September started off with a nice, easy going few weeks before our family trip to Germany to celebrate Chris’s grandfather’s 90th birthday. But of course, we love to add a little adventure to things—Chris’s recent “hobby” repairing Apple devices is taking over a lot of his time (and space in our house!).

For our monthly donation, our theme is period equity and education. You can read more about them and vote for your favorite in the poll below!

We track our income, spending, and savings each month to stay on our FIRE path and share it with you. Please keep reading to see our monthly updates, tips, and charity reviews.

Budget Update

In the Sankey diagram below, the income on the left matches our expenses on the right.

We’ll run through the income and expense sources for the month and remark on any interesting items.

Income Summary

As mentioned recently, Chris has really turned a little hobby of repairing various computer electronics into a mini business. That money will flow through his actual business and appear as his “Consulting” income over time. In reality, it’s less than $1,000 in profit over the recent months. But he’s enjoying it and rescuing some old iPhones, iPads, iMacs, Dell laptops, and so on. Less e-waste and happy buyers with refurbed, modern machines!

Aside from our usual monthly income, here are some interesting anecdotes:

Dividends

Our quarterly dividends are something we use to make ends meet more and more these days. We anticipate significant dividend payments from our various stock holdings—most of it from Vanguard funds like VTSAX. More than half of our distributions were automatically reinvested in our tax-advantaged accounts.

We earned $3,432 in total distributions.

Cashback

We use various online referral platforms, bonuses, etc. to earn cashback on purchases on certain activities. Some of our favorites are Rakuten and Swagbucks.

- Chris earned $2000 from a Charles Schwab promotion for transferring $500K+ of new funds—he moved his brokerage account from Vanguard.

- We earned a pair of small rebates from American Express for overcharging, totaling about $31.

- Our health insurance paid out a small rebate of about $7.

We earned $2,037 in cashback.

Accountable Plan

If you’re interested in the details of how an accountable plan for businesses works, check out this original post.

Chris’s business reimbursed him for the use of our house, utilities, health insurance, and other expenses. This reimbursement covers expenses for the third quarter of 2024.

Chris received $1,276 in reimbursements.

Local Sales

We’re still finding occasional success upgrading our old gear or selling off promos via our local Facebook Marketplace/Craigslist. Related purchases appear in their expense sections below, too [for more details].

- We sold our travel MacBook Pro for $440 (mentioned in August, 2023 with its initial purchase at $358!)

- Jenni sold her old 2008 MacBook for $60.

- We sold a few more items from our wedding: $40—box of wine glasses.

We earned $540 from local sales.

Expense Summary

From our $9,111 monthly budget, we saved and invested about $6,480.

After subtracting our credits and savings—we spent about $2,607 on living expenses.

That’s 54% of our FIRE budget from 2022 ($4,787/month).

Being home greatly brings our expenses down! Let’s break down some of the more exciting details.

Food & Dining

Looks like our dining/food expenses are finally lower than our long-term average! It’s been a while since that happened. Of course, it helps to have been home.

Groceries

At $251, our grocery bill is exceptionally low. This comes from great deals at our local Publix (those B1G1 promos!) and from a few grocery delivery service promos (DoorDash, Gopuff). We tend to stock up on shelf stable stuff and frozen items when the deal is good and it’s something we eat anyway.

Restaurants, Fast food, Alcohol & bars

We dined out with family once while still home, but we started racking up our restaurant visits on our trip that began at the end of the month—Germany and Belgium!

On our first night in Frankfurt, we scouted out a lovely family run Ethiopian place and had a gobsmackingly tasty meal.

We spent $383 on food & dining this month.

Shopping

The never-ending cycle of upgrades continues…

Electronics & Software

- As mentioned last month, we’ve had access to cheap iPhone 12 deals and took advantage—we bought a third for just $35 (!!). This’ll be locked to Metro for some months. We’ll use it for a future trade-in or as an upgrade from Jenni’s iPhone 11 in the future.

- We upgraded our WiFi router to a newer Linksys device with WiFi 6 support—about $16 from a deal on Woot!

We spent $51 on shopping this month.

Auto & Transport

We still do our own basic car maintenance. And, this month was oil change month. We set our Prius and 300ZX up on ramps then swapped out the old for fresh synthetic oil along with new filters. Those cramped quarters are making us each a little more sore as we age, but it’s still very doable. This month:

- $55—DIY oil changes

- $27—fuel

- $28—public transportation (in Germany!)

We spent about $110 on auto & transport this month.

Travel

We kicked off a family trip to Germany and Belgium on September 23. We’ll be back on October 7. We’ll be celebrating Chris’s grandfather’s 90th birthday! On October 3, we’ll sneak off for a short little adventure on the way to our flight home from Belgium—an excuse to explore Dusseldorf and Brussels for a few days before the flight back.

Air Travel

We flew from Virginia to Frankfurt. We’ll return from Brussels. The combo let us cut our costs significantly, and we’ll use it as an opportunity to take the train up to Belgium with a little exploration mixed in. Our small $42 flight cost this month comes from the balance of our pair of roundtrip tickets on SAS Airlines. Chris used 50,000 Merrill Lynch points—a signup bonus he earned many years ago—to wipe out $1,000 of the flight cost. A great deal!

Hotel

Our first night in Frankfurt was at an Ibis near the train station. This let us settle in, explore a little of Frankfurt, and have easy walking access from the trains. Jenni used her Chase Reserve card to book that first night for 9,918 points. Our hotel cost this month, about $4, was for taxes on that first night.

Throughout the rest of September, we stayed with family friends near Heidelberg at no direct lodging expense to us.

Car Rental & Taxi

After our first night in Frankfurt, we met up with family who also arrived at the airport and helped settle them in. We picked up a rental car, too. Again, we used Jenni’s Chase Reserve card to book the Hertz car—total: 18,137 points. That’ll cover us through October 3.

We spent $47 on travel this month.

We’ll have a complete summary cost of our Germany/Belgium trip in next month’s update!

ⓘ Curious about some of the other expenses that we didn’t address? We’ve written about every expense in this month’s diagram either in this post or in the past. Check out our previous budget updates for more detail or ask in the comments below!

How Much We Work

We like to keep track of how much time we spend doing work that is paid.

Let’s add this month to the list…

Design Note: A reader suggested we should collapse the hours worked and net worth history history tables below. They’ve started to get quite long after a handful of years! Let us know if this works well for you in the comments.

History of Monthly “Hours Worked”

| Month | Chris (Hours Worked) | Jenni (Hours Worked) |

|---|---|---|

| May 2020 | 41 | 108 |

| Jun 2020 | 38 | 96 |

| Jul 2020 | 36 | 120 |

| Aug 2020 | 39 | 48 |

| Sep 2020 | 27 | 76 |

| Oct 2020 | 26 | 104 |

| Nov 2020 | 27 | 57 |

| Dec 2020 | 28 | 57 |

| Jan 2021 | 25 | 102 |

| Feb 2021 | 24 | 104 |

| Mar 2021 | 24 | 106 |

| Apr 2021 | 23 | 85 |

| May 2021 | 17 | 29.75 |

| Jun 2021 | 19 | 66 |

| Jul 2021 | 21 | 30.25 |

| Aug 2021 | 23 | 16.5 |

| Sep 2021 | 26 | 28 |

| Oct 2021 | 22 | 49 |

| Nov 2021 | 21 | 51 |

| Dec 2021 | 64 | 27 |

| Jan 2022 | 32 | 80 |

| Feb 2022 | 29 | 63 |

| Mar 2022 | 14 | 70 |

| Apr 2022 | 15 | 21 |

| May 2022 | 14 | 36 |

| Jun 2022 | 6 | 12 |

| Jul 2022 | 13 | 45.5 |

| Aug 2022 | 15 | 96 |

| Sep 2022 | 12 | 54 |

| Oct 2022 | 14 | 34.5 |

| Nov 2022 | 12 | 72 |

| Dec 2022 | 11 | 16.5 |

| Jan 2023 | 10 | 88 |

| Feb 2023 | 11 | 81.5 |

| Mar 2023 | 12 | 47.5 |

| Apr 2023 | 8 | 1 |

| May 2023 | 16 | 100 |

| Jun 2023 | 10 | 109 |

| Jul 2023 | 12 | 48 |

| Aug 2023 | 16 | 54.5 |

| Sep 2023 | 9 | 20 |

| Oct 2023 | 14 | 22 |

| Nov 2023 | 15 | 22 |

| Dec 2023 | 16 | 12 |

| Jan 2024 | 12 | 61.25 |

| Feb 2024 | 14 | 28.5 |

| Mar 2024 | 16 | 61.5 |

| Apr 2024 | 12 | 22 |

| May 2024 | 8 | 19.5 |

| Jun 2024 | 18 | 19.5 |

| Jul 2024 | 14 | 44 |

| Aug 2024 | 18 | 81 |

| Sep 2024 | 15 | 20 |

Jenni continues to dump all of her earnings into her 401(k). The lead pharmacist—the person who took over her old job!—is out on maternity leave so Jenni has been helping out a lot.

Net Worth Update

Net worth is not our primary measurement and can understand it can be discouraging if you’re working yourself out of debt. We also understand it’s difficult to be transparent with our readers without divulging this information so we continue to do so.

Account breakdown

The market keeps chugging along and so do our investments. From a high level, our assets and liabilities are shown in the data table below as of September 30, 2024.

| Description | Value (USD, $) |

|---|---|

| 401(k) | 1,012,658 |

| Brokerage | 929,274 |

| Roth IRA | 201,356 |

| Traditional IRA | 24,361 |

| HSA | 60,589 |

| Real Estate | 435,700 |

| Mortgage | (135,715) |

| Miscellaneous Assets | 25,000 |

| Checking & Savings | 39,335 |

| Net Worth | 2,592,558 |

- Miscellaneous assets include specific investments we’ve made in physical assets (think collectibles) and treasury bonds

- Amounts do not reflect the value of the businesses Chris owns or their assets, which should appear as income to us over future years

- Jenni’s Prius is omitted

The S&P 500 was up about 2.0% for the month.

We were a little behind that with a 1.3% gain. This can mostly be attributed to our housing value falling around $10K.

Overall, our net worth increased by around $32K this month.

Net Worth History

| Date | Amount | % Change |

|---|---|---|

| July 2020 | $1,555,289 | – |

| August 2020 | $1,597,334 | 2.7% |

| September 2020 | $1,566,393 | (2.0%) |

| October 2020 | $1,568,182 | 0.01% |

| November 2020 | $1,720,113 | 9.6% |

| December 2020 | $1,810,864 | 5.3% |

| January 2021 | $1,860,996 | 2.8% |

| February 2021 | $1,878,154 | 0.9% |

| March 2021 | $1,918,269 | 2.1% |

| April 2021 | $2,010,849 | 4.8% |

| May 2021 | $2,049,213 | 1.9% |

| June 2021 | $2,093,896 | 2.2% |

| July 2021 | $2,092,153 | (0.1%) |

| August 2021 | $2,130,761 | 1.8% |

| September 2021 | $2,070,730 | (2.8%) |

| October 2021 | $2,151,272 | 3.9% |

| November 2021 | $2,095,273 | (2.6%) |

| December 2021 | $2,160,235 | 3.1% |

| January 2022 | $2,055,292 | (4.9%) |

| February 2022 | $2,058,001 | 0.01% |

| March 2022 | $2,134,428 | 3.7% |

| April 2022 | $1,968,069 | (7.8%) |

| May 2022 | $1,975,569 | 0.04% |

| June 2022 | $1,868,397 | (5.4%) |

| July 2022 | $1,975,608 | 5.7% |

| August 2022 | $1,878,352 | (5.2%) |

| September 2022 | $1,735,997 | (7.6%) |

| October 2022 | $1,820,287 | 4.9% |

| November 2022 | $1,920,635 | 5.5% |

| December 2022 | $1,866,513 | (2.8%) |

| January 2023 | $1,953,691 | 4.7% |

| February 2023 | $1,882,656 | (3.6%) |

| March 2023 | $1,969,566 | 4.6% |

| April 2023 | $1,981,934 | 0.6% |

| May 2023 | $1,995,247 | 0.7% |

| June 2023 | $2,092,479 | 4.9% |

| July 2023 | $2,189,821 | 4.7% |

| August 2023 | $2,140,296 | (2.2%) |

| September 2023 | $2,042,865 | (4.6%) |

| October 2023 | $2,015,648 | (1.3%) |

| November 2023 | $2,157,404 | 7.0% |

| December 2023 | $2,261,458 | 4.8% |

| January 2024 | $2,296,269 | 1.5% |

| February 2024 | $2,365,110 | 3.0% |

| March 2024 | $2,434,250 | 2.9% |

| April 2024 | $2,371,284 | (2.6%) |

| May 2024 | $2,423,205 | 2.2% |

| June 2024 | $2,472,353 | 2.0% |

| July 2024 | $2,513,877 | 1.7% |

| August 2024 | $2,560,215 | 1.8% |

| September 2024 | $2,592,558 | 1.3% |

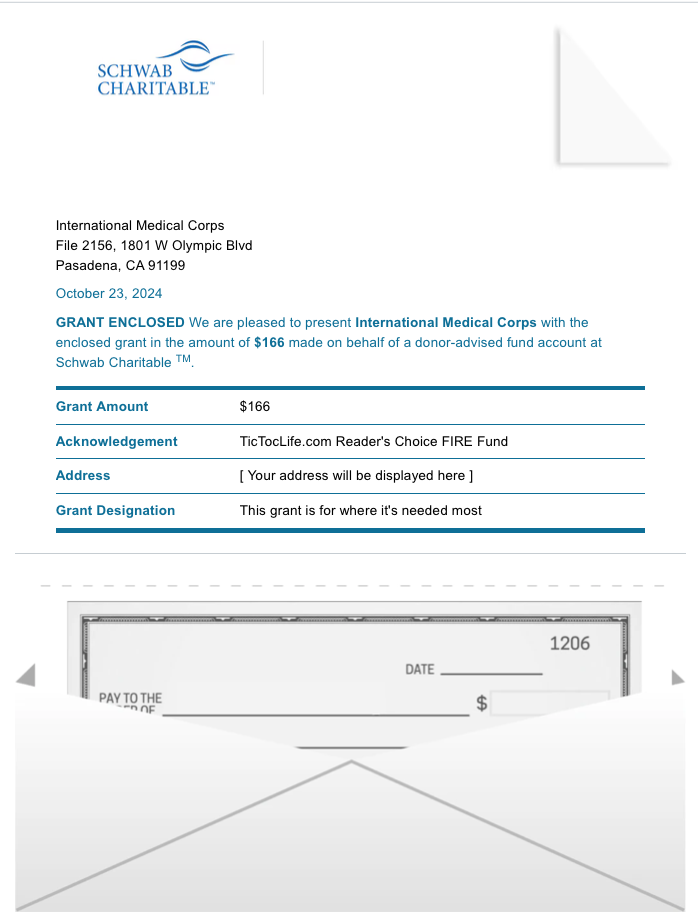

Previous Donation Winner

Our top charity run-off last month was a close race with the winner being International Medical Corps. This global humanitarian aid organization continues to provide essential care and services to those affected by conflict, natural disasters, or disease. We are glad to support them again with our donation below.

Our Reader’s Fund seeks to leverage the principles of FIRE to build a lifetime of giving.

Thank you for your participation in our polls over the last 50 months. We’ve given $6,500 to deserving charities with your help in deciding which organizations to donate to.

Polls are now open for our next round of candidates: Menstrual Equity and Education.

Charity Round-Up

A few things we all have in common are natural bodily functions. We all pee and we all poop. We even all fart and burp! And about half of us menstruate every month for a good portion of our lives. It’s literally how our species repopulates. But for such a natural process, the period stigma is still very much alive. Due to negative social and cultural beliefs, embarrassment and shame, people just avoid the topic completely. By not having this conversation, women’s lives are affected more than just once a month.

ad to discrimination and humiliation, and can prevent people from seeking health care for menstrual-related pain

Let’s face it, the conversation about menstruation has got to change. PERIOD. Each of the following organizations is working to make this change possible in unique ways. We invite you to learn more about great work around the world and join us in donating to one of them by casting your vote.

Summaries below include the impact metrics and a link to their Guidestar profile which details the nonprofit’s operations and transparency.

1) Sylvia’s Sisters

Why? Period poverty! 40% of menstruators struggle to afford basic hygiene supplies they need which leads to missing work or school due to the lack of access to period supplies.

Where? Central Virginia, United States, and Uganda

What? Sylvia’s Sisters is a nonprofit organization founded by two friends 7,000 miles apart with a mutual problem. Women and children were stuck without the necessary hygiene supplies to attend work or school. Missed days lead to poor education and low income. They came up with a simple fix of providing ‘period kits’, both disposable and reusable, for those menstruators in need, both in Uganda and the Richmond area. Through their efforts, they now can provide menstruation health and hygiene awareness and facilitate reliable access to clean water to wash reusable products.

2) Days For Girls International

Why? They are turning period problems into period pathways for individuals and communities through their various solutions to the period problem.

Where? Asia, Oceania, South America, North America, Africa

What? Days for Girls International is a global organization working to eliminate the stigma and limitations associated with menstruation. Their environmental and reusable DFG Pad kit comes with a waterproof shield, washable absorbent liners, soap, extra panties, and a carry pouch that lasts several years! At each distribution event, health educators provide menstruation education to reduce the period stigma. They work with the local communities to become DFG Social Enterprise leaders and spread the knowledge even further while earning an income.

3) The Pad Project

Why? A period should end a sentence, not a girl’s education.

Where? India, Tanzania, Afghanistan, Kenya, Sri Lanka, Nepal, Pakistan, United States

Our Notes: The Pad Project is a global nonprofit founded by eight high school students in 2013 determined to have menstrual equity for all. Their film project, “Period. End of Sentence.” won the Academy Award for Best Documentary Short in 2019. The documentary highlights a rural village in India fighting the period stigma while they learn to manufacture pads. Since then, the project has placed nine pad-making machines in two countries employing women from the community to make and sell the products. They’ve expanded to eight washable programs where access to clean water is available. They even have school programs in four states to distribute products to kids in need. They’ve found a way to turn a period into an education!

Nonprofit poll

After reviewing the list above, please take a moment to vote for which nonprofit you think will put funds to use in the best way.

(Have trouble using or seeing the poll above? Some reader tools or apps may not display it. View this page in a browser or use this link to our Reader Fund page which has a copy of the poll!)

Thank you for taking the time to vote!

One of our primary goals with TicTocLife is building a stream of giving within the FIRE community and that starts with knowledge.

Want to hear about the results? Sign up for our free FIRE Insider newsletter! We send it out every few weeks and include the monthly poll results and donation winners. You can see an archive of the FIRE Insider and sign up here!

What’s Next

Chris is still working on other posts:

- Inflation bond (I Bond) experience

- Our transition from Intuit’s Mint budgeting app to a different tool

- The big annual FIRE budget post for 2023

- Credit card rewards points breakdown—as suggested by a reader!

Between travel and Chris’s recent electronics hobbies, we just haven’t had enough time to dedicate to writing these post ideas. But, hopefully soon.

As we look forward to October, we’ll have a little more downtime once we’ve settled back in from our trip. We’ve already got a late winter Portugal trip coming together, and possibly another warm-weather escape before then! But fall is a lovely time in Virginia, we’ll do some leaf peeping and gather with family/friends for Halloween.

We appreciate the ongoing conversation we have with you, our readers. Thank you! We always enjoy your comments, so let us know what’s on your mind below!

What’re your latest hobbies?

Let us know in the comments or on Threads and X (Twitter)!

One reply on “New Hobbies and Bretzels (Sep 2024 Update)”

Those Bretzels look amazing! Seems like a very fun hobby to pick up. The world could use less e-waste! I’m also fascinated by the idea of buying a newer phone for super cheap and then using it for an upgrade later, I’ve never seen that before. Good thinking~