Coming off last month’s big dividend distribution, it’s time for us to spend some of that money! January included a short trip to Florida and the beginning of nearly a full month of travel in Portugal. That includes our very first business class, lay flat, transatlantic flight! Check out our trip breakdown for Florida below and some of our initial expenses for the big Portugal trip.

For our monthly donation, our theme is filling the gaps in international aid by our country—the USA—pulling significant funding via USAID. You can read more about the three charities we’re considering and vote for your favorite in the poll below!

We track our income, spending, and savings each month to stay on our FIRE path and share it with you. Keep reading to see our monthly updates, tips, and charity reviews.

Budget Update

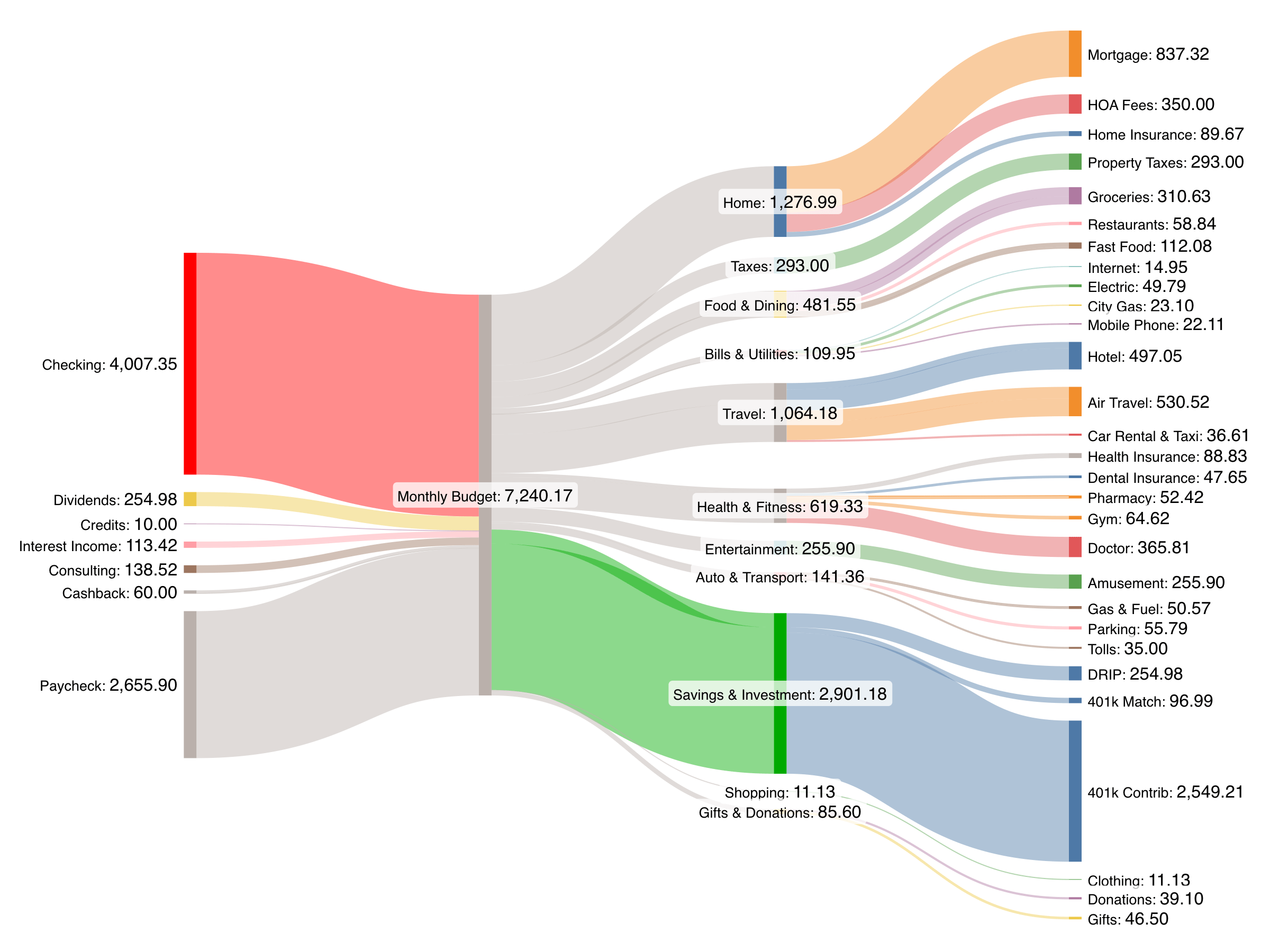

In the Sankey diagram below, the income on the left matches our expenses on the right.

We’ll run through the income and expense sources for the month and remark on any interesting items.

Income Summary

Aside from our usual monthly income, here are some interesting anecdotes:

Dividends

We anticipate significant dividend payments from our various stock holdings—most of it from Vanguard funds like VTSAX. This month’s distribution comes from one of the few legacy individual stocks we still own.

We earned $255 in total distributions.

Cashback

We had two interesting cashback transactions this month:

- One of our Citi cards offered 10% back at CVS; $50 max. We purchased a $492 VISA Gift Card which was about $500 with fees. We then used the card to put a payment on our home insurance—netting us about $42 in savings.

- For several months last year, we earned $10 or $20/month for making deposits into our Laurel Road savings accounts. A portion of that promo has returned and we earned $10 this month for a transfer in.

We received $60 in cashback.

Expense Summary

From our $7,240 monthly budget, we saved and invested $2,901. This comes from 401(k) investments this month.

After subtracting our credits and savings—we spent about $4,329 on living expenses.

That’s 90% of our FIRE budget from 2022 ($4,787/month).

Let’s break down some of the more exciting details this month.

Food & Dining

Our food expenses came out close to as-expected this month as we had a bit of travel but also cut back on groceries as we’re planning to be away for February.

Groceries

At $311, most of our food-related costs came in as groceries. We took advantage of a series of Instacart promotions to save around $45 this month. Our accounts offered $15 off $60+ when checking out with Venmo. We picked up the groceries to help cut out any fees. Jenni spent a week with her family to help her mother recovery from a surgery. She helped stock up on groceries while there.

Restaurants, Fast food, Alcohol & bars

Our dining out expenses this month came from a short trip to Florida and the start of our big trip to Portugal at the end of the month. We spent about $70 fast food and quick takeout foods. We spent another $101 on sit down dining. Most of each of these expenses was while we were in southwest Florida getting a break from the Virginia winter.

We spent $482 on food & dining this month.

Travel

Our Florida-related travel expenses are collated and broken down in the trip cost table below. But, we also started to incur costs for our trip to Portugal at the end of January. That trip runs from 1/28 to 2/26. We’ll have a full trip cost summary table in the next monthly update. We’ll make mention of the Portugal trip costs we incurred in those last few days of January below.

Air Travel

We break down our Florida flight costs in our trip table in this post—we spent about $151 on our pair of round trip Spirit tickets to Florida.

But, separately, we had a $200 air travel cost unrelated to these trips. Without going into too much detail, this expense reflects us retaining 40K Chase UR points for our future use. Considering they’re usually worth about 1.5 cents/point for us, this is a very good deal.

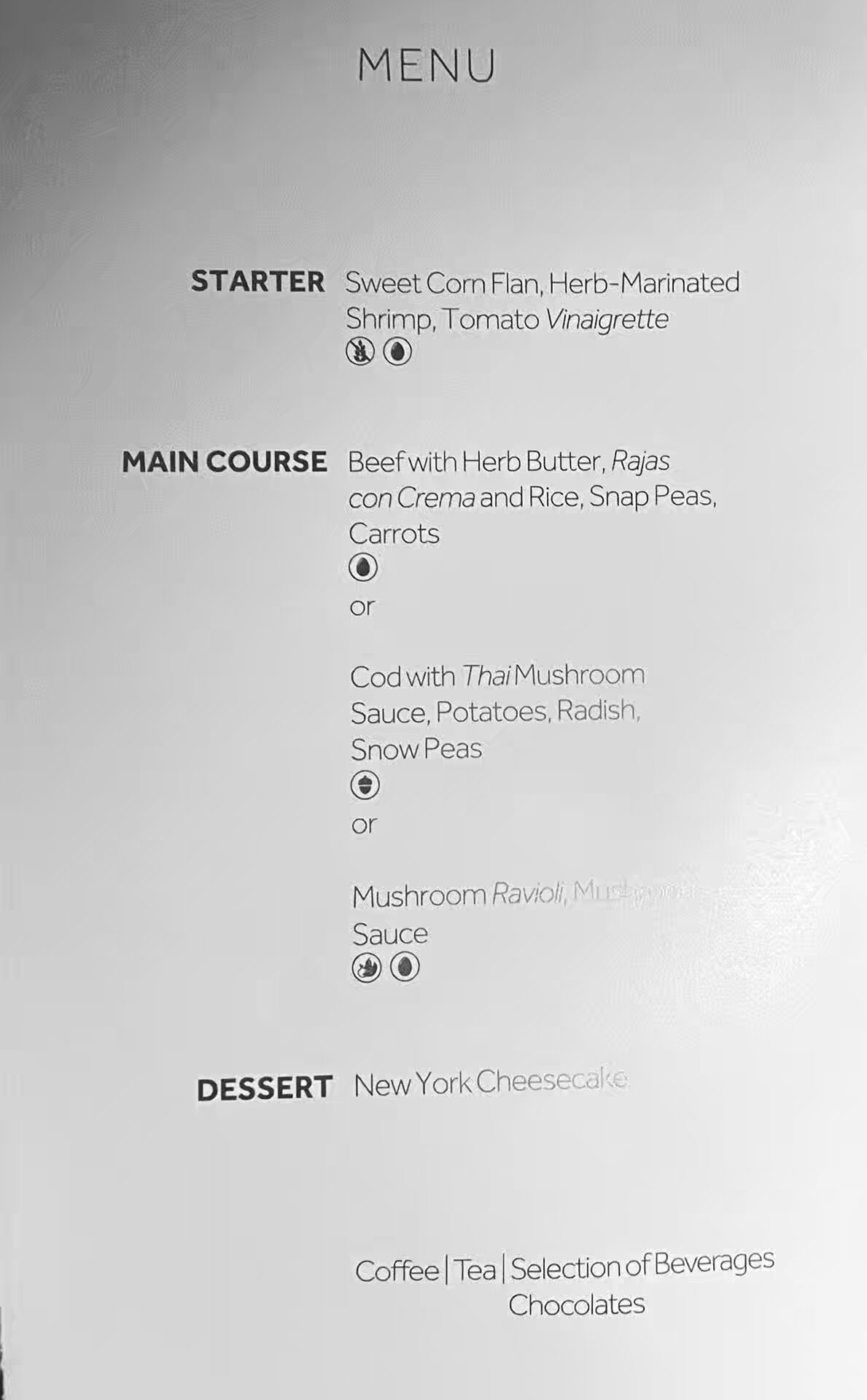

Additionally, we flew from Richmond to JFK to Lisbon on January 28. The first leg to JFK was on Delta. We used a combo of Chris’s AMEX points (8,545) and Jenni’s Delta miles (8,000 plus a $5.60 fee) to get there. After a nice long layover at JFK’s lounges, we flew Portugal’s TAP airline for 35,000 Avianca miles and $52.80 in fees per person. That’s one way—which might sound a little expensive—but it’s because it was our very first business class transatlantic flight!

Instead of being squashed in economy and getting to Lisbon early in the morning with no sleep, we each got to sprawl out in our little lay flat beds and get some rest. Unfortunately, this sweet spot miles redemption on Avianca is no longer available as they recently adjusted their rates. And while we both really enjoyed the first time experience, we each agreed it’d be hard to justify paying more than a few hundred bucks for a similar upgrade in the future.

We also incurred a $60 cost for Avianca’s Lifemiles+ membership. This allowed us to earn back some of the miles we used on this flight (and on another recent trip) plus a few other small benefits. The monthly cost seemed to be worth it when we calculated the cost, but with their award chart recently changing, we ended the membership.

Hotel

Our trip cost table below shows all of our hotel expenses for Florida—we spent about $116 and used points/certificates for most nights.

But, we also incurred the first few nights expenses for our trip to Portugal at the end of the month. We stayed just south of Lisbon in Setúbal from January 29 to February 2 for $265 via a Booking.com apartment. That’s about $66.23/night, which seems pretty great for a complete apartment.

Car Rental

We booked our Florida car rental via Jenni’s Chase Sapphire Reserve which meant it cost us just under 9K points. That’s a great deal and there’s more details in the trip cost table below for Florida.

We also rented a car for the first period of our trip to Portugal at the end of the month. Picking it up from Lisbon’s airport via Enterprise, the cost was just about $43! That’s super cheap for a rental from January 29 to February 2. We again used Jenni’s Chase card which came to just 2,835 points.

We spent $1,064 on travel this month.

Expense Conclusion

While that covers the big stuff, we still had a few random things small purchases to mention that might be of interest.

Health Insurance

Our monthly out-of-pocket health insurance costs went up a little as we’ve tweaked our insurance selection with the new year. We continue to be on individual health plans via the ACA. Our coverage is pretty good, so we’ll see if there’s changes on the horizon for our plans.

Doctor

Our medical expenses are elevated this month and have been recently. This is attributed to expected and routine monitoring, testing, and so on for preventative care and keeping an eye on our health. Don’t worry, we’re in good shape!

Amusement

We spent a good bit on amusing ourselves while in Florida—about $255. While that’s not Disney money, it’s still quite a bit compared to our typical trips for something this short. We took our friends out on a nature preserve, which was about $63 for five of us, and we joined them for a dinner cruise which was about $192. We thoroughly enjoyed both along with the opportunity to catch up with old friends!

Florida Travel Summary

We took an 5-day trip to southwest Florida from January 8 to 12. This trip was another escape from Virginia’s winter. We centered it around some beach visits and catching up with old friends in the area.

Let’s break down our trip budget.

We’ll include all expenses we incurred for the trip—even groceries, restaurants, and amusement. But we’ll skip expenses that we incurred during the trip that were not part of the trip (for example, our utility bill back home in Virginia).

Trip cost table

Let’s take a look at our total trip cost. In the table below, you’ll find four columns:

- Description: a summary of what the expense was for. We’ve included some basic geographical information for things like flights or hotels.

- Cost: our incurred expense in US dollars for the described line item. In some cases, this appears as zero. If a travel currency like hotel points, airline miles, or a credit card reward certificate covers the total expense, we record a zero here. Sometimes, there’s a minor fee in addition to using points/miles for surcharges or taxes.

- Rewards Points/Miles: we maximize our credit card rewards and frequent traveler currencies to cover the costs of our travel wherever possible. You’ll see a short description of the type of certificate or currency that we used.

- Estimated Value: when using a reward from the previous column to cover an expense, we record what we would have otherwise paid for the line item. This gives us a sense of our savings.

The table is generally in chronological order.

We still incurred expenses at home (mortgage, utilities, etc.)—but these do not appear as part of our trip costs.

| Description | Cost (USD, $) | Rewards Pts/Miles | Est. Value (USD, $) |

|---|---|---|---|

| Flight—RIC→FLL (2x, Economy) | 150.78 | ||

| Hotel: Basic—1 nights | 116.07 | ||

| Hotel: Fairfield Inn—2 nights | 2x Free Night Certificate | 644.00 | |

| Hotel: FLL Hyatt—1 night | 8,000 Hyatt Points | 166.73 | |

| Rental car: Florida, 5 days | 8,893 Chase UR | 133.40 | |

| Gas & fuel (rental car) | 29.20 | ||

| Dining: restaurants, fast food | 95.22 | ||

| Groceries | 25.99 | ||

| Amusement—tickets | 255.20 | ||

| Airport parking: 4 nights | 21.50 | ||

| Total | 693.96 | 16,893 Pts, 2x Free Nt. Certs. | 944.13 |

Trip cost discussion

We spent about $694 on a 5 day trip for two people. That’s about $139/day (or about $70/person). We tried to keep our costs low by using points/certificates where we could, but the reality is that southwest Florida is just expensive. Had we not used those points/certificates, we’d have spent another $944 which would make the trip cost about $328/day! Our flight on Spirit was one of the few standout cheap expenses (about $151 for both of us, direct). Phew.

Jenni used her Chase Sapphire Reserve card for our car rental. This allowed us to pool our Chase Ultimate Rewards (UR) points and redeem those for a value of 1.5 cents per point (instead of the typical 1:1). Chase had a booking rate on their portal similar to what we could find with Priceline so we were happy to use about 9K points instead of $133. We transferred some Chase points to Hyatt (1:1) to get a hotel for 8K points instead of about $167 near the airport at the end of our trip.

Summary—

We cut about 57% of the cost of this trip by using points/certificates instead of cash for our various expenses. That’s pretty good, and kept the trip to a reasonable daily cost.

We’ll have a similar trip breakdown in our February update for our trip to Portugal (1/28 to 2/26).

ⓘ Curious about some of the other expenses that we didn’t address? We’ve written about every expense in this month’s diagram either in this post or in the past. Check out our previous budget updates for more detail or ask in the comments below!

How Much We Work

We like to keep track of how much time we spend doing work that is paid.

Let’s add this month to the list…

Design Note: A reader suggested we should collapse the hours worked and net worth history history tables below. They’ve started to get quite long after a handful of years! Let us know if this works well for you in the comments.

History of Monthly “Hours Worked”

| Month | Chris (Hours Worked) | Jenni (Hours Worked) |

|---|---|---|

| May 2020 | 41 | 108 |

| Jun 2020 | 38 | 96 |

| Jul 2020 | 36 | 120 |

| Aug 2020 | 39 | 48 |

| Sep 2020 | 27 | 76 |

| Oct 2020 | 26 | 104 |

| Nov 2020 | 27 | 57 |

| Dec 2020 | 28 | 57 |

| Jan 2021 | 25 | 102 |

| Feb 2021 | 24 | 104 |

| Mar 2021 | 24 | 106 |

| Apr 2021 | 23 | 85 |

| May 2021 | 17 | 29.75 |

| Jun 2021 | 19 | 66 |

| Jul 2021 | 21 | 30.25 |

| Aug 2021 | 23 | 16.5 |

| Sep 2021 | 26 | 28 |

| Oct 2021 | 22 | 49 |

| Nov 2021 | 21 | 51 |

| Dec 2021 | 64 | 27 |

| Jan 2022 | 32 | 80 |

| Feb 2022 | 29 | 63 |

| Mar 2022 | 14 | 70 |

| Apr 2022 | 15 | 21 |

| May 2022 | 14 | 36 |

| Jun 2022 | 6 | 12 |

| Jul 2022 | 13 | 45.5 |

| Aug 2022 | 15 | 96 |

| Sep 2022 | 12 | 54 |

| Oct 2022 | 14 | 34.5 |

| Nov 2022 | 12 | 72 |

| Dec 2022 | 11 | 16.5 |

| Jan 2023 | 10 | 88 |

| Feb 2023 | 11 | 81.5 |

| Mar 2023 | 12 | 47.5 |

| Apr 2023 | 8 | 1 |

| May 2023 | 16 | 100 |

| Jun 2023 | 10 | 109 |

| Jul 2023 | 12 | 48 |

| Aug 2023 | 16 | 54.5 |

| Sep 2023 | 9 | 20 |

| Oct 2023 | 14 | 22 |

| Nov 2023 | 15 | 22 |

| Dec 2023 | 16 | 12 |

| Jan 2024 | 12 | 61.25 |

| Feb 2024 | 14 | 28.5 |

| Mar 2024 | 16 | 61.5 |

| Apr 2024 | 12 | 22 |

| May 2024 | 8 | 19.5 |

| Jun 2024 | 18 | 19.5 |

| Jul 2024 | 14 | 44 |

| Aug 2024 | 18 | 81 |

| Sep 2024 | 15 | 20 |

| Oct 2024 | 51 | 18 |

| Nov 2024 | 5 | 15 |

| Dec 2024 | 19 | 12 |

| Jan 2025 | 17.5 | 17 |

Most of our [limited] labor income this month went into 401(k) contributions.

Net Worth Update

Net worth is not our primary measurement and can understand it can be discouraging if you’re working yourself out of debt. We also understand it’s difficult to be transparent with our readers without divulging this information so we continue to do so.

Account breakdown

The market keeps chugging along and so do our investments. From a high level, our assets and liabilities are shown in the data table below as of January 31, 2025.

| Description | Value (USD, $) |

|---|---|

| 401(k) | 1,068,037 |

| Brokerage | 947,620 |

| Roth IRA | 199,132 |

| Traditional IRA | 25,833 |

| HSA | 65,991 |

| Real Estate | 448,600 |

| Mortgage | (133,998) |

| Miscellaneous Assets | 25,000 |

| Checking & Savings | 43,490 |

| Net Worth | 2,689,706 |

- Miscellaneous assets include specific investments we’ve made in physical assets (think collectibles) and treasury bonds

- Amounts do not reflect the value of the businesses Chris owns or their assets, which should appear as income to us over future years

- Jenni’s Prius is omitted

The S&P 500 was up about 2.7% for the month.

We were up about 2.6%. So, we performed inline with the S&P.

Overall, our net worth increased by around $68K this month.

Net Worth History

| Date | Amount | % Change |

|---|---|---|

| July 2020 | $1,555,289 | – |

| August 2020 | $1,597,334 | 2.7% |

| September 2020 | $1,566,393 | (2.0%) |

| October 2020 | $1,568,182 | 0.01% |

| November 2020 | $1,720,113 | 9.6% |

| December 2020 | $1,810,864 | 5.3% |

| January 2021 | $1,860,996 | 2.8% |

| February 2021 | $1,878,154 | 0.9% |

| March 2021 | $1,918,269 | 2.1% |

| April 2021 | $2,010,849 | 4.8% |

| May 2021 | $2,049,213 | 1.9% |

| June 2021 | $2,093,896 | 2.2% |

| July 2021 | $2,092,153 | (0.1%) |

| August 2021 | $2,130,761 | 1.8% |

| September 2021 | $2,070,730 | (2.8%) |

| October 2021 | $2,151,272 | 3.9% |

| November 2021 | $2,095,273 | (2.6%) |

| December 2021 | $2,160,235 | 3.1% |

| January 2022 | $2,055,292 | (4.9%) |

| February 2022 | $2,058,001 | 0.01% |

| March 2022 | $2,134,428 | 3.7% |

| April 2022 | $1,968,069 | (7.8%) |

| May 2022 | $1,975,569 | 0.04% |

| June 2022 | $1,868,397 | (5.4%) |

| July 2022 | $1,975,608 | 5.7% |

| August 2022 | $1,878,352 | (5.2%) |

| September 2022 | $1,735,997 | (7.6%) |

| October 2022 | $1,820,287 | 4.9% |

| November 2022 | $1,920,635 | 5.5% |

| December 2022 | $1,866,513 | (2.8%) |

| January 2023 | $1,953,691 | 4.7% |

| February 2023 | $1,882,656 | (3.6%) |

| March 2023 | $1,969,566 | 4.6% |

| April 2023 | $1,981,934 | 0.6% |

| May 2023 | $1,995,247 | 0.7% |

| June 2023 | $2,092,479 | 4.9% |

| July 2023 | $2,189,821 | 4.7% |

| August 2023 | $2,140,296 | (2.2%) |

| September 2023 | $2,042,865 | (4.6%) |

| October 2023 | $2,015,648 | (1.3%) |

| November 2023 | $2,157,404 | 7.0% |

| December 2023 | $2,261,458 | 4.8% |

| January 2024 | $2,296,269 | 1.5% |

| February 2024 | $2,365,110 | 3.0% |

| March 2024 | $2,434,250 | 2.9% |

| April 2024 | $2,371,284 | (2.6%) |

| May 2024 | $2,423,205 | 2.2% |

| June 2024 | $2,472,353 | 2.0% |

| July 2024 | $2,513,877 | 1.7% |

| August 2024 | $2,560,215 | 1.8% |

| September 2024 | $2,592,558 | 1.3% |

| October 2024 | $2,576,903 | (0.6%) |

| November 2024 | $2,685,615 | 4.2% |

| December 2024 | $2,621,732 | (2.4%) |

| January 2025 | $2,689,706 | 2.6% |

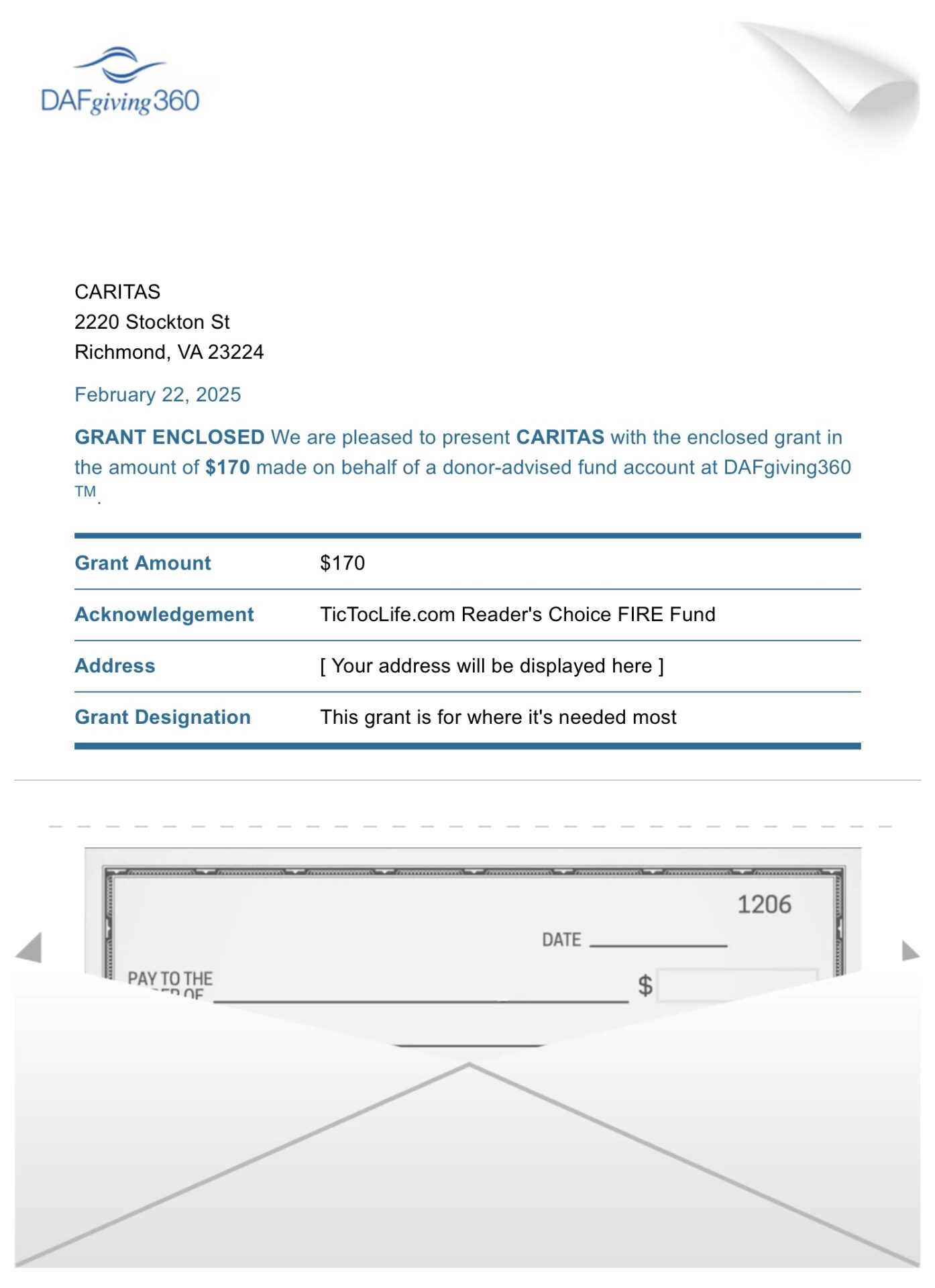

Previous Donation Winner

With this polar vortex hitting the east coast repeatedly this winter, our donation winner, CARITAS, will have extra funds to help keep their emergency shelters open during these chilly nights.

Our Reader’s Fund seeks to leverage the principles of FIRE to build a lifetime of giving.

Thank you for your participation in our polls over the last 4 years. We’ve given over $7,000 to deserving charities with your help in deciding which organizations to donate to.

Polls are now open for our next round of candidates: filling the gap left by USAID.

Charity Round-Up

The United States Agency for International Development (“USAID”) was started by John F. Kennedy in 1961. Its public goal was to provide assistance outside the USA where need was great and often acute. Natural disasters, refugee crises, and war have often been the sparks for the organization’s greatest projects. And of course, a less public purpose for the organization is to act as a tool of “soft power” for the United States. It’s not all altruistic, but that doesn’t mean the project outcomes haven’t had massively positive, life-saving results.

The agency is on life support with only a few percent of its approximate 10,000 person employment still working to finalize its scope as our government redirects its focus. This means some $40B in international aid will no longer be delivered to related projects and relief. And so, our desire this month is to learn a little more about some of the top partners USAID worked with to see if we can put just a little money into projects that are losing much more right now.

Each of these organizations provides humanitarian aid around the globe and have all been hit by the funding freeze. They need our support to keep their work moving forward. Each organization has an excellent charity rating. We invite you to learn more about great work around the world and join us in donating to one of them by casting your vote.

Summaries below include the impact metrics and a link to their Guidestar profile which details the nonprofit’s operations and transparency.

1) ReSurge International

Why? 90% of global burden of surgical disease occurs in low income countries. Increasing the access to surgical care can reduce the number of fatalities and alleviate poverty by allowing them to return to normal life and contribute to their family and community. Last year, half of ReSurge’s funding came from a USAID grant.

Where? Ethiopia, Tanzania, Uganda, Nepal, Zambia, Zimbabwe, Switzerland, India

What? ReSurge International is a nonprofit organization providing reconstructive surgical care for low-income communities. They provide free treatment, restoring normal function to those affected by a congenital defect, accident, trauma, burns or cancer. They train new surgeons, reducing the shortage of surgeons train and help develop the local surgical centers for a long term solution. Training just one surgeon has the potential to treat 10,000 patients. If that surgeon becomes a trainer, that number grows to over 400,000.

2) AVAC – AIDS Vaccine Advocacy Coalition

Why? Without funding for treatment and prevention measures for HIV, the next generation will see a dramatic rise in HIV cases. We are already way behind the 20205 global target of less than 370,000 cases, with 1.3 million HIV infections diagnosed in 2023.

Where? Globally

What? AVAC is a non-profit organization with a vision for a world without AIDS and improving global health. They promote effective HIV prevention options and equal access for everyone who needs them, including education measures. Their policy and advocacy groups help the development of an HIV vaccine and the distribution of PreP (pre-exposure prophylaxis).

If US AIDS funding is lost, the UN Program on AIDS estimates by 2029:

- 350,000 new HIV infections in children

- 8.7 million new HIV adult infections

- 6.3 million AIDS-related deaths

- 3.4 million additional AIDS orphans

3) CARE

Why? This trusted organization has been providing humanitarian aid for over 80 years reaching 53 million people. 90% of their expenses goes directly towards their programs. Even with all their current fundraising, they only have 54% of what they would need to help everyone they can reach.

Where? Globally with a focus in Bangladesh, Brazil, Peru, Ecuador, Mexico, Thailand, Syria, Jordan, Yemen, Nepal, India, Africa

Our Notes: CARE is a non-profit organization providing humanitarian aid around the globe, with a focus on women and children. They are active in 121 countries and implemented 1,450 poverty-fighting development and humanitarian aid projects last year.

They fight poverty from various angles:

- Emergency food & water

- Crisis

- Healthcare

- Climate

- Education

- Equality

Nonprofit poll

After reviewing the list above, please take a moment to vote for which nonprofit you think will put funds to use in the best way.

(Have trouble using or seeing the poll above? Some reader tools or apps may not display it. View this page in a browser or use this link to our Reader Fund page which has a copy of the poll!)

Thank you for taking the time to vote!

One of our primary goals with TicTocLife is building a stream of giving within the FIRE community and that starts with knowledge.

Want to hear about the results? Sign up for our free FIRE Insider newsletter! We send it out every few weeks and include the monthly poll results and donation winners. You can see an archive of the FIRE Insider and sign up here!

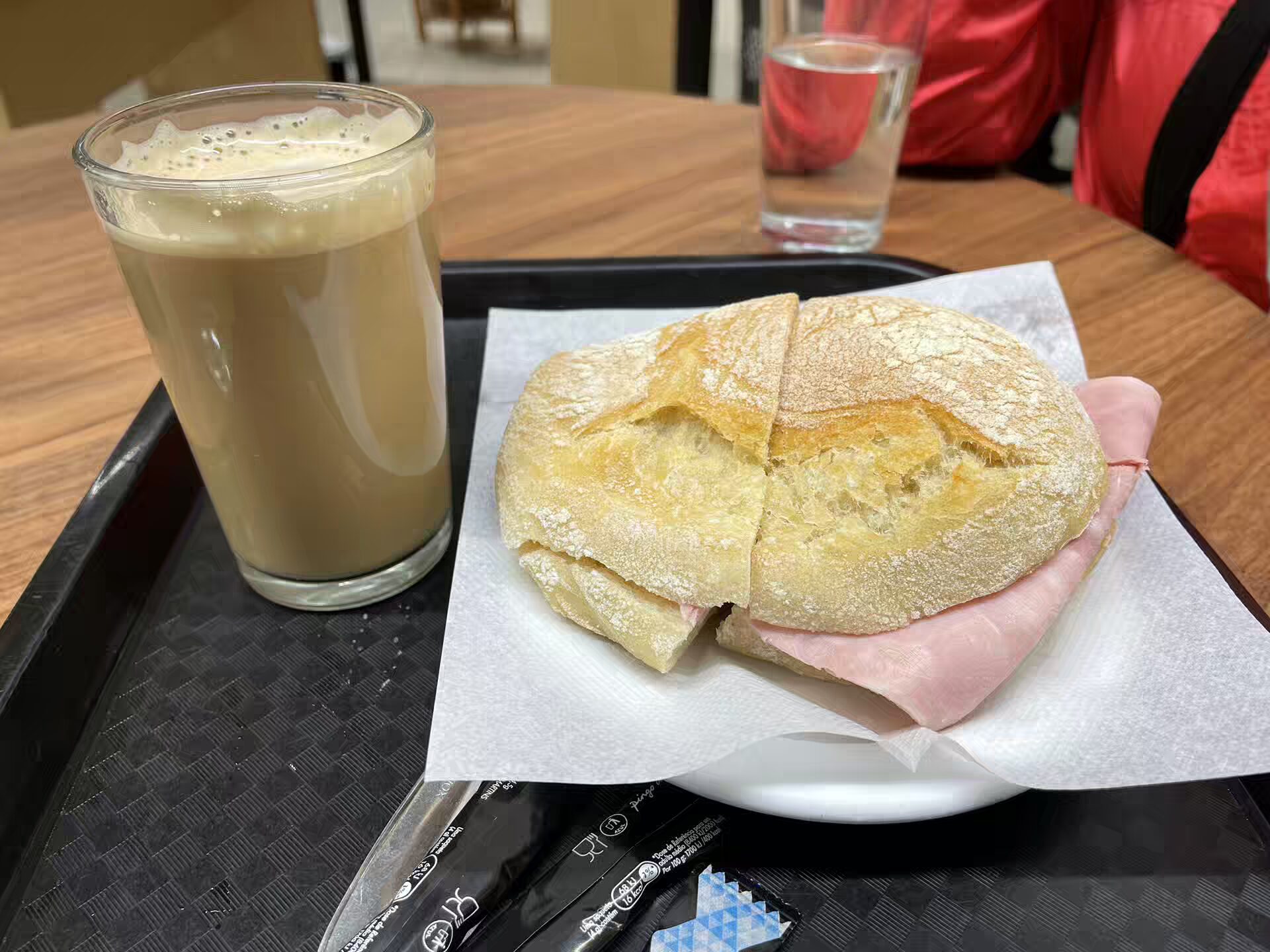

What’s Next

The end of January started a very long trip to Portugal for us. We’ll be exploring Lisbon with family and then making our way to southern Portugal—the Algarve—with a friend joining us for a bit of the time. The south coast will make for a lovely break from the end of Virginia’s winter. By the end of February, we’ll start meandering back up to central Portugal to end the trip.

Much of our next month will be spent enjoying this bit of the Iberian peninsula—soaking in the sunny parts, exploring Roman ruins, going on coastal hikes, and generally making good use of what FIRE has given us the freedom to do.

By the final few days of the month, once we’re back home, we’ll be working to catch up on the what we delayed over the month. That’ll include getting our taxes ready for mid-March’s due dates.

We’ll have a big break down of the nearly complete month of traveling for you in our next post! Until then…

Have any big spring travel plans?

Let us know in the comments or on Threads and X (Twitter)!