June was supposed to be a recovery from May’s big event—our wedding! And while we did get a little R&R in, we also took a big trip to Montana for a close friend’s 40th birthday celebration. Exploring Glacier National Park was amazing, but not quite the layback-and-relax rest we could use. Still, life is short and we had a blast!

For our monthly donation, our theme is heat relief nonprofits. You can read more about them and vote for your favorite in the poll below!

We track our income, spending, and savings each month to stay on our FIRE path and share it with you. Please keep reading to see our monthly updates, tips, and charity reviews.

Budget Update

In the Sankey diagram below, the income on the left matches our expenses on the right.

We’ll run through the income and expense sources for the month and remark on any interesting items.

Income Summary

Our part-time work income continued to be pretty low—but quarterly dividends, Chris’s business expense reimbursement, and other miscellaneous income kept us afloat.

Aside from our usual monthly income, here are some interesting anecdotes:

Dividends

We had another strong showing of quarterly dividends! We anticipate significant dividend payments from our various stock holdings—most of it from Vanguard funds like VTSAX. More than half of our distributions were automatically reinvested in our tax-advantaged accounts.

We earned $4,706 in total distributions.

Accountable Plan

If you’re interested in the details of how an accountable plan for businesses works, check out this original post.

Chris’s business reimbursed him for the use of our house, utilities, health insurance, and other expenses. This reimbursement covers expenses for the second quarter of 2024.

Chris received $1,186 in reimbursements.

Credits

Several of our credit cards offer statement credits for purchasing with certain companies. This month we used:

- Our Chase cards earn back $10/15 per quarter from Instacart which we use on local grocery pickups. Rumors are that this is ending in July! 🙁

We received $65 in statement credits.

Local Sales

We’re still finding occasional success upgrading our old gear or selling off promos via our local Facebook Marketplace/Craigslist.

- Chris sold a new 27″ Dell monitor for $120 (details in the Electronics & Software section on the cost).

- Jenni sold her 10.5″ iPad Pro for $180 (and upgraded to an iPad Air 3 for less!).

- We sold the chaffing dishes and a set of “Mr. & Mrs.” wood blocks from the wedding for $55.

We earned $355 from local sales.

Cashback

We use various online referral platforms, bonuses, etc. to earn cashback on purchases on certain activities. Some of our favorites are Rakuten and Swagbucks.

- Chris earned $125 from an E*TRADE promotion for transferring $5,000 of new funds.

We earned $125 in cashback.

Expense Summary

From our $8,184 monthly budget, we saved and invested about $3,812.

After subtracting our credits and savings—we spent about $4,372 on living expenses.

That’s 91% of our FIRE budget from 2022 ($4,787/month).

A good chunk of our spending went to our trip to Montana this month! Let’s break down some of the more exciting details.

Food & Dining

Food saw a bump in costs this month primarily due to recent grocery expenses being a bit low—we had some restocking we needed to do.

Groceries

At $629, our grocery spending this month was exceptionally high. We restocked some spices, coffee, nuts, and various other household goods. We also contributed to stocking the Airbnb we stayed in with our group while in Montana.

Restaurants, Fast food, Alcohol & bars

Despite taking a trip this month with friends, our dining-out expenses were pretty low. We had one bar visit while out as well as some quick convenience food stops.

In addition, we went out for a good friend’s 40th birthday—not the one in Montana!

Lastly, we celebrated our first month wedding anniversary with sushi out.

We spent $756 on food & dining this month.

Shopping

Time for some upgrades!

Sporting Goods

Jenni replaced her running shoes and some sports bras. Out of our five bikes, four have been down for repairs. We picked up a few basic parts (tubes, grease, star nut) and related supplies to start fixing them up.

Electronics & Software

- Chris purchased a repair kit for his Klipsch computer speakers’ subwoofer cone for about $21.

- He also bought a 27″ Dell monitor for $124 and earned back $30 from his remaining AMEX Platinum benefit. Atop that, he earned a $75 Dell gift card for later use. This is the same monitor he sold for $120 (mentioned in “Local Sales” above).

- Jenni purchased a replacement Wi-Fi router for our place as coverage in some areas of the house was spotty. A used Netgear Nighthawk router on Facebook Marketplace for $20 now offers excellent coverage for us!

- She also upgraded her iPad with an iPad Air 3 via eBay for $111.35 (and sold her old one for $180!).

We spent $361 on shopping this month.

Montana Travel Summary

We took a 9-day trip to Montana near Glacier National Park to celebrate a close friend’s 40th birthday. It was a surprise party, and the man at the center of our attention certainly was surprised by the nearly dozen-person group that met him in the mountains!

We’ll include all expenses we incurred for the trip—even groceries, restaurants, and amusement. But we’ll skip expenses that we incurred during the trip that were not part of the trip (for example, our utility bill back home in Virginia).

Trip cost table

Let’s take a look at our total trip cost. In the table below, you’ll find four columns:

- Description: a summary of what the expense was for. We’ve included some basic geographical information for things like flights or hotels.

- Cost: our incurred expense in US dollars for the described line item. In some cases, this appears as zero. If a travel currency like hotel points, airline miles, or a credit card reward certificate covers the total expense, we record a zero here. Sometimes, there’s a minor fee in addition to using points/miles for surcharges or taxes.

- Rewards Pts/Miles: we maximize our credit card rewards and frequent traveler currencies to cover the costs of our travel wherever possible. You’ll see a short description of the type of certificate or currency that we used.

- Estimated Value: when using a reward from the previous column to cover an expense, we record what we would have otherwise paid for the line item. This gives us a sense of our savings.

The table is generally in chronological order.

We still incurred expenses at home (mortgage, utilities, etc.)—but these do not appear as part of our trip costs.

| Description | Cost (USD, $) | Rewards Pts/Miles | Est. Value (USD, $) |

|---|---|---|---|

| Flight—RIC→MSO (Roundtrip) | — | 70,486 CC Pts | 1,084.40 |

| Airbnb: 9 nights total | — | ||

| Uber: RIC to/from | 45.47 | ||

| Rental Car: 9 days | 268.42 | ||

| Dining: restaurants, fast food, coffee shops | 45.00 | ||

| Groceries | 133.39 | ||

| Amusement: e-bike rental/shuttle, whitewater rafting, pontoon boat | 616.88 | ||

| Air travel: earning CC points (card fee). | 109.45 | ||

| Total | 1,218.61 | 70,486 CC Pts | 1,084.40 |

Trip cost discussion

We had a good time on our trip to Montana! That good time is evidenced by our spending in the entertainment and amusement categories. 🙂 Here is where that $617 went:

- $340—While visiting Glacier Park, MT we rented e-bikes for a ride up the infamous, beautiful “Going-to-the-Sun Road” along with the rest of our travel group. And had a shuttle ride to take us with the bikes into the park ($80).

- $177 w/tip—We went on a guided whitewater rafting morning at the edge of West Glacier—wetsuits and all!

- $100—The group rented a pontoon boat to tool around Flathead Lake which we joined and contributed to.

We rented a car from the Missoula airport to help ferry people to the lakehouse and our adventures. A little crossover from Alamo served us well with some of the harsher roads we found ourselves on.

We flew United using credit card points to cover the flight cost for both of us. That said, we do have an air travel cost of about $109 for this trip. That’s from fees we paid to purchase Visa Gift Cards (which we then paid other bills with). Why pay $109 in fees? We earned a significant number of credit card reward points (worth more than $109).

Even though we stayed at a stunning lakehouse on Flathead Lake, we didn’t have any hotel-related costs. The host—the birthday boy’s girlfriend—insisted it was her gift to the group. Quite the gift considering the cost of a lakehouse for nearly a dozen people!

Summary—

For a 9-day trip, we spent $1,218.61. That’s about $68/person per day. We used credit card points to avoid the $1,084 flight cost—although, as mentioned above, these aren’t always “free”!

ⓘ Curious about some of the other expenses that we didn’t address? We’ve written about every expense in this month’s diagram either in this post or in the past. Check out our previous budget updates for more detail or ask in the comments below!

How Much We Work

We like to keep track of how much time we spend doing work that is paid.

Let’s add this month to the list…

| Month | Chris (Hours Worked) | Jenni (Hours Worked) |

|---|---|---|

| May 2020 | 41 | 108 |

| Jun 2020 | 38 | 96 |

| Jul 2020 | 36 | 120 |

| Aug 2020 | 39 | 48 |

| Sep 2020 | 27 | 76 |

| Oct 2020 | 26 | 104 |

| Nov 2020 | 27 | 57 |

| Dec 2020 | 28 | 57 |

| Jan 2021 | 25 | 102 |

| Feb 2021 | 24 | 104 |

| Mar 2021 | 24 | 106 |

| Apr 2021 | 23 | 85 |

| May 2021 | 17 | 29.75 |

| Jun 2021 | 19 | 66 |

| Jul 2021 | 21 | 30.25 |

| Aug 2021 | 23 | 16.5 |

| Sep 2021 | 26 | 28 |

| Oct 2021 | 22 | 49 |

| Nov 2021 | 21 | 51 |

| Dec 2021 | 64 | 27 |

| Jan 2022 | 32 | 80 |

| Feb 2022 | 29 | 63 |

| Mar 2022 | 14 | 70 |

| Apr 2022 | 15 | 21 |

| May 2022 | 14 | 36 |

| Jun 2022 | 6 | 12 |

| Jul 2022 | 13 | 45.5 |

| Aug 2022 | 15 | 96 |

| Sep 2022 | 12 | 54 |

| Oct 2022 | 14 | 34.5 |

| Nov 2022 | 12 | 72 |

| Dec 2022 | 11 | 16.5 |

| Jan 2023 | 10 | 88 |

| Feb 2023 | 11 | 81.5 |

| Mar 2023 | 12 | 47.5 |

| Apr 2023 | 8 | 1 |

| May 2023 | 16 | 100 |

| Jun 2023 | 10 | 109 |

| Jul 2023 | 12 | 48 |

| Aug 2023 | 16 | 54.5 |

| Sep 2023 | 9 | 20 |

| Oct 2023 | 14 | 22 |

| Nov 2023 | 15 | 22 |

| Dec 2023 | 16 | 12 |

| Jan 2024 | 12 | 61.25 |

| Feb 2024 | 14 | 28.5 |

| Mar 2024 | 16 | 61.5 |

| Apr 2024 | 12 | 22 |

| May 2024 | 8 | 19.5 |

| Jun 2024 | 18 | 19.5 |

Jenni worked just as much as last month—not all that much—and Chris worked a little more than normal, catching up from last month’s wedding.

Net Worth Update

Net worth is not our primary measurement and can understand it can be discouraging if you’re working yourself out of debt. We also understand it’s difficult to be transparent with our readers without divulging this information so we continue to do so.

Account breakdown

The market keeps chugging along and so do our investments. From a high level, our assets and liabilities are shown in the data table below as of June 30, 2024.

| Description | Value (USD, $) |

|---|---|

| 401(k) | 954,423 |

| Brokerage | 868,812 |

| Roth IRA | 196,438 |

| Traditional IRA | 23,127 |

| HSA | 58,859 |

| Real Estate | 440,100 |

| Mortgage | (136,989) |

| Miscellaneous Assets | 25,000 |

| Checking & Savings | 42,583 |

| Net Worth | 2,472,353 |

- Miscellaneous assets include specific investments we’ve made in physical assets (think collectibles) and treasury bonds

- Amounts do not reflect the value of the businesses Chris owns or their assets, which should appear as income to us over future years

- Jenni’s Prius is omitted

The S&P 500 was up about 3.5% for the month.

We were a little behind that with a 2.0% gain.

Overall, our net worth increased by around $49K this month.

Net Worth History

| Date | Amount | % Change |

|---|---|---|

| July 2020 | $1,555,289 | – |

| August 2020 | $1,597,334 | 2.7% |

| September 2020 | $1,566,393 | (2.0%) |

| October 2020 | $1,568,182 | 0.01% |

| November 2020 | $1,720,113 | 9.6% |

| December 2020 | $1,810,864 | 5.3% |

| January 2021 | $1,860,996 | 2.8% |

| February 2021 | $1,878,154 | 0.9% |

| March 2021 | $1,918,269 | 2.1% |

| April 2021 | $2,010,849 | 4.8% |

| May 2021 | $2,049,213 | 1.9% |

| June 2021 | $2,093,896 | 2.2% |

| July 2021 | $2,092,153 | (0.1%) |

| August 2021 | $2,130,761 | 1.8% |

| September 2021 | $2,070,730 | (2.8%) |

| October 2021 | $2,151,272 | 3.9% |

| November 2021 | $2,095,273 | (2.6%) |

| December 2021 | $2,160,235 | 3.1% |

| January 2022 | $2,055,292 | (4.9%) |

| February 2022 | $2,058,001 | 0.01% |

| March 2022 | $2,134,428 | 3.7% |

| April 2022 | $1,968,069 | (7.8%) |

| May 2022 | $1,975,569 | 0.04% |

| June 2022 | $1,868,397 | (5.4%) |

| July 2022 | $1,975,608 | 5.7% |

| August 2022 | $1,878,352 | (5.2%) |

| September 2022 | $1,735,997 | (7.6%) |

| October 2022 | $1,820,287 | 4.9% |

| November 2022 | $1,920,635 | 5.5% |

| December 2022 | $1,866,513 | (2.8%) |

| January 2023 | $1,953,691 | 4.7% |

| February 2023 | $1,882,656 | (3.6%) |

| March 2023 | $1,969,566 | 4.6% |

| April 2023 | $1,981,934 | 0.6% |

| May 2023 | $1,995,247 | 0.7% |

| June 2023 | $2,092,479 | 4.9% |

| July 2023 | $2,189,821 | 4.7% |

| August 2023 | $2,140,296 | (2.2%) |

| September 2023 | $2,042,865 | (4.6%) |

| October 2023 | $2,015,648 | (1.3%) |

| November 2023 | $2,157,404 | 7.0% |

| December 2023 | $2,261,458 | 4.8% |

| January 2024 | $2,296,269 | 1.5% |

| February 2024 | $2,365,110 | 3.0% |

| March 2024 | $2,434,250 | 2.9% |

| April 2024 | $2,371,284 | (2.6%) |

| May 2024 | $2,423,205 | 2.2% |

| June 2024 | $2,472,353 | 2.0% |

Previous Donation Winner

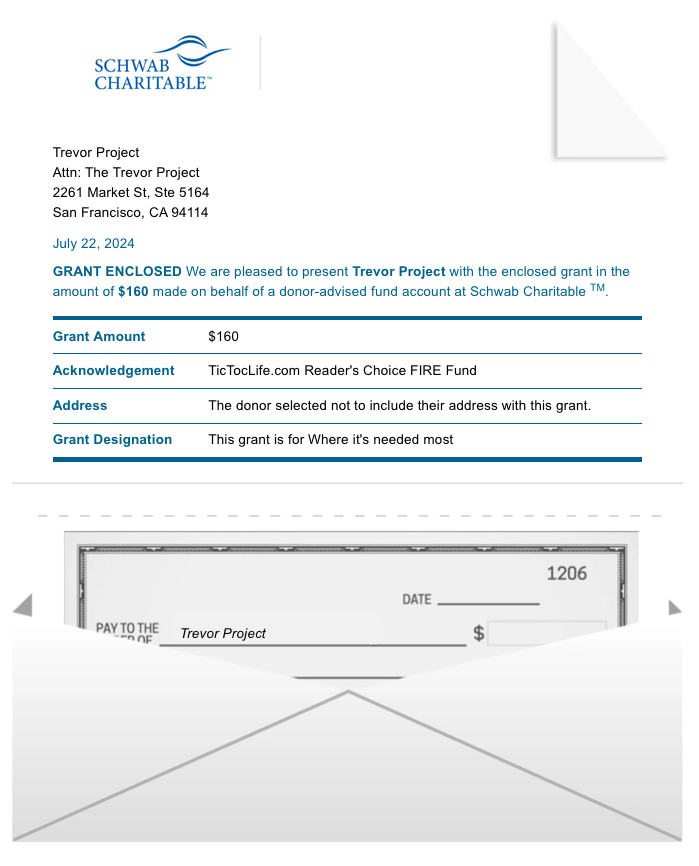

Congratulations to our poll winner, The Trevor Project. As the leading national nonprofit organization providing crisis intervention and suicide prevention services to the LGBTQ under 25, they are the phone call that could be the difference between life and death.

Our Reader’s Fund seeks to leverage the principles of FIRE to build a lifetime of giving.

Thank you for your participation in our polls over the last 47 months. We’ve given $6,000 to deserving charities with your help in deciding which organizations to donate to.

Polls are now open for our next round of candidates: heat relief nonprofits.

Charity Round-Up

The extreme heat waves blanketing the world this summer are proving to be more deadly than all other natural disasters combined. We’ve picked three charities that are beating the heat and protecting the most vulnerable.

As always, each organization has excellent charity ratings to ensure our donation will have the most significant impact. We invite you to learn more about them and join us in donating to one of them by casting your vote.

Summaries below include the impact metrics and a link to their Guidestar profile which details the nonprofit’s operations and transparency.

1) Americares

Why? Americares is paying attention to the emergencies caused by this summer’s heatwaves. With their support, over 40 clinics in the U.S. have created heat-health action plans to connect patients with community resources that will keep them safe when temperatures rise. These plans help reduce patients’ exposure to extreme heat.

Where? United States, Africa, Asia, South America, El Salvador, Syria, Colombia, India, Liberia, and Yemen

What? Americares is a global organization working to help those affected by disaster or poverty. With the high temperatures affecting the health of people living with low incomes, homelessness, or being forced to be outside because of their jobs, Americares supports no-cost clinics and community health centers providing care and relief from the heat. They recently joined the HeatWise Policy Partnership to help policymakers at all levels understand how to implement effective heat resilience strategies.

2) Save the Children Federation, Inc.

Why? Extreme temperatures cause dehydration, illness, and death among the most vulnerable, including the young and elderly. Kids today will see about seven times more heat waves than their grandparents. The children in northern India are facing temperatures of 122°F, one of the worst heatwaves on record.

Where? Globally

What? Save the Children Federation, Inc. is a nonprofit humanitarian organization founded in 1919. With extreme heat becoming more of a negative effect on children’s health, Save the Children is helping communities prepare for heatwaves and adapt to the impacts of climate change for the future through environmental education, access to green employment opportunities, and supplying emergency aid and food for those affected by drought.

3) Greater Good Charities

Why? Extreme heat affects everyone of all ages but this organization doesn’t forget about all of the furry friends suffering as well! Animal shelters are overwhelmed with pets displaced by wildfires and reduced adoption rates during the summer months. Grants help supply shelters with the essentials to keep pets safe and cool.

Where? The United States, Puerto Rico, Mexico, Brazil, Nepal, Ukraine, United Kingdom, Canada, Vietnam, Haiti, Africa and Australia.

Our Notes: Greater Good Charities was founded in 2007 focusing on the simple principle that when communities work together and take small actions, they can change the world. Their organization assists people and pets worldwide. They’ve helped evacuate pets from Ukraine, relocate pets from dangerous areas to improve their chances of adoption, renovate shelters to accommodate pets, distribute food and supplies to those in need, offer quick fixes to control overpopulation and supply medical funding for adoptable pets. Anything they can do to amplify the greater good.

Nonprofit poll

After reviewing the list above, please take a moment to vote for which nonprofit you think will put funds to use in the best way.

(Have trouble using or seeing the poll above? Some reader tools or apps may not display it. View this page in a browser or use this link to our Reader Fund page which has a copy of the poll!)

Thank you for taking the time to vote!

One of our primary goals with TicTocLife is building a stream of giving within the FIRE community and that starts with knowledge.

Want to hear about the results? Sign up for our free FIRE Insider newsletter! We send it out every few weeks and include the monthly poll results and donation winners. You can see an archive of the FIRE Insider and sign up here!

What’s Next

Chris is still working on other posts:

- Inflation bond (I Bond) experience

- Our transition from Intuit’s Mint budgeting app to a different tool

- The big annual FIRE budget post for 2023

Expect a breakdown of our wedding planning and costs to go with our May budget that touched on the wedding (update: wedding expense breakdown published!).

But, more immediately, July brings another big trip for us! We’re headed to The Netherlands to explore North Holland in the “Waterland” area. Lots of biking to come! We’ll see a little of the Dutch city life in The Hague and Rotterdam, too! From there, we’re headed to Copenhagen for a few days to get a taste of Denmark. We’re excited to share all the details in our update for July.

Thanks, as always, for joining us on our FIRE adventure!

How are your summer trips shaking out?

Let us know in the comments or on Threads and X (Twitter)!

One reply on “Montana Glacier Adventures (June 2024 Update)”

Ah. Glacier National Park. A place we’ve always wanted to visit, but haven’t managed to because of the twin challenges of flying out to that remote part of the country and the inherently short visitation season in the summer. We’ve heard that reservations/tickets way in advance (up to a year ahead) are needed in some cases. What was your experience like on that logistics front? Any suggestions/recommendations for prospective visitors looking to possibly make the trip sometime in summer 2025?

It would be a great opportunity to drop by Waterton Lakes National Park area as well. Did you make it that far up north?

Excellent deal on the rental car. $268 for 9 days for the SUV!! How did you score that?

What was the Airbnb lakehouse cost per day (total for the group) — dare I ask?

An enjoyable read as always. Thanks for the post!