With Easter coming—and a good deal in hand—we decided to take a last minute trip to Austria and the Czech Republic in March! We’re booked for mid-March to mid-April and intend to enjoy a bit of Central Europe as the festivities start for the big spring holiday. It’s an area we haven’t explored much but has loads of history and lets us stretch our boundaries a little from Western Europe.

Naturally, the trip has taken over most of our FIRE update’s focus for the month. What we didn’t anticipate is that a trade war would bloom and blossom while we were traveling! Fortunately—perhaps—the trip kept us at arm’s length from the ongoing economic uncertainty and peak to valley cycle of our investments.

For our monthly donation, our theme is Mental Health Awareness. You can read more about the three charities we’re considering and vote for your favorite in the poll below!

We track our income, spending, and savings each month to stay on our FIRE path and share it with you. Keep reading to see our monthly updates, tips, and charity reviews.

Budget Update

In the Sankey diagram below, the income on the left matches our expenses on the right.

We’ll run through the income and expense sources for the month and remark on any interesting items.

Income Summary

We certainly bumped our income over last month’s, but, we’re still falling pretty short of our spending. Of course, that’s kind of how it’s supposed to work with FIRE!

Aside from our usual monthly income, here are some interesting anecdotes:

Dividends

We earned a nice dose of quarterly dividends! We anticipate significant dividend payments from our various stock holdings—most of it from Vanguard funds like VTSAX. More than half of our distributions were automatically reinvested in our tax-advantaged accounts.

We earned $3,824 in total distributions.

Accountable Plan

If you’re interested in the details of how an accountable plan for businesses works, check out this original post.

Chris’s business reimbursed him for the use of our house, utilities, health insurance, and other expenses. This reimbursement covers expenses for the first quarter of 2024.

Chris received $1,254 in reimbursements.

Local Sales

We each upgraded our respective iPhones (11 and 12) to 13. So, we sold off the old ones. Details below in our expenses for what we paid and how.

We earned $405 in local sales.

Tax Refund

Those 401(k)/IRA contributions and a low income really help to offset our tax burden!

We earned back $1,211 in tax refunds.

Expense Summary

From our $22,906 monthly budget, we saved and invested $17,615 dollars! Most of this [seemingly massive] investment comes from making our annual traditional IRA contributions. That’s two of us at the $7,000 annual contribution limit. But, most of this money is flowing out of our checking/savings accounts and into the IRAs.

After subtracting our credits and savings—we spent about $5,281 on living expenses.

That’s 110% of our FIRE budget from 2022 ($4,787/month).

Let’s break down some of the more exciting details this month.

Food & Dining

Despite another month with a significant amount of travel, we managed to cut down on our food-related spending significantly. We lopped off nearly two-thirds! That comes, primarily, from reducing how much we dined out—even while in the Czech Republic this month.

Groceries

At $389, our grocery expenses were pretty close to our normal range. Food prices were generally lower in Czechia, especially a lot of the stuff we consume a lot of like yogurt, grains, veg, and gluten-free items for Jenni. Not to mention eggs. 🙂 We were pleasantly surprised!

We stumbled across a special store while in Brno that specialized in selling extremely discounted food and some household goods. Apparently, they collect items that were over produced, significantly beyond their “best by” dates (but still safe), and sell them in a very barebones warehouse. We couldn’t believe how inexpensive some items were—and we tried a few with no issues.

Some examples:

- A small keg of beer for about $7

- A popular sport drink, Prime, for about $0.26

- 750ml of pre-mixed Starbucks cappuccino/latte for $0.77

Don’t think we have places like this in the US!

Restaurants, Fast food, Alcohol & bars

At about $186, we think we did well balancing our desire to experience local culture through food and reigning in our dining expenses. Notably, we spent a good chunk of our budget while dining out in Virginia with friends!

We spent $575 on food & dining this month.

Travel

We started a 32-day trip to the Czech Republic from March 16 to April 16. Prague and the history of Bohemia and Moravia have been calling Chris’s name for many years, so when our calendar lined up along with a flight—we jumped! We’ll have a full trip cost summary table in the next monthly update.

Air Travel

Our flights from the US were direct from DC to Vienna. Yes, we went to Austria first in order to visit the Czech Republic. 🙂 That might sound a little crazy, but we were able to get a direct flight to Vienna which doesn’t exist to Prague from DC. And, Prague is just about equidistant to a large regional city in the eastern part of Czechia we wanted to visit: Brno. So, we flew to Vienna and had a nice 2-hour bus ride up to eastern Czechia.

Our pair of direct, one-way flights on Austrian Airlines to Vienna were $869. We used Jenni’s Chase points to cover the cost (57,933). One-way flights are generally more expensive, but this allowed us some flexibility on our plans since we didn’t have a clear idea of what we were doing, where, and when on this trip.

Hotel

Our first stay was via Airbnb in Brno from March 17 to 28. The total cost was $1,001. That’s an average nightly price of $91. That’s pretty great for a complete apartment in the urban, walkable part of the city! We quite enjoyed it.

We spent the end of March exploring Prague from yet another apartment. Despite being in Prague, and on the famous “Royal Route”, we got a really great deal on this [even bigger] apartment. About $373 total or $93/night!

Chris also paid a $125 annual fee for his AMEX Hilton but that was partially offset by a $50 Hilton hotel credit he earned this month from our travels in Portugal in February. That credit is available four times per year, so, if used well—more than pays for the card. Not to mention the annual free night certificate!

Auto & Transport—Public Transport

Brno has some first-rate trams and a system that runs all over the city. We really loved using it as it was about $1/ride with great connectivity. The system was modern—all we had to do was tap to pay with our phones on the trams after boarding and then we were off!

We also used the long distance train (“Railjet”) to travel to Prague which was less than $40 for a 2.5 hour ride in a nice, comfy train. No complaints!

We spent $1,442 on travel this month.

Expense Conclusion

While that covers the big stuff, we still had a few random things small purchases to mention that might be of interest.

Home Insurance

We saw a pretty big jump in insurance rates on our home this year. Our annual rate jumped from about $1,076 to $1,376. That’s nearly a 28% increase and our home hasn’t changed. Granted, values around us continue to climb. We maintain a pretty low level of coverage as well. After looking through competing offers, we ended up eating the increase as Travelers (Geico) continues to be the lowest rate available to us.

State Taxes

Our pair of driver’s licenses were due up for renewal. As many other US citizens have noticed—there’s a new license type available we’re being pushed towards: “Real ID”. While there’s apparently some benefits to the new ID, the practical outcome for us is that it’s a slightly higher cost and a Real ID will be required for identify verification when flying domestically. However, we already have passports which work fine for domestic flights. To avoid the slight cost difference—and, more importantly, having to go to the DMV—we opted to renew with the regular Virginia license. We’ll have to remember to bring our passports for any domestic flights!

Auto Insurance

Another big insurance bill—$486—this time for our cars! The rate has moved around slightly over the last few years but it’s generally been pretty consistent, unlike the big bump we saw on our home this month. Both are provided by Geico, which also earns us a slight combo savings—and being a Berkshire Hathaway shareholder. We maintain low coverage on our 1990 Nissan 300ZX and 2011 Toyota Prius.

Electronics & Software

We made yet another bump to our pair of iPhones this month. This time, we sold off our old iPhone 11 and 12 (you may have noticed the $405 in Local Sales income earlier in the post). In exchange, we spent about $575 on two brand new iPhone 13. Each came with one month of service and were carrier locked for 60 days. We left the phones in a drawer after the initial month of service, then switched them both to Tello eSIMs after 60 days. Aside from the incremental camera/speed/design improvements, we’re both happy to move from 64GB to 128GB of storage! Net cost was only about $170.

ⓘ Curious about some of the other expenses that we didn’t address? We’ve written about every expense in this month’s diagram either in this post or in the past. Check out our previous budget updates for more detail or ask in the comments below!

How Much We Work

We like to keep track of how much time we spend doing work that is paid.

Let’s add this month to the list…

History of Monthly “Hours Worked”

| Month | Chris (Hours Worked) | Jenni (Hours Worked) |

|---|---|---|

| May 2020 | 41 | 108 |

| Jun 2020 | 38 | 96 |

| Jul 2020 | 36 | 120 |

| Aug 2020 | 39 | 48 |

| Sep 2020 | 27 | 76 |

| Oct 2020 | 26 | 104 |

| Nov 2020 | 27 | 57 |

| Dec 2020 | 28 | 57 |

| Jan 2021 | 25 | 102 |

| Feb 2021 | 24 | 104 |

| Mar 2021 | 24 | 106 |

| Apr 2021 | 23 | 85 |

| May 2021 | 17 | 29.75 |

| Jun 2021 | 19 | 66 |

| Jul 2021 | 21 | 30.25 |

| Aug 2021 | 23 | 16.5 |

| Sep 2021 | 26 | 28 |

| Oct 2021 | 22 | 49 |

| Nov 2021 | 21 | 51 |

| Dec 2021 | 64 | 27 |

| Jan 2022 | 32 | 80 |

| Feb 2022 | 29 | 63 |

| Mar 2022 | 14 | 70 |

| Apr 2022 | 15 | 21 |

| May 2022 | 14 | 36 |

| Jun 2022 | 6 | 12 |

| Jul 2022 | 13 | 45.5 |

| Aug 2022 | 15 | 96 |

| Sep 2022 | 12 | 54 |

| Oct 2022 | 14 | 34.5 |

| Nov 2022 | 12 | 72 |

| Dec 2022 | 11 | 16.5 |

| Jan 2023 | 10 | 88 |

| Feb 2023 | 11 | 81.5 |

| Mar 2023 | 12 | 47.5 |

| Apr 2023 | 8 | 1 |

| May 2023 | 16 | 100 |

| Jun 2023 | 10 | 109 |

| Jul 2023 | 12 | 48 |

| Aug 2023 | 16 | 54.5 |

| Sep 2023 | 9 | 20 |

| Oct 2023 | 14 | 22 |

| Nov 2023 | 15 | 22 |

| Dec 2023 | 16 | 12 |

| Jan 2024 | 12 | 61.25 |

| Feb 2024 | 14 | 28.5 |

| Mar 2024 | 16 | 61.5 |

| Apr 2024 | 12 | 22 |

| May 2024 | 8 | 19.5 |

| Jun 2024 | 18 | 19.5 |

| Jul 2024 | 14 | 44 |

| Aug 2024 | 18 | 81 |

| Sep 2024 | 15 | 20 |

| Oct 2024 | 51 | 18 |

| Nov 2024 | 5 | 15 |

| Dec 2024 | 19 | 12 |

| Jan 2025 | 17.5 | 17 |

| Feb 2025 | 4 | 8 |

| Mar 2025 | 14 | 12 |

While we worked a little more than last month, it wasn’t much! Our combined wage hours were 26.

Net Worth Update

Net worth is not our primary measurement and can understand it can be discouraging if you’re working yourself out of debt. We also understand it’s difficult to be transparent with our readers without divulging this information so we continue to do so.

Account breakdown

The market keeps chugging along and so do our investments. From a high level, our assets and liabilities are shown in the data table below as of March 31, 2025.

| Description | Value (USD, $) |

|---|---|

| 401(k) | 1,014,361 |

| Brokerage | 912,422 |

| Roth IRA | 190,927 |

| Traditional IRA | 37,568 |

| HSA | 64,091 |

| Real Estate | 458,300 |

| Mortgage | (133,131) |

| Miscellaneous Assets | 25,000 |

| Checking & Savings | 12,170 |

| Net Worth | 2,581,708 |

- Miscellaneous assets include specific investments we’ve made in physical assets (think collectibles) and treasury bonds

- Amounts do not reflect the value of the businesses Chris owns or their assets, which should appear as income to us over future years

- Jenni’s Prius is omitted

The S&P 500 was down about 5.8% for the month.

We were down about 3.1%. So, we outperformed the S&P—which is generally expected on down months with our more defensive investments.

Overall, our net worth decreased by around $83K this month.

Net Worth History

| Date | Amount | % Change |

|---|---|---|

| July 2020 | $1,555,289 | – |

| August 2020 | $1,597,334 | 2.7% |

| September 2020 | $1,566,393 | (2.0%) |

| October 2020 | $1,568,182 | 0.01% |

| November 2020 | $1,720,113 | 9.6% |

| December 2020 | $1,810,864 | 5.3% |

| January 2021 | $1,860,996 | 2.8% |

| February 2021 | $1,878,154 | 0.9% |

| March 2021 | $1,918,269 | 2.1% |

| April 2021 | $2,010,849 | 4.8% |

| May 2021 | $2,049,213 | 1.9% |

| June 2021 | $2,093,896 | 2.2% |

| July 2021 | $2,092,153 | (0.1%) |

| August 2021 | $2,130,761 | 1.8% |

| September 2021 | $2,070,730 | (2.8%) |

| October 2021 | $2,151,272 | 3.9% |

| November 2021 | $2,095,273 | (2.6%) |

| December 2021 | $2,160,235 | 3.1% |

| January 2022 | $2,055,292 | (4.9%) |

| February 2022 | $2,058,001 | 0.01% |

| March 2022 | $2,134,428 | 3.7% |

| April 2022 | $1,968,069 | (7.8%) |

| May 2022 | $1,975,569 | 0.04% |

| June 2022 | $1,868,397 | (5.4%) |

| July 2022 | $1,975,608 | 5.7% |

| August 2022 | $1,878,352 | (5.2%) |

| September 2022 | $1,735,997 | (7.6%) |

| October 2022 | $1,820,287 | 4.9% |

| November 2022 | $1,920,635 | 5.5% |

| December 2022 | $1,866,513 | (2.8%) |

| January 2023 | $1,953,691 | 4.7% |

| February 2023 | $1,882,656 | (3.6%) |

| March 2023 | $1,969,566 | 4.6% |

| April 2023 | $1,981,934 | 0.6% |

| May 2023 | $1,995,247 | 0.7% |

| June 2023 | $2,092,479 | 4.9% |

| July 2023 | $2,189,821 | 4.7% |

| August 2023 | $2,140,296 | (2.2%) |

| September 2023 | $2,042,865 | (4.6%) |

| October 2023 | $2,015,648 | (1.3%) |

| November 2023 | $2,157,404 | 7.0% |

| December 2023 | $2,261,458 | 4.8% |

| January 2024 | $2,296,269 | 1.5% |

| February 2024 | $2,365,110 | 3.0% |

| March 2024 | $2,434,250 | 2.9% |

| April 2024 | $2,371,284 | (2.6%) |

| May 2024 | $2,423,205 | 2.2% |

| June 2024 | $2,472,353 | 2.0% |

| July 2024 | $2,513,877 | 1.7% |

| August 2024 | $2,560,215 | 1.8% |

| September 2024 | $2,592,558 | 1.3% |

| October 2024 | $2,576,903 | (0.6%) |

| November 2024 | $2,685,615 | 4.2% |

| December 2024 | $2,621,732 | (2.4%) |

| January 2025 | $2,689,706 | 2.6% |

| February 2025 | $2,665,053 | (0.9%) |

| March 2025 | $2,581,708 | (3.1%) |

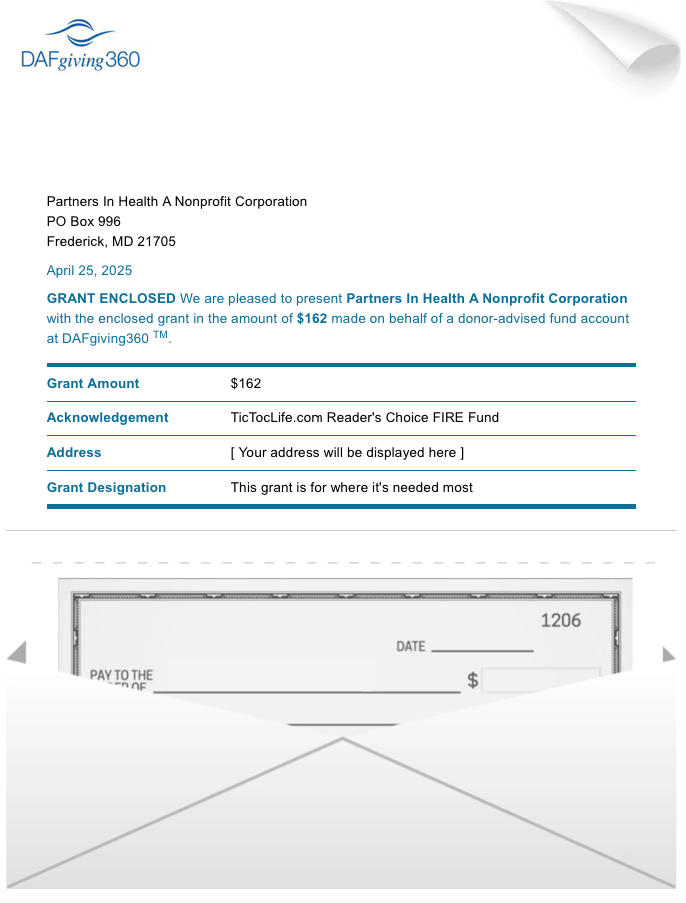

Previous Donation Winner

Tuberculosis (TB) is a disease we’ve been hearing about a lot lately. This global threat infects over 10 million people a year and kills 10%. This month’s donation recipient, Partners in Health, is fighting this deadly disease by making access to care and medications more readily available, thereby reducing a potential global outbreak.

Our Reader’s Fund seeks to leverage the principles of FIRE to build a lifetime of giving.

Thank you for your participation in our polls over the last 4 years. We’ve given over $7,500 to deserving charities with your help in deciding which organizations to donate to.

Polls are now open for our next round of candidates: Mental Health.

Charity Round-Up

Right now doesn’t seem like the best time to pull state and federal funding for mental health support organizations. But that is exactly what is happening in the United States at a time when the need for these services is exponentially increasing. Huge budget cuts mean fewer services or the loss of them altogether. Instead of advancing their established programs and improving outcomes in communities all across the country, mental health organizations are now fighting to even exist.

These organizations provide support to people and their families affected by mental illness and need our help to stay afloat. Each organization has an excellent charity rating. We invite you to learn more about great work around the world and join us in donating to one of them by casting your vote.

Summaries below include the impact metrics and a link to their Guidestar profile which details the nonprofit’s operations and transparency.

1) Shatterproof

Why? Just about 50 million Americans suffer from substance abuse disorder (SUD). It is one of the only medical conditions to be punished instead of providing treatment for a cure. It impacts everyone in the community beyond those suffering from SUD from a healthcare and economic perspective. Finding the right treatment and making it affordable is our best chance to help our communities.

Where? The United States

Our Notes: Shatterproof is a nonprofit organization whose mission is to increase access to recovery, prevention, and mental health resources. They are working to establish a national standard of care for addiction treatment that is based on science. And they are having success getting these standards adopted by 23 insurers so far! They provide resources and tools for communities to promote an end to the addiction crisis. Their annual events bring tens of thousands of people together, all impacted by this disease. Together, they stand to bring awareness about SUD and advocate for change in policies.

2) The Jed Foundation

Why? Sometimes we forget how hard it is to meet all the expectations of our family, friends, and teachers while still trying to be a kid growing up in this very competitive world. It is hard and stressful! And sometimes, these young adults need extra emotional and mental health support to keep them moving forward instead of deep down into their own dark thoughts.

Where? The United States

Our Notes: Jed Foundation was founded after their son Jed’s suicide to develop suicide prevention programs at schools for teens and young adults. Today they are the leading nonprofit for teens and young adults to get the emotional and mental health support they need to navigate life’s challenges. They hope to prevent future suicides by ensuring mental health is recognized as part of general health and wellness and is not associated with shame, secrecy, or prejudice.

3) NAMI National

Why? The mental health crisis is very real. Mental health issues affect 1 out of 5 people in the United States and there is not enough support or funding for appropriate care. 80% of every donated dollar directly supports the programs provided by NAMI.

Where? The United States

Our Notes: National Alliance on Mental Illness (NAMI) National is a grassroots mental health organization composed of over 700 NAMI State Organizations. NAMI is dedicated to building better lives for people through free education, support programs, and advocacy of mental health solutions. Their NAMI HelpLine offers free information on community resources mental health providers and treatment offers. It can be the difference of life and death.

Nonprofit poll

After reviewing the list above, please take a moment to vote for which nonprofit you think will put funds to use in the best way.

(Have trouble using or seeing the poll above? Some reader tools or apps may not display it. View this page in a browser or use this link to our Reader Fund page which has a copy of the poll!)

Thank you for taking the time to vote!

One of our primary goals with TicTocLife is building a stream of giving within the FIRE community and that starts with knowledge.

Want to hear about the results? Sign up for our free FIRE Insider newsletter! We send it out every few weeks and include the monthly poll results and donation winners. You can see an archive of the FIRE Insider and sign up here!

What’s Next

With our taxes behind us and the first bit of our Austria/Czech Republic trip complete, April holds more exploration in the western part of Czechia. Just as March was drawing to a close, we left for Prague and some very exciting places to visit and learn about in this very old city. Much of April will be spent exploring and enjoying the culture—especially as Easter festivals come into full life.

Later in the month, we’ll be back home and catching up on life in Virginia. With a few months spent away in the spring, we’ll have some much needed time spent with friends. And hopefully, not worrying about the latest economic woes and convulsions of the market! So far, so good!

How did your taxes turn out for fiscal 2024? Are you handling the ups and downs of the latest economic turmoil well?

Let us know in the comments or on Threads and X (Twitter)!