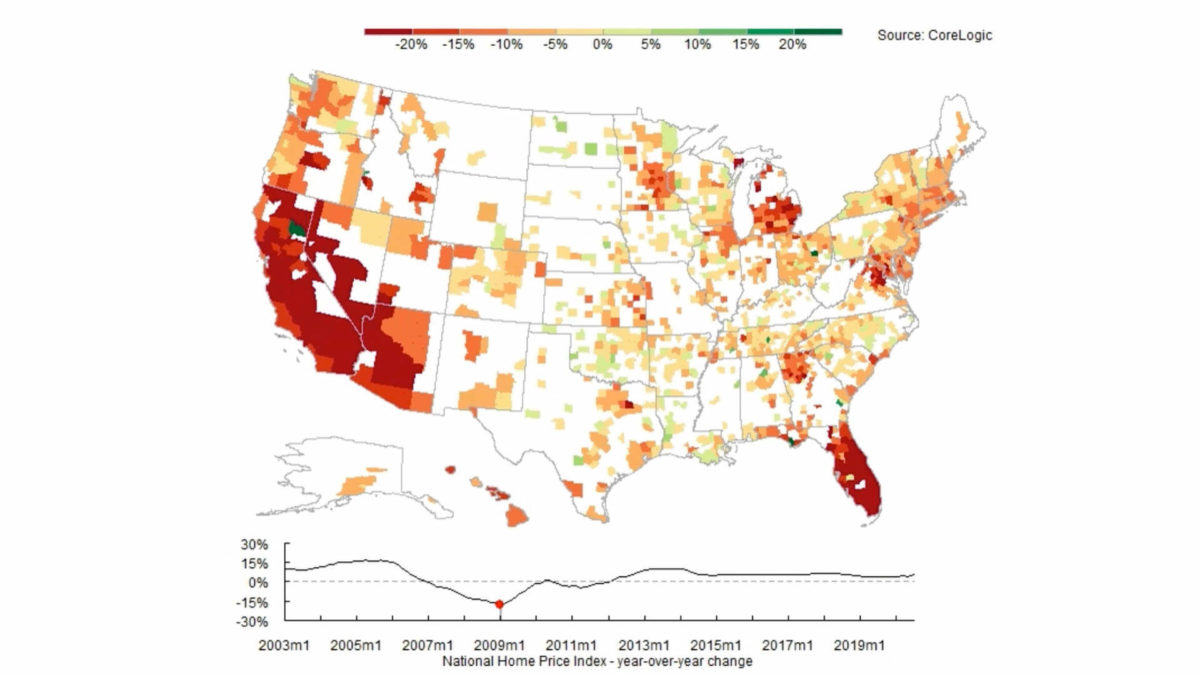

Could real estate investing be the route for Mike’s family to reach financial independence with their $1.5M net worth goal?

Our thirteen-year saga from student loan debt, to graduate school, shifting careers, and starting two businesses. At the lowest point, we went from a negative $107K net worth to $1.2M in nine years. This is how we became millionaires and reached financial independence.

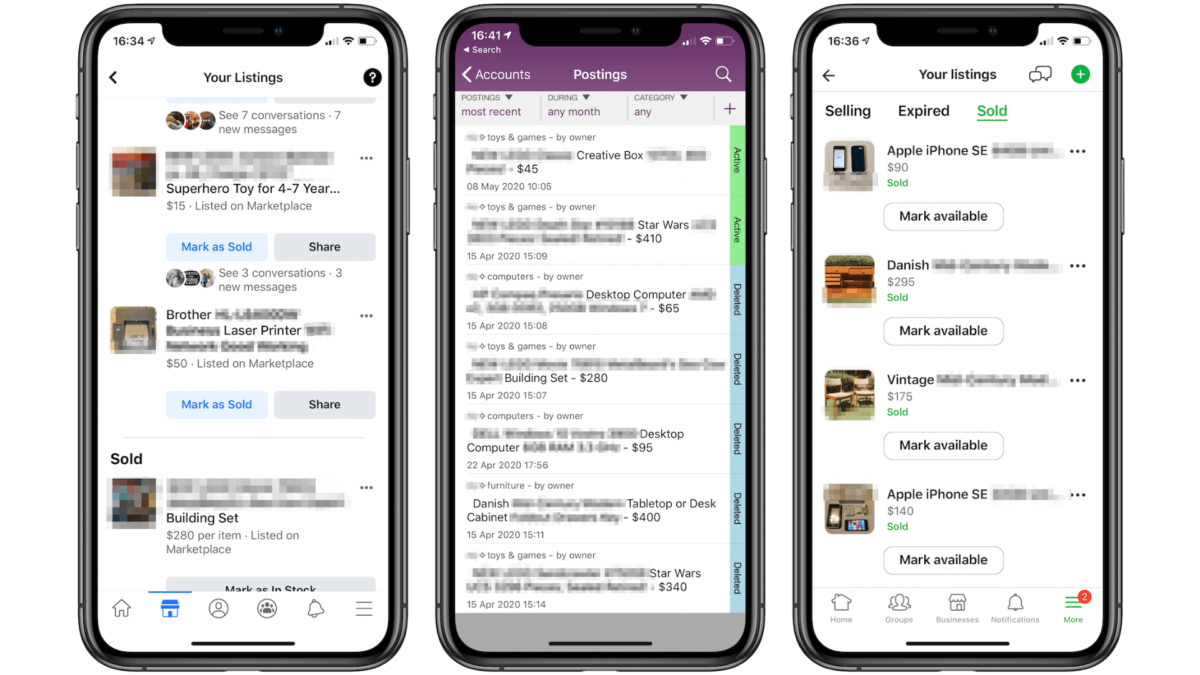

Part of our method of becoming millionaires was to constantly leverage apps & websites to sell stuff locally, here’s our step-by-step guide and tools!

Discover the risks of individual stocks vs index funds. Learn from my costly mistake and make fruitful investment decisions to help you reach FIRE!

How to automate your finances: learn to put savings on auto, pay debts & credit cards without overdrawing accounts. Make a wealth-building routine!