Winter’s sharp, cold fingers pushed us to escape Virginia for somewhere warm! We found a respite from its grasp—and yet another moment to appreciate our financial independence—in the tiny island of Barbados. Read on rundown on our winter escape to Barbados!

With 2024 in full bloom, we continued our donation tradition to one of three nonprofits on digital technology. You can read more about them and vote for your favorite in the poll below!

Each month, we track our income, spending, and savings to stay on our FIRE path and share it with you. Please keep reading to see our monthly updates, tips, and charity reviews.

Budget Update

If you’d like a more detailed description of our typical monthly cash flow (like our jobs or housing situation), check out our previous budget updates.

In the Sankey diagram below, the income on the left matches our expenses on the right.

We’ll run through the income and expense sources for the month and remark on any interesting items.

Income Summary

We survived Virginia’s winter in January but didn’t make it through February—we had an escape to Barbados! So, our income was down from last month’s “catchup” with much less income-generating effort.

Aside from our usual monthly income, here are some interesting anecdotes:

eBay

We sold an old collectible from one of our hobbies to earn a few hundred bucks on eBay. We also sold off an unused wool scarf and car part from Jenni’s previous Prius.

We earned $298 in from eBay sales.

Credits

Several of our credit cards offer statement credits for purchasing with certain companies. Chris’s AMEX gold earned $10 back for Grubhub which he used on a local bakery pickup.

We received $10 in statement credits.

Consulting

Chris has been earning around $470/month from his ongoing consulting business. In reality, this is slowly drawing down assets and funds within the business.

Consulting earned $462.

Cashback

Laurel Road no-fee checking accounts earn a $10 monthly bonus for making direct deposits of at least $2,500/month.

We earned $10 in cash back.

Expense Summary

From our $5,232 monthly budget, we saved and invested about $979.

After subtracting our credits and savings, we spent about $4,252 on living expenses.

That’s 89% of our FIRE budget from 2022 ($4,787/month).

Let’s break down some of the more exciting details.

Food & Dining

All-in-all, this category seems to be a bit below average.

Groceries

Our grocery spending came to about $342. We’re finally getting to the end of the food stored up in our pantry. This figure includes the groceries we bought for the first nine days of the month in Barbados.

Restaurants, Fast food, Alcohol & bars

Restaurants and fast food came to about $211. This comes almost entirely from dining out while in Barbados. We sampled lots of local cuisine—whether small restaurants, an art cafe, or the local fish fry. Delicious stuff!

We spent $553 on food & dining this month.

Travel

Our trip to Barbados began on January 30 and we were back February 9. We escaped the worst of Virginia’s winter—trading it for sun, ocean, and swimmable temperatures! Chris also renewed his passport—the “general” subcategory—at a total cost of $136. He saved about $20 by taking the photos himself and getting them printed at our nearby Walgreens for under a buck.

Hotel

We spent February 1 to 9 at three different Airbnbs near Barbados’s capital, Bridgetown. The first—where our stay started on January 30—turned out to be a really lovely place. The fully stocked plantation-style cottage was tough to leave with its close ocean access, boardwalk, and delicious eateries nearby.

But, we also loved the more rural apartment we stayed in afterward. It was even larger with a similarly accessible beach.

Our last stay was in the more urban part of Bridgetown which gave us easy access to museums and other city-related sights. It was a tiny studio apartment but met our needs—plus it was dirt cheap!

The total cost for these Airbnbs in February was about $1,000 or about $112/night. We saved a few dozen bucks through discounted Airbnb gift cards.

Car Rental & Taxi

We opted for Uber to take us home from our local airport. Chris used his $10 monthly Uber credit to help keep the price reasonable.

In Barbados, we used local taxis to get to/from our stays. The run to Bridgetown’s airport was a little costly—$34 for a pretty short ride but we quite enjoyed our driver.

We spent $1,212 on travel this month.

Full trip cost breakdown below!

Barbados Travel Summary

Now that we’ve discussed our February travel expenses, we can combine our January expenses from the same trip. That’ll give us the total cost of our trip to Barbados for 11 days.

We’ll include all expenses we incurred for the trip—even groceries, restaurants, and amusement. But we’ll skip expenses that we incurred during the trip that were not part of the trip (for example, our utility bill back home in Virginia).

Trip cost table

Let’s take a look at our total trip cost. In the table below, you’ll find four columns:

- Description: a short summary of what the expense was for. We’ve included some basic geographical information for things like flights or hotels.

- Cost: our incurred expense in US dollars for the described line item. In some cases, this appears as zero. If a travel currency like hotel points, airline miles, or a credit card reward certificate covers the total expense, we record a zero here. In some cases, there’s a minor fee in addition to using points/miles for surcharges or taxes.

- Rewards Pts/Miles: we maximize our credit card rewards and frequent traveler currencies to cover the costs of our travel wherever possible. You’ll see a short description of the type of certificate or currency that we used.

- Estimated Value: when using a reward from the previous column to cover an expense, we record what we would have otherwise paid for the line item. This gives us a sense of our savings.

The table is generally in chronological order. Expenses from January (last month) are also included.

We still incurred expenses at home (mortgage, utilities, etc.)—but these do not appear as part of our trip costs.

| Description | Cost (USD, $) | Rewards Pts/Miles | Est. Value (USD, $) |

|---|---|---|---|

| Flight—RIC→BGE (Roundtrip) | 262.40 | 44,000 AA Miles | 1,668.00 |

| Hotels: 10 nights total | 1,255.17 | ||

| Taxis & Uber | 134.61 | ||

| Dining: restaurants, fast food, coffee shops | 220.41 | ||

| Groceries | 156.04 | ||

| Amusement: tickets, tours, entry fees | 40.20 | ||

| Mobile phone: eSIMs | 13.00 | ||

| Total | 2,081.83 | 44,000 Miles | 1,668.00 |

Trip cost discussion

Ultimately, it cost us about $2,082 to soak in Barbados’s beauty for 11 days. That’s about $189/day or around $95/person/day on average. That’s all-in—food, fun, shelter, and transit!

Had we not cut our expenses by $1,406 (net) through the use of airline miles, we would have spent about $317/day or nearly 68% more! Those flights were normally $834/person!

One thing we’d like to reinforce is that while this blog is about personal finance and financial independence—that is not the focus of trips like this for us.

We thoroughly enjoy them. If we want to buy tickets for an experience, try a new food, or tack on flights to a nearby island for a new experience—we do it.

FIRE isn’t about deprivation, it’s about freedom!

Simply being able to research, plan ahead, and have the flexibility to travel on off days during shoulder seasons massively cuts down on costs. And, it cuts your queue times and crowds!

Expense Conclusion

While that covers the big stuff, we still had a few random things small purchases to mention that might be of interest.

Eye care

Chris had to replace a pair of sunglasses after losing a pair in the ocean—which seems like a pretty standard move for him! He replaced the prescription pair through Goggles4U he lost, and picked up another duplicate, for just about $26 shipped. That sure seems like a great deal!

Mobile Phone

While we’re both on dirt cheap SIM cards for home use (Mint for Jenni, Tello for Chris), we’ve continued to have success with eSIMs while abroad. Even on Barbados, we found Airalo (referral, get $3 off first eSIM) worked with a good local provider. We paid $6.50 for 1GB of data over 7 days and just rotated who bought the eSIM halfway through the trip. Having internet access the moment you land at a new place is such a game changer for travel!

Auto Insurance

Our biannual car insurance payment was due for our two vehicles. $479 is quite a bit of money when you consider neither of us drive much!

How Much We Work

We like to keep track of how much time we spend doing work that is paid.

Let’s add this month to the list…

| Month | Chris (Hours Worked) | Jenni (Hours Worked) |

|---|---|---|

| May 2020 | 41 | 108 |

| Jun 2020 | 38 | 96 |

| Jul 2020 | 36 | 120 |

| Aug 2020 | 39 | 48 |

| Sep 2020 | 27 | 76 |

| Oct 2020 | 26 | 104 |

| Nov 2020 | 27 | 57 |

| Dec 2020 | 28 | 57 |

| Jan 2021 | 25 | 102 |

| Feb 2021 | 24 | 104 |

| Mar 2021 | 24 | 106 |

| Apr 2021 | 23 | 85 |

| May 2021 | 17 | 29.75 |

| Jun 2021 | 19 | 66 |

| Jul 2021 | 21 | 30.25 |

| Aug 2021 | 23 | 16.5 |

| Sep 2021 | 26 | 28 |

| Oct 2021 | 22 | 49 |

| Nov 2021 | 21 | 51 |

| Dec 2021 | 64 | 27 |

| Jan 2022 | 32 | 80 |

| Feb 2022 | 29 | 63 |

| Mar 2022 | 14 | 70 |

| Apr 2022 | 15 | 21 |

| May 2022 | 14 | 36 |

| Jun 2022 | 6 | 12 |

| Jul 2022 | 13 | 45.5 |

| Aug 2022 | 15 | 96 |

| Sep 2022 | 12 | 54 |

| Oct 2022 | 14 | 34.5 |

| Nov 2022 | 12 | 72 |

| Dec 2022 | 11 | 16.5 |

| Jan 2023 | 10 | 88 |

| Feb 2023 | 11 | 81.5 |

| Mar 2023 | 12 | 47.5 |

| Apr 2023 | 8 | 1 |

| May 2023 | 16 | 100 |

| Jun 2023 | 10 | 109 |

| Jul 2023 | 12 | 48 |

| Aug 2023 | 16 | 54.5 |

| Sep 2023 | 9 | 20 |

| Oct 2023 | 14 | 22 |

| Nov 2023 | 15 | 22 |

| Dec 2023 | 16 | 12 |

| Jan 2024 | 12 | 61.25 |

| Feb 2024 | 14 | 28.5 |

Jenni worked a little more with the new year kicking off and supporting a coworker who was on paternity leave.

Net Worth Update

Net worth is not our primary measurement and can understand it can be discouraging if you’re working yourself out of debt. We also understand it’s difficult to be transparent with our readers without divulging this information so we continue to do so.

Account breakdown

The market keeps chugging along and so do our investments. From a high level, our assets and liabilities are shown in the data table below as of February 29, 2024.

| Description | Value (USD, $) |

|---|---|

| 401(k) | 907,428 |

| Brokerage | 824,358 |

| Roth IRA | 171,421 |

| Traditional IRA | 15,711 |

| HSA | 59,664 |

| Real Estate | 422,400 |

| Mortgage | (138,252) |

| Miscellaneous Assets | 51,642 |

| Checking & Savings | 50,738 |

| Net Worth | 2,365,110 |

- Miscellaneous assets include specific investments we’ve made in physical assets (think collectibles) and treasury bonds

- Amounts do not reflect the value of the businesses Chris owns or their assets, which should appear as income to us over future years

- Jenni’s Prius is omitted

The S&P 500 was up about 5.2% for the month.

We did a bit worse for the month with a 3.0% gain. We have some transfers lagging that should be reflected in a higher gain next month.

Overall, our net worth increased by around $69K this month. This is also our highest recorded net worth.

Net Worth History

| Date | Amount | % Change |

|---|---|---|

| July 2020 | $1,555,289 | – |

| August 2020 | $1,597,334 | 2.7% |

| September 2020 | $1,566,393 | (2.0%) |

| October 2020 | $1,568,182 | 0.01% |

| November 2020 | $1,720,113 | 9.6% |

| December 2020 | $1,810,864 | 5.3% |

| January 2021 | $1,860,996 | 2.8% |

| February 2021 | $1,878,154 | 0.9% |

| March 2021 | $1,918,269 | 2.1% |

| April 2021 | $2,010,849 | 4.8% |

| May 2021 | $2,049,213 | 1.9% |

| June 2021 | $2,093,896 | 2.2% |

| July 2021 | $2,092,153 | (0.1%) |

| August 2021 | $2,130,761 | 1.8% |

| September 2021 | $2,070,730 | (2.8%) |

| October 2021 | $2,151,272 | 3.9% |

| November 2021 | $2,095,273 | (2.6%) |

| December 2021 | $2,160,235 | 3.1% |

| January 2022 | $2,055,292 | (4.9%) |

| February 2022 | $2,058,001 | 0.01% |

| March 2022 | $2,134,428 | 3.7% |

| April 2022 | $1,968,069 | (7.8%) |

| May 2022 | $1,975,569 | 0.04% |

| June 2022 | $1,868,397 | (5.4%) |

| July 2022 | $1,975,608 | 5.7% |

| August 2022 | $1,878,352 | (5.2%) |

| September 2022 | $1,735,997 | (7.6%) |

| October 2022 | $1,820,287 | 4.9% |

| November 2022 | $1,920,635 | 5.5% |

| December 2022 | $1,866,513 | (2.8%) |

| January 2023 | $1,953,691 | 4.7% |

| February 2023 | $1,882,656 | (3.6%) |

| March 2023 | $1,969,566 | 4.6% |

| April 2023 | $1,981,934 | 0.6% |

| May 2023 | $1,995,247 | 0.7% |

| June 2023 | $2,092,479 | 4.9% |

| July 2023 | $2,189,821 | 4.7% |

| August 2023 | $2,140,296 | (2.2%) |

| September 2023 | $2,042,865 | (4.6%) |

| October 2023 | $2,015,648 | (1.3%) |

| November 2023 | $2,157,404 | 7.0% |

| December 2023 | $2,261,458 | 4.8% |

| January 2024 | $2,296,269 | 1.5% |

| February 2024 | $2,365,110 | 3.0% |

Previous Donation Winner

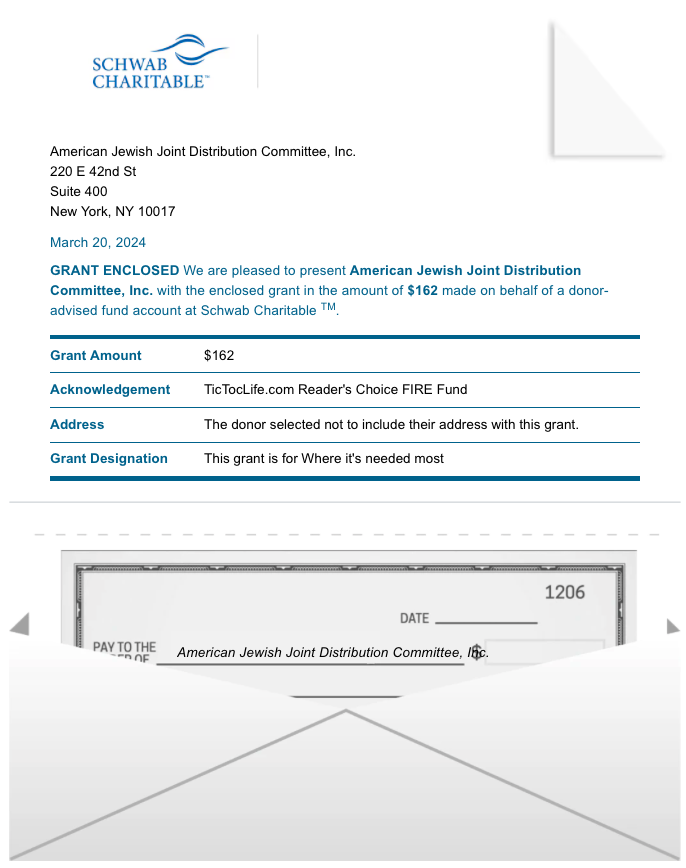

Congratulations to the American Jewish Joint Distribution Committee, as this month’s poll winner. This organization has been helping aid Ukraine since the very beginning and will continue until this war is over.

Our Reader’s Fund seeks to leverage the principles of FIRE to build a lifetime of giving.

Thank you for your participation in our polls over the last 43 months. We’ve given $5,000 to deserving charities with your help in deciding which organizations to donate to.

Polls are now open for our next round of candidates: Digital Technology Organizations.

Charity Round-Up

Digital technology has become an integral part of our lives from bridging the digital divide to safeguarding privacy. But not everyone has equal access or an understanding of this digital realm.

These three charities work to ensure that no one is left behind in the digital revolution. They have great charity ratings to ensure our donation will have the most significant impact. We invite you to learn more about them and join us in donating to one of them by casting your vote.

Summaries below include the impact metrics and a link to their Guidestar profile which details the nonprofit’s operations and transparency.

1) The Electronic Frontier Foundation

Why? The capabilities of the internet are getting bigger and better than ever. With the expansion of technology, our digital privacy is vulnerable. Protecting our privacy rights in the digital world is just one focus of many for this organization.

Where? Global

Our Notes: The Electronic Frontier Foundation is a nonprofit organization that helps to promote and defend internet civil liberties. Their mission is to ensure that technology supports freedom, justice and innovation for all people of the world. A few areas of focus are online free speech, digital privacy, computer security, and transparency and accountability.

2) Wikimedia Foundation, Inc.

Why? Knowledge is power! With Wikipedia’s free online encyclopedia to over 60 million articles, all it takes is an internet connection to gain access to information that can change lives and create a well informed and functional society.

Where? Global

Our Notes: Wikimedia Foundation, Inc. is a nonprofit foundation that brings free information through their various knowledge websites including Wikipedia, Wikimedia Commons (a multimedia repository), and Wikisource (a collection of primary source materials). In addition to their thousands of editors, the foundation supports these sites with software and engineering improvements, and server maintenance.

3) Connect to Compete, Inc.

Why? Everyone deserves to be able to use the power of the internet to access opportunities regardless of age, race, geography, income, or education level.

Where? The United States

Our Notes: Connect to Compete, Inc., aka EveryoneOn, is a nonprofit charity that fights for digital equity. They provide affordable internet services and computers to low income families. They also help people of all ages develop their digital skills to empower the knowledge of the internet.

Nonprofit poll

After reviewing the list above, please take a moment to vote for which nonprofit you think will put funds to use in the best way.

(Have trouble using or seeing the poll above? Some reader tools or apps may not display it. View this page in a browser or use this link to our Reader Fund page which has a copy of the poll!)

Thank you for taking the time to vote!

One of our primary goals with TicTocLife is building a stream of giving within the FIRE community and that starts with knowledge.

Want to hear about the results? Sign up for our free FIRE Insider newsletter! We send it out every few weeks and include the monthly poll results and donation winners. You can see an archive of the FIRE Insider and sign up here!

What’s Next

With our big winter trip in the rearview, we spent much of February how we expect March to be: catching up on life. FIRE doesn’t mean an escape from chores, errands, maintenance, and the general grind of life. But, it does make it a lot more enjoyable!

We’ll spend a good bit of time catching up with friends and family, no doubt. And, of course, we’ll be working on our wedding planning for May. We’ve got a lot to work on to bring that event into fruition!

We’re recharged and ready for it!

How has 2024 started for you and your finances?

Let us know in the comments or on Threads and X (Twitter)!

2 replies on “$2,082 for Our 11-Day Winter Escape (Feb. 2024 Update)”

I love reading your updates. Thanks for sharing with so much detail.

My wife and I are about 2 years behind you based on the numbers and navigating the last few years of the FI journey can be tough. I like your approach of a modified work schedule as a way to ease out of full time work.

Any thoughts on how long you’ll keep up the modified schedule vs full RE? How has that target moved over time? Your spending is still in line, but are you gunning for a little fatter FI now?

Hey David!

Thanks for your comment. 🙂

We’re happy to share all the details as it does seem to help folks in their pursuit to financial independence. That’s great!

Yeah, we tried to make for a slow and easy transition from full time work, to part time, and onto “retirement”.

For the foreseeable future, we’ll keep with a similar “work” schedule. We don’t really have a motivation to change it, at the moment. But, we’re very willing to if that changes.

Right now, we both like the work we’re doing. In fact, one of our key questions to ask each other as a checkin for our ongoing work is: “would you keep doing this for free?” That’s what encouraged each of us to initially cut out portions of our work, where we wouldn’t say “yes” to that question. So, we’re left with the parts we really enjoy, find fulfilling, meaningful, etc. In fact, we each put a fair amount of effort into things that might be considered “work” but we do for free. A lot of that revolves around nonprofits and volunteering, which, as they tend to be related to our professional backgrounds, blur a bit into the work we still get paid for.

No doubt we’ll continue to cut out paid work, and maybe, one day we’ll be without.

Our spending/income/assets have little to do with all that at this point. You’re right, our assets easily support going full FIRE and thankfully our spending hasn’t really risen beyond inflation over the years. And that’s without really trying to keep it that way. Fortunately our tastes seem to be pretty simple!

While things could change, we expect that we won’t ever catch our spending up to what our assets will provide in ongoing income/growth. So, we’ll likely continue to increase our donations.

Thanks for coming by! We hope you continue to enjoy our updates. 🙂