Ah…what a lovely way to spend our mostly-retired FIRE lifestyle. For nearly all of February we were in Portugal. We soaked up the mild weather, kept the sun overhead on numerous hikes, and had the pleasure of welcoming two family members and one friend to the lovely Iberian peninsula for the first time. No surprise, it was one of our most expensive travel months to date!

For our monthly donation, our theme is preventing disease. You can read more about the three charities we’re considering and vote for your favorite in the poll below!

We track our income, spending, and savings each month to stay on our FIRE path and share it with you. Keep reading to see our monthly updates, tips, and charity reviews.

Budget Update

In the Sankey diagram below, the income on the left matches our expenses on the right.

We’ll run through the income and expense sources for the month and remark on any interesting items.

Income Summary

The most notable thing about our income this month is…just how little money we made! We spent nearly the whole month in Portugal so this makes sense.

In fact, our total income of about $165 came largely from Chris’s small consulting payment from his company ($139). The remainder was from bank interest and a dining credit with AMEX.

Expense Summary

From our $7,732 monthly budget, we saved and invested zero dollars! With so little income, there wasn’t really any room to invest anything.

After subtracting our credits and savings—we spent about $7,722 on living expenses.

That’s 161% of our FIRE budget from 2022 ($4,787/month).

Let’s break down some of the more exciting details this month.

Food & Dining

This is likely one of our highest food-related expense months we’ve ever had! We spent nearly the whole month in Portugal and had friends/family along for about half the time. Naturally, we dined out more than usual.

Groceries

Well, we virtually doubled our grocery expenses this month at $591. Even as inexpensive as groceries are in Portugal, we’re not benefiting from strategically shopping sales and what not like we do at home. On top of that, we buy more convenience foods and tend to try lots of different local foods via the grocery store. Lastly, with visitors for about half the month, certainly some of their grocery expenses seeped into our costs–though they did make some contributions.

Restaurants, Fast food, Alcohol & bars

Our dining out expenses this month came from a short trip to Florida and the start of our big trip to Portugal at the end of the month. We spent about $126 fast casual food and $104 at bars. We spent another $681 on sit down dining. As high as our restaurant expenses were, a large chunk was at Fado restaurants. So, it was basically dinner and a musical show—something we love!

We spent $1,502 on food & dining this month.

Auto & Transport

We had a variety of auto & transport costs this month that really added up! Mostly, this was due to a our big trip.

Gas & Fuel

At $192, our fuel expenses all came from our trip around Portugal. Between the two car rentals, we had a vehicle for a large portion of the trip. Our fuel expenses were actually higher than the underlying car rental cost! Still, we found it well-worthwhile. We visited a lot of Portugal that has poor access to public transit and couldn’t have seen what we did, reasonably, in any other way.

Auto Insurance

Our biannual auto insurance for our two cars—a 2011 Prius and 1990 300ZX—came in at about $486. That’s inline with what our insurance has been historically with a little inflation.

Public Transport

We used the metro, funicular, train and tram system a good bit while in Lisbon. It’s always a lot of fun to try all the different modes of travel to get around the hilly city! A good deal at about $60.

Parking

We mostly managed to avoid parking fees with the rental car. But, convenience and limited choice meant we did spend about $14 across a few different days.

Tolls

Like our fuel expense, our toll expenses were very high. Again, this comes with the territory when traveling across Portugal. Their highway system is quite good but not cheap. The route between Lisbon and the southern (Algarve) coast has a single toll that can easily be about $20! That’s only about a 2.5 hour drive. We spent about $70 on tolls.

We spent $832 on auto & transport this month.

Travel

Our Portugal-related travel expenses are collated and broken down in the trip cost table below. This includes some expenses that appeared in last month’s update as the trip started on January 28.

Air Travel

Our flights from the US—in our first time fancy lay flat seats—appear in last month’s update. Our flights back home were similarly bought with points, though in regular economy.

We transferred AMEX points to Hawaiian Airlines and then onto Alaska Airlines. You can’t direct transfer from AMEX to Alaska so Hawaiian acts as a middle man with no transfer costs (aside the small amount AMEX now charges for any transfer). We then used the Alaska miles to book an American Airlines flight back to the US. Phew!

A little complicated but it worked out incredibly well as our ideal return flights were 23K miles/person plus $83.51 in taxes/transfer fees. A great deal!

Hotel

Our trip cost table below shows all of our hotel expenses for Portugal. In February, we spent about $2,857. That’s just about $114/night. This includes a $95 annual fee for Chris’s Chase Sapphire Preferred since we derive most of the card’s value from hotel-related savings. We also directly applied a few savings like discounted Airbnb gift cards and a $50 hotel credit Chris received from that Chase card.

In total, we stayed at:

- two Airbnbs

- four Hotels

- one Apartment (Booking.com)

- one farm stay

Let’s have a quick look at some of the places we stayed…

We also incurred the first apartment expense for our trip to Portugal in January in Setúbal. That additional expense appears in the trip breakdown table.

Car Rental

We booked our Portugal car rentals via Jenni’s Chase Sapphire Reserve which meant it cost us just under 11,896 points. That’s a great deal as we had the car from February 8 to 26!

The first car rental we had that started January 29 to February 2, also appears in the trip table. We again used Jenni’s Chase card which came to just 2,835 points.

We spent $3,053 on travel this month.

Expense Conclusion

While that covers the big stuff, we still had a few random things small purchases to mention that might be of interest.

Furnishings

After several trips to Portugal, Chris finally broke down and bought a bit of azulejos tile art in a specific style that has called to him on each trip. The traditional blue and white painted tile in the form of a Portuguese Caravel or Carrack ship really called to him! The sailing tradition and cultural heritage seemed to match beautifully together and so he picked up a two tile piece from an art seller in Sintra for about $36. The artist themselves just retired so it’s likely one of the last available in this hand-painted style. Jenni also picked up a few small Portuguese decorations bringing our total to $57 on home furnishings.

Amusement

Impressively, we spent about the same amount—$252—this month on amusement across our entire trip to Portugal as we did while in Florida last month (on a much shorter trip). That’s despite doing several activities in Portugal!

Some examples:

- Numerous tickets to ruins of Ancient Rome

- A live Fado performance in a historic Portuguese cathedral

- Too many medieval castle steps, ramparts, and wall walks to remember

- Presentation and tour of a working cork factory

- A ride 230 meters below the surface in a tiny elevator to see a sprawling, still operational, rock salt mine

- A fortified harbor, Spanish fort, and sailing school rolled into one at the tip of Europe in Sagres

- Access to Lisbon’s first coal power station as a museum complete with a tour through the entire system of boilers and power generation

- A chance to see the spectacular estate and gardens in Sintra where the Knight’s Templar just might have been recruiting deep down a well

- And lots of small municipal museums, church donations, and hikes to tops of towers

What a ride!

Portugal Travel Summary

We took an 30-day trip to Portugal from January 28 to February 26. We’ve thoroughly enjoyed Portugal throughout our several trips in recent years there. This time, we managed to have along Chris’s sister and brother-in-law as well as Nicole—one of our closest and oldest friends! They were along February 2-8 and February 4-14, respectively.

Let’s break down our trip budget.

We’ll include all expenses we incurred for the trip—even groceries, restaurants, and amusement. But we’ll skip expenses that we incurred during the trip that were not part of the trip (for example, our utility bill back home in Virginia).

Trip cost table

Let’s take a look at our total trip cost. In the table below, you’ll find four columns:

- Description: a summary of what the expense was for. We’ve included some basic geographical information for things like flights or hotels.

- Cost: our incurred expense in US dollars for the described line item. In some cases, this appears as zero. If a travel currency like hotel points, airline miles, or a credit card reward certificate covers the total expense, we record a zero here. Sometimes, there’s a minor fee in addition to using points/miles for surcharges or taxes.

- Rewards Points/Miles: we maximize our credit card rewards and frequent traveler currencies to cover the costs of our travel wherever possible. You’ll see a short description of the type of certificate or currency that we used.

- Estimated Value: when using a reward from the previous column to cover an expense, we record what we would have otherwise paid for the line item. This gives us a sense of our savings.

The table is generally in chronological order.

We still incurred expenses at home (mortgage, utilities, etc.)—but these do not appear as part of our trip costs.

| Description | Cost (USD, $) | Rewards Pts/Miles | Est. Value (USD, $) |

|---|---|---|---|

| Flight—RIC→JFK (2x, Economy) | 5.60 | 8,545 AMEX Pts; 8,000 Delta Miles | 256.36 |

| Flight—JFK→LIS (2x, Business) | 165.60 | 70,000 Avianca Miles | 4,865.14 |

| Flight—LIS→RIC (2x, Economy) | 167.02 | 46,000 AMEX Pts | 1074.98 |

| Hotel: Apartment, Setúbal—4 nights | 264.91 | ||

| Hotel: Airbnb, Lisbon—6 nights | 1,092.59 | 1,144.31 | |

| Hotel: Farm stay, Aljezur—2 nights | 243.80 | ||

| Hotel: Apartment, Carvoeiro—5 nights | 378.11 | ||

| Hotel: Hotel, Loulé—3 nights | 242.47 | ||

| Hotel: Hotel, Estoi—1 night | 115.12 | ||

| Hotel: Airbnb, Tavira—4 nights | 381.23 | ||

| Hotel: Hotel, Beja—2 nights | 266.19 | ||

| Hotel: Hotel, Lisbon—1 night | 33.47 | 83.47 | |

| Rental car: Setúbal, 5 days | 2,835 Chase UR | 42.52 | |

| Rental car: Lisbon, 19 days | 11,896 Chase UR | 178.44 | |

| Gas & fuel (rental car) | 191.89 | ||

| Dining: restaurants, fast food, alcohol & bars | 851.88 | ||

| Groceries | 649.97 | ||

| Amusement—tickets | 252.04 | ||

| Parking | 28.48 | ||

| Tolls | 70.37 | ||

| Public Transportation | 60.17 | ||

| Gifts, Furnishings, Clothing | 159.94 | ||

| Mobile Phone (eSIM) | 20.00 | ||

| Total | 5,640.85 | 147,276 Pts/Miles | 6,417.44 |

Trip cost discussion

We spent about $5,641 on a 29 day trip for two people. That’s about $195/day (or about $98/person). We tried to keep our costs low by using points/certificates where we could, but this still ended up an exceptionally expensive trip. We also cut about $102 by using discounted Airbnb gift cards and a $50 credit on our Chase card for a hotel booking.

Had we not used those discounts and points/certificates, we’d have spent another $6,417 which would make the trip cost about $416/day!

Jenni used her Chase Sapphire Reserve card for our car rentals. This allowed us to pool our Chase Ultimate Rewards (UR) points and redeem those for a value of 1.5 cents per point (instead of the typical 1:1). Chase had a booking rate on their portal similar to what we could find with Priceline so we were happy to use about 15K points instead of $221.

We transferred some AMEX points to Avianca Lifemiles (1:1) to book our outbound flights from JFK to LIS in business on Portugal’s TAP airline. That cost us 70K points plus taxes/fees instead of about $4,865. Similarly, we used a combination of Delta miles and AMEX points to book our Delta flights initially from RIC to JFK to get the trip started. That cost us about 17K miles/points instead of about $256. And lastly, we repeated a similar trick to transfer AMEX Pts to Hawaiian Miles and onto Alaska Miles to book an American Airlines flight—wacky, right?—back from Portugal for 46,000 miles/points plus taxes/fees. That same flight as half of a roundtrip would have cost us $1,075.

Summary—

We cut about 53% of the cost of this trip by using points/certificates instead of cash for our various expenses. Despite this, the daily cost of the trip was quite high to our usual. Especially considering that Portugal is generally a low cost visit. We attribute most of the elevated cost to having three visitors throughout the trip. Which, we very much found to be worthwhile!

ⓘ Curious about some of the other expenses that we didn’t address? We’ve written about every expense in this month’s diagram either in this post or in the past. Check out our previous budget updates for more detail or ask in the comments below!

How Much We Work

We like to keep track of how much time we spend doing work that is paid.

Let’s add this month to the list…

Design Note: A reader suggested we should collapse the hours worked and net worth history history tables below. They’ve started to get quite long after a handful of years! Let us know if this works well for you in the comments.

History of Monthly “Hours Worked”

| Month | Chris (Hours Worked) | Jenni (Hours Worked) |

|---|---|---|

| May 2020 | 41 | 108 |

| Jun 2020 | 38 | 96 |

| Jul 2020 | 36 | 120 |

| Aug 2020 | 39 | 48 |

| Sep 2020 | 27 | 76 |

| Oct 2020 | 26 | 104 |

| Nov 2020 | 27 | 57 |

| Dec 2020 | 28 | 57 |

| Jan 2021 | 25 | 102 |

| Feb 2021 | 24 | 104 |

| Mar 2021 | 24 | 106 |

| Apr 2021 | 23 | 85 |

| May 2021 | 17 | 29.75 |

| Jun 2021 | 19 | 66 |

| Jul 2021 | 21 | 30.25 |

| Aug 2021 | 23 | 16.5 |

| Sep 2021 | 26 | 28 |

| Oct 2021 | 22 | 49 |

| Nov 2021 | 21 | 51 |

| Dec 2021 | 64 | 27 |

| Jan 2022 | 32 | 80 |

| Feb 2022 | 29 | 63 |

| Mar 2022 | 14 | 70 |

| Apr 2022 | 15 | 21 |

| May 2022 | 14 | 36 |

| Jun 2022 | 6 | 12 |

| Jul 2022 | 13 | 45.5 |

| Aug 2022 | 15 | 96 |

| Sep 2022 | 12 | 54 |

| Oct 2022 | 14 | 34.5 |

| Nov 2022 | 12 | 72 |

| Dec 2022 | 11 | 16.5 |

| Jan 2023 | 10 | 88 |

| Feb 2023 | 11 | 81.5 |

| Mar 2023 | 12 | 47.5 |

| Apr 2023 | 8 | 1 |

| May 2023 | 16 | 100 |

| Jun 2023 | 10 | 109 |

| Jul 2023 | 12 | 48 |

| Aug 2023 | 16 | 54.5 |

| Sep 2023 | 9 | 20 |

| Oct 2023 | 14 | 22 |

| Nov 2023 | 15 | 22 |

| Dec 2023 | 16 | 12 |

| Jan 2024 | 12 | 61.25 |

| Feb 2024 | 14 | 28.5 |

| Mar 2024 | 16 | 61.5 |

| Apr 2024 | 12 | 22 |

| May 2024 | 8 | 19.5 |

| Jun 2024 | 18 | 19.5 |

| Jul 2024 | 14 | 44 |

| Aug 2024 | 18 | 81 |

| Sep 2024 | 15 | 20 |

| Oct 2024 | 51 | 18 |

| Nov 2024 | 5 | 15 |

| Dec 2024 | 19 | 12 |

| Jan 2025 | 17.5 | 17 |

| Feb 2025 | 4 | 8 |

No surprise, we barely worked this month. Our combined wage hours was just 12!

Net Worth Update

Net worth is not our primary measurement and can understand it can be discouraging if you’re working yourself out of debt. We also understand it’s difficult to be transparent with our readers without divulging this information so we continue to do so.

Account breakdown

The market keeps chugging along and so do our investments. From a high level, our assets and liabilities are shown in the data table below as of February 28, 2025.

| Description | Value (USD, $) |

|---|---|

| 401(k) | 1,056,348 |

| Brokerage | 937,566 |

| Roth IRA | 198,828 |

| Traditional IRA | 25,350 |

| HSA | 66,860 |

| Real Estate | 449,700 |

| Mortgage | (133,565) |

| Miscellaneous Assets | 25,000 |

| Checking & Savings | 38,966 |

| Net Worth | 2,665,053 |

- Miscellaneous assets include specific investments we’ve made in physical assets (think collectibles) and treasury bonds

- Amounts do not reflect the value of the businesses Chris owns or their assets, which should appear as income to us over future years

- Jenni’s Prius is omitted

The S&P 500 was down about 1.4% for the month.

We were down about 0.9%. So, we outperformed the S&P—which is generally expected on down months.

Overall, our net worth decreased by around $25K this month.

Net Worth History

| Date | Amount | % Change |

|---|---|---|

| July 2020 | $1,555,289 | – |

| August 2020 | $1,597,334 | 2.7% |

| September 2020 | $1,566,393 | (2.0%) |

| October 2020 | $1,568,182 | 0.01% |

| November 2020 | $1,720,113 | 9.6% |

| December 2020 | $1,810,864 | 5.3% |

| January 2021 | $1,860,996 | 2.8% |

| February 2021 | $1,878,154 | 0.9% |

| March 2021 | $1,918,269 | 2.1% |

| April 2021 | $2,010,849 | 4.8% |

| May 2021 | $2,049,213 | 1.9% |

| June 2021 | $2,093,896 | 2.2% |

| July 2021 | $2,092,153 | (0.1%) |

| August 2021 | $2,130,761 | 1.8% |

| September 2021 | $2,070,730 | (2.8%) |

| October 2021 | $2,151,272 | 3.9% |

| November 2021 | $2,095,273 | (2.6%) |

| December 2021 | $2,160,235 | 3.1% |

| January 2022 | $2,055,292 | (4.9%) |

| February 2022 | $2,058,001 | 0.01% |

| March 2022 | $2,134,428 | 3.7% |

| April 2022 | $1,968,069 | (7.8%) |

| May 2022 | $1,975,569 | 0.04% |

| June 2022 | $1,868,397 | (5.4%) |

| July 2022 | $1,975,608 | 5.7% |

| August 2022 | $1,878,352 | (5.2%) |

| September 2022 | $1,735,997 | (7.6%) |

| October 2022 | $1,820,287 | 4.9% |

| November 2022 | $1,920,635 | 5.5% |

| December 2022 | $1,866,513 | (2.8%) |

| January 2023 | $1,953,691 | 4.7% |

| February 2023 | $1,882,656 | (3.6%) |

| March 2023 | $1,969,566 | 4.6% |

| April 2023 | $1,981,934 | 0.6% |

| May 2023 | $1,995,247 | 0.7% |

| June 2023 | $2,092,479 | 4.9% |

| July 2023 | $2,189,821 | 4.7% |

| August 2023 | $2,140,296 | (2.2%) |

| September 2023 | $2,042,865 | (4.6%) |

| October 2023 | $2,015,648 | (1.3%) |

| November 2023 | $2,157,404 | 7.0% |

| December 2023 | $2,261,458 | 4.8% |

| January 2024 | $2,296,269 | 1.5% |

| February 2024 | $2,365,110 | 3.0% |

| March 2024 | $2,434,250 | 2.9% |

| April 2024 | $2,371,284 | (2.6%) |

| May 2024 | $2,423,205 | 2.2% |

| June 2024 | $2,472,353 | 2.0% |

| July 2024 | $2,513,877 | 1.7% |

| August 2024 | $2,560,215 | 1.8% |

| September 2024 | $2,592,558 | 1.3% |

| October 2024 | $2,576,903 | (0.6%) |

| November 2024 | $2,685,615 | 4.2% |

| December 2024 | $2,621,732 | (2.4%) |

| January 2025 | $2,689,706 | 2.6% |

| February 2025 | $2,665,053 | (0.9%) |

Previous Donation Winner

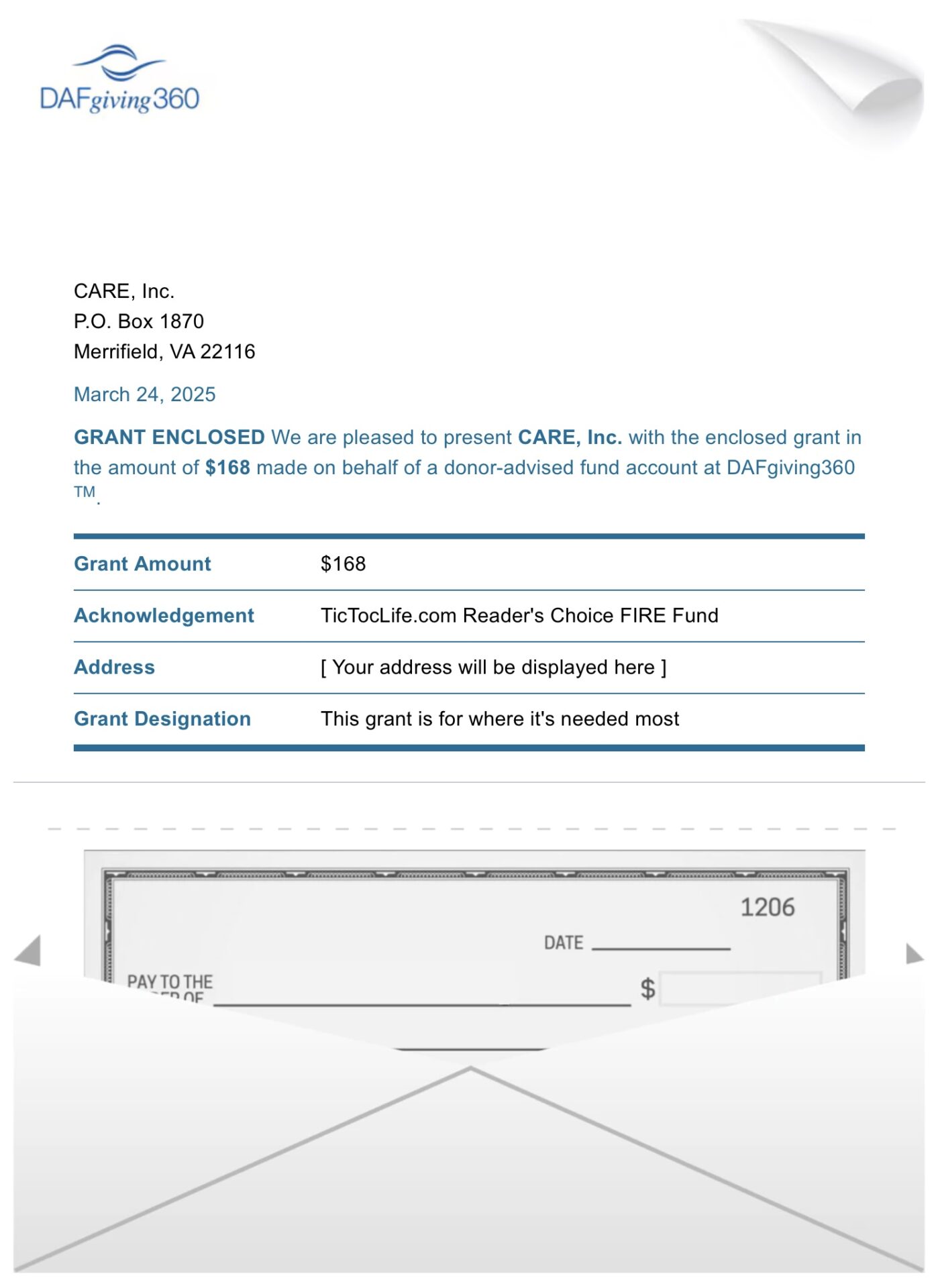

Because of your votes, we’ll be helping to keep the projects of CARES, Inc. alive despite the loss of funding from USAID. CARES is active in 121 countries providing humanitarian aid to women and children for over 80 years.

Our Reader’s Fund seeks to leverage the principles of FIRE to build a lifetime of giving.

Thank you for your participation in our polls over the last 4 years. We’ve given over $7,000 to deserving charities with your help in deciding which organizations to donate to.

Polls are now open for our next round of candidates: preventing disease.

Charity Round-Up

Infections do not see borders! It can only take one case to get out of control and start a worldwide spread of a potentially preventable disease. But advancements in science and technology have the power to keep a grasp of many diseases with vaccines. But in underdeveloped countries, vaccines are a luxury most can’t afford and communities heavily rely on help from the outside. Until vaccines become affordable, smaller countries with outbreaks need our support. And if you are able, get up to date on your vaccines at home. Your pharmacist is an excellent resource if you need help.

Each of these organizations are fighting to keep infections at bay and prevent a global outbreak. Unfortunately, these organizations have also been affected by the funding freeze to USAID. They need our support to keep their work moving forward. Each organization has an excellent charity rating. We invite you to learn more about great work around the world and join us in donating to one of them by casting your vote.

Summaries below include the impact metrics and a link to their Guidestar profile which details the nonprofit’s operations and transparency.

1) GAIA Vaccine Foundation

Why? HPV can cause cervical and genital cancer and we have a vaccine to prevent this cancer! Next step, make it affordable and available to everyone.

Our Notes: The GAIA Vaccine Foundation is a nonprofit organization. Their hope is to have vaccines available all around the world at a reasonable price, reducing the number of people contracting preventable infectious diseases. They screen for HPV and vaccinate those who may have missed vaccinations at school. While their focus is on vaccines, they also provide HIV treatment to pregnant women and free anonymous HIV testing in Mali, Africa. With a high rate of teen pregnancies, they have also started an educational and nutrition support program as a way to keep the body as healthy as possible. They are able to do these things through individual donations.

Where? Mali, Africa

2) IAVI

Why ? We can’t let the viruses win. Funding is critical to keep viruses at bay, even the ones we haven’t heard of. We need scientists to continue to find the cures for all of the bad things that keep trying to kill us.

Where? India, Africa, United States- California, New York, Europe.

Our Notes: IAVI is a nonprofit organization that develops vaccines for emerging infectious diseases. Their mission is to use science and technology to get vaccines into the hands of doctors all around the world to stop preventable deaths. They have teams currently working on a vaccine for tuberculosis and HIV and HIV antibodies. Other not as well known but still extremely dangerous viruses are the Lassa virus causing hemorrhagic illness, the Marburg virus with a 88% fatality rate and the threat of being used as a bioterrorism weapon, and the Sudan virus responsible for Ebola outbreak. IAVI is working around the clock to stop these diseases from becoming well known with treatments and vaccines.

3) Partners In Health

Why? Tuberculosis is a global threat infecting over 10 million people a year and killing 10% of those infected. Treatment rates are as high as 88% but access to medicine isn’t always available. Being poor shouldn’t equal being sick.

Where? Rwanda, Peru, Lesotho, Liberia, Sierra Leone, Malawi, Navajo, New Mexico, Haiti, Mexico, Kazakhstan

Our Notes: Partners in Health is a nonprofit corporation whose goal is to bring modern medical sciences to those who need them most, relieving them of some of their despair. Their focus is improving health related outcomes in areas of the world where basic health care barely exists. They ensure communities have proper infrastructure to support a public health center such as a building and roads. They provide clean water and food. They train health care providers to deliver effective care in these remote areas of the world. Their current campaign is fighting the curable disease called tuberculosis that infects 10 million people a year and kills over 10% of those infected.

Nonprofit poll

After reviewing the list above, please take a moment to vote for which nonprofit you think will put funds to use in the best way.

(Have trouble using or seeing the poll above? Some reader tools or apps may not display it. View this page in a browser or use this link to our Reader Fund page which has a copy of the poll!)

Thank you for taking the time to vote!

One of our primary goals with TicTocLife is building a stream of giving within the FIRE community and that starts with knowledge.

Want to hear about the results? Sign up for our free FIRE Insider newsletter! We send it out every few weeks and include the monthly poll results and donation winners. You can see an archive of the FIRE Insider and sign up here!

What’s Next

With our big trip to Portugal complete, we’re excited for a little break at home in early March. We’ll be focused on completing our taxes—both personal and business! Mid-March holds the due date for the corporate taxes, so that’ll be our priority.

We’re concerned about how our switch from a pair of single folks to the married, filing jointly tax status will impact our adjusted gross income and our taxes more broadly. Between associated tax rate and ACA health insurance credits, we’re uncertain where our taxes will come out in the end.

Fortunately, we have pretty great flexibility with our AGI by way of Chris’s business and our pair of traditional IRA deductions. Chris made a significant 401(k) contribution to close 2024, anticipating our tax status change. In addition, his business can make a matching 401(k) contribution (“profit sharing”) until his corporate due date. Mixed with our two IRA contributions ($14,000 in potential deductions), we should be able to move our taxable income (and AGI) down a bit under $20K if needed. So, we’ll see how our taxes shake out.

And, lastly, we’ll be off on another trip before March ends. This time: Austria and the Czech Republic! It’s a bit of a last second adventure as our plans are coming together—which will be another thing for us to work on in early March—but sometimes, those are the most fun!

Any big changes to your tax strategy this year?

Let us know in the comments or on Threads and X (Twitter)!