Today I’m going to review two popular forms of investment: ETF vs stock.

I dove deep into each investment type to uncover the pros and cons.

Why should you care about ETFs on your road to financial independence?

They’re the secret way to get a piece of Bill Gates’ net worth in that bar you always hear about. More on that in a minute.

Within each investment I evaluated:

- Risk

- Efficiency

- Diversification

- Liquidity

We’ll also go over the major types of ETFs.

Be sure to read this review through to the end to help you make the best investment decision for yourself.

ETF vs Stock Difference

Before I get to the detailed comparison itself, I want to quickly provide an explanation about what makes ETFs vs stocks different.

What is an ETF?

An exchange-traded fund, or ETF, owns a group of assets without having to own all the component parts individually.

The ETF’s assets are often other stocks representing a particular type of investing goal.

ETFs:

- Have individual ticker symbols

- Trade on the stock market

- Own the underlying assets that the collection represents

ETFs are frequently just groups of stocks and traded the same way.

So how might ETFs be better for your portfolio than individual stocks?

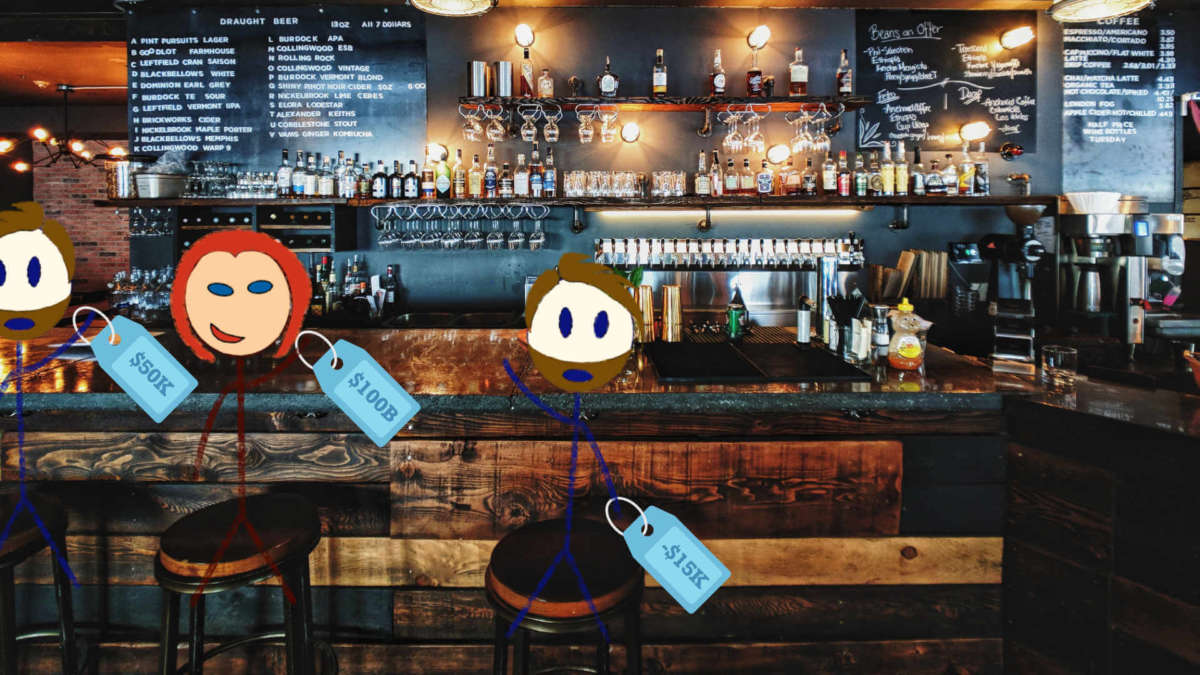

Bill Gates walks into a bar…

There’s an old statistics joke that goes:

When Bill Gates walks into a bar, everyone inside becomes a billionaire—on average.

Since Bill Gates’ net worth is over $100 billion these days, the average person’s net worth in that bar can hit $1 billion even if there are 100 people in there.

For every Bill Gates, there’s a you or me. We bring the average down.

But—you know—I’d settle for a cool billion.

That’s the great thing about ETFs: they can let you become the average person in the bar when Bill Gates walks in.

No, you won’t be Bill Gates with the $100 billion net worth—but is that really as much money as you need?

How much money is enough for you might be a little different than for me, but if your goal is to reach financial freedom—you don’t need to aim for the stars when merely average will do.

Through diversification, you can achieve healthy returns with ETFs vs stocks.

No, you won’t get that 10-bagger with an ETF like you might with stocks.

But you also drastically reduce the chance of being the person in the bar who’s investments went bankrupt—instead, you get to be the average and ride the coattails of the big winners.

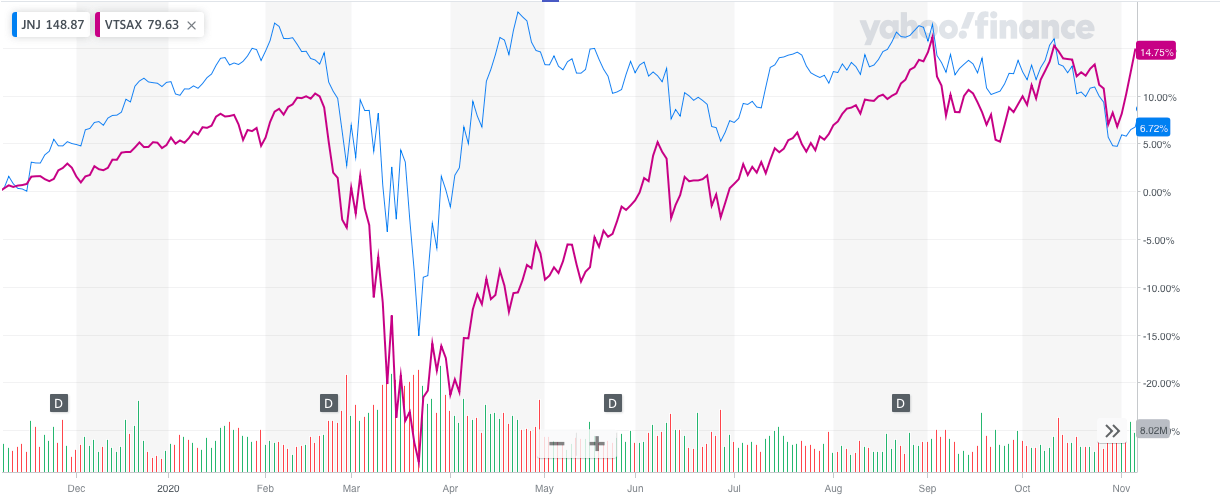

My own experience with index funds vs stocks revealed just how much of a gamble stocks can be if you don’t know what you’re doing. Index funds are often ETFs.

What are the types of ETFs?

There are many different types of ETFs. In fact, as of 2019, there were nearly 7,000 different ETFs globally.

You can almost certainly find an ETF to match your investment strategy.

Let’s take a look at the 9 most popular types of ETFs.

Types of ETF

Index

Tracks an index like the S&P 500, DOW, or NASDAQ.

Active

Humans make decisions about invested assets in attempt to beat an index.

Inverse

Value increases when an underlying index or market declines.

Industry

Comprised of investments in a particular sector or industry like biotech or retail.

Commodity

Tracks with the price of a good such as oil, gold, or soybeans.

Bond

Invests in specific types of bonds like corporate, municipal or government.

Foreign

Targets a particular country’s own market or currency.

Style

A preset group of investments filtered by a style such as growth, small-cap, or blue chip.

Leveraged

Provides multiplied effects of daily price changes with hefty leverage fees.

The most popular and most relevant type of ETF to your pursuit of financial independence is index ETFs.

Index ETFs are a subset of index funds which can also be index mutual funds.

Two of the most popular index funds are an ETF (VTI) and a mutual fund (VTSAX), both of which are operated by Vanguard.

They’re some of my favorite investments, read my VTSAX vs VTI review for more.

ETF vs Stock Pros and Cons

Because I’ve already experimented with both ETFs and Stocks in my investment portfolio, I invest in ETFs. I’ve been happy with them.

But, there are advantages of owning individual stocks vs ETFs.

| Stock | ETF | |

|---|---|---|

| Risk | More | Less |

| Efficiency | More | Less |

| Diversification | Less | More |

| Liquidity | More | Less |

Let’s go over each of these different pros and cons to identify which advantage matters most to you for your own investments.

ETF vs Stock: Risk

The primary purpose of buying ETFs over Stocks is to mitigate risk.

By owning a mix of assets, ETFs do not rely on the performance of a singular asset. This spreads out the risk of bankruptcy, corruption, or simple under performance.

Nearly 500 corporate bankruptcies have occurred so far in 2020 which could wipe out individual stock investors.

ETFs help an investor achieve the “average” of the ETF’s goal. While that means they reduce the likelihood of extreme growth, they also reduce the likelihood of signification loss.

There is one important risk factor to consider with ETFs: counterparty risk.

What’s counterparty risk?

Think of an ETF that tracks the price of gold. That ETF owns physical gold. While unlikely, it’s possible that the party operating the ETF doesn’t fulfill their promise or representation for the ETF.

Perhaps, for example, they actually owned less gold than claimed or some of it was stolen.

ETFs introduce additional parties into your investment which can create counterparty risk.

ETF vs Stock: Efficiency

Stock ownership is a straightforward 1:1 relationship between you and the investment. Often, this is a share in a company—owning stock now gives you direct representation in the company.

ETFs have a particular goal to track an index, sector, or asset type.

As ETFs need to own actual assets, they need liquidity to execute transactions.

This means that ETFs often carry some amount of cash in order to execute trades. That cash balance will (generally negatively) affect the performance of the ETF versus the investment type it attempts to track.

ETF vs Stock: Diversification

In order to diversify individual stock investments, you’ll need to own a wide variety of stock across many different industries.

Properly diversifying a portfolio of individual stock would require owning hundreds—if not thousands—of stocks. At that point, the cost to execute all the trades would become significant for the average individual investor.

If you paid $5 per trade per stock and owned 500 different shares to diversify your portfolio, you’re looking at spending $2,500 in transaction fees to make the purchase!

You can expect to pay another $2,500 to sell them, too!

You could achieve the same thing by owning a single ETF with the same underlying set of stocks for just a single $5 transaction fee.

The point of diversification is partly reduce volatility, which is important when you need to plan ahead and draw down your investments during retirement.

You don’t want to be forced to sell shares to meet your personal expenses when your individual stocks are experiencing down markets.

Diversification is the single biggest reason to buy an ETF vs stock.

ETF vs Stock: Liquidity

As long as there are shares outstanding, you can purchase an individual stock. Liquidity is dictated directly by the market.

An ETF’s goal is to maintain a particular ratio of underlying assets that match their mission.

As the ETF grows or shrinks, they need to trade in their component parts to maintain the right set of underlying assets.

The nature of an ETF representing a group of other assets means that the ETF will be inherently less liquid than the individual parts it composes.

If there isn’t much availability of underlying shares, there will be even less availability of an ETF that includes them.

Trading ETFs vs stocks are very similar. Both can be sold and purchased during trading hours, immediately.

This can make ETFs more attractive to certain investors than mutual funds which are generally only traded once per day.

ETF vs Stock: And The Winner Is

So, why should you buy ETFs?

ETFs are good choices when you want to invest in an industry that has rare, huge stars but many misses and failures.

Think of something like biotech where one company has a breakout drug but many other companies’ drug research fails.

A biotech ETF could make sense if you aren’t sure which company is going to be the big winner.

Why should you buy individual stocks?

On the other hand, an industry like regulated utilities offers similar returns for the companies within the industry.

An ETF can still be a good choice to diversify across the industry, but will probably have a return similar to the companies within the ETF since there’s not much deviation from the mean.

Because of the reduction in risk and lower cost to diversify, ETFs might be the better choice for the average investor.

ETFs can help you more easily be a disciplined investor, avoiding the human behavioral concerns that might knock your returns off track.

If you believe you can compete with expert traders, you might want to go with individual stocks.

Now It’s Your Investment Choice

I’d like to hear what you think about this ETF vs stock comparison.

When it comes to buying equities vs ETFs, which do you invest in?

Are you happy to be Bill Gates’ average in a bar?

Or do you prefer to be Bill Gates—and capture maximum returns despite the risk?

Let me know in the comments below!

ETF vs Stock FAQ

Stocks are generally individual, direct ownership of an associated asset like a share of a company. An Exchange-Traded Fund (ETF) is a collection of securities—sometimes stocks—which typically track an index. Owning an ETF gives you indirect ownership of the underlying securities.

Individual stock ownership gives you more control over your investment diversification. ETFs introduce some minor inefficiencies of having a third-party involved managing the underlying securities. Though not usually a problem for regular individual investors, individual stocks typically have more liquidity than ETFs.

ETFs are often a smart investment choice for amateur individual investors as they allow them to achieve an average return while reducing risk and increasing diversification.

10 replies on “ETF vs Stock: Invest to Be Bill Gates (or Just Be in the Bar)?”

I use index ETFs like VTI, ITOT, and SCHB all the time. A couple years ago I tried a barbell approach with the leverage ETF UPRO, with mixed success before dropping the strategy because my Vanguard account stopped allowing me to trade it.

I’m not sure I 100% agree on the counter-party risk and the liquidity risks of ETFs. Seems like you could still have the same counter-party risk with individual stocks, especially in the face of fraud or creative accounting. And there are many smaller stocks, that are much more illiquid than an ETF that may contain them. Maybe those risks apply to certain classes of ETFs more than others?

Woo so far as those ultra short/long ETFs… I lost my shirt the one time I messed with them a decade ago. Probably good it wasn’t with all that much money (relatively!).

The biggest issue with them is probably the fact that they’re designed to mirror performance on a daily basis, holding them longterm won’t actually earn the 2x or 3x return because of the built-in degradation that occurs.

So far as counterparty risk:

You do absolutely have that risk you mentioned (fraud, etc) within individual stocks—but the ETFs that hold those stocks also have that risk inherent to the fact that they own individual stocks. But then on top of that the ETF operator itself has its own internal risk (again, things like fraud or technical issues with matching their index target). So you’ve got an additional party involved and carry their risk, too.

So far as liquidity, the concern is similar—illiquid stocks will lend themselves to liquidity problems with ETFs that hold them. Investopedia does a good job of explaining this relationship:

https://www.investopedia.com/articles/exchangetradedfunds/08/etf-liquidity.asp

But to be clear, it’s certainly possible to have an industry ETF that is more liquid than an industry stock—that’ll depend on a whole bunch of factors. Tiny companies are certainly going to be less liquid than giant ETFs in the same sector.

To your point, the devil is in the details 🙂

Great breakdown, Chris! I agree with your conclusion that ETFs are best for the average investor. Of course, taking more risk on stocks could leader to higher returns. But that’s only if you select the right stocks. Personally, I prefer stocks because it’s easier to predict dividend raises. But I also think every investor should own the S&P 500.

Thanks Graham!

Yea, I think I was attempting to address ETF vs stock from the vantage point of your average retail / individual investor.

ETFs can offer a little flexibility if an amateur really wants to get involved in a sector, but also shield them from losing their shirt because a biotech company’s research turns out to be a failure and they go to zero.

I think doing both is perfectly reasonable. For instance, we invest in equity and bond ETF’s in our tax deferred plans. These are long term and will support us through retirement.

Our taxable accounts is where I have a concentrated portfolio. It is much harder and takes considerably more time, but it is my favorite hobby so I enjoy the process. Sure there are the mistakes.

When I am correct, I usually can find a multi-bagger on a very concentrated investment, but there are no certainties.

There are so many unknowns which I think intimates most people.

I like to make predictions on a range of possible outcomes and then follow the story unfold.

Hey Mr. TPM!

I think this is a really important point about your suggestion—individual stocks can definitely be the better choice for some folks who are willing to put in the effort to not only learn about investing but also research the individual companies. And are willing to hope for some luck 🙂

There’s certainly people out there who can beat the index!

But from the vantage point of individual investors, your regular average amateur Jill or Jane, I wanted to offer an ETF vs stock comparison that would help give them a bit of a comparative overview.

To be sure, it’s quite fun to try to hunt down the treasures and follow the growth of companies you start to get to know. I did it for years! 🙂

We enjoy reading these types of articles because there is just so much to learn. We’ve paused on our investing for the moment but when we resume think we will be doing both probably leaning heavier on ETFs. In the meantime, gathering info so we know the best places for our money.

Glad to hear you guys are making careful decisions! That’s great, especially working through it together.

So far as what’s best for you: make sure you evaluate what your investments need to do to reach your own goals.

What makes sense for your own approach will differ a lot if you need to see 5% avg returns over 30 years versus 50% returns in the next few versus having “play money”.

I can see the allure of investing in individual companies…hitting the next amazon, sexy dividends, having a legit reason to follow day to day stock market news. But for us, we like the simplicity of investing in funds that track indexes. It’s just less to worry about than having to keep track of a company’s fundamentals, earnings, dividends, weighting in our portfolio etc. I’ll take higher peace of mind return than a “possible” higher stock return any day.

That said, I do see myself buying individual stocks on the side, down the road in life, as a playground percentage of my portfolio. Maybe to supplement my bond allocation, if the yields stay so horrendously low.

Haha, yes—it’s like a little treasure hunt to me.

Can you find the diamond in the rough? Outsmart all the other investors?

It’s fun!

At least for us, I think the biggest shift in our investments that pushed us to broad index funds (ETFs and mutual funds) was that we just don’t need to see growth beyond the average expectation. So, no reason to risk what’s there more than is necessary.

And I can go have fun in other ways 🙂