Before family Thanksgiving gatherings commenced this month, we escaped the encroaching cold on a trip to Cancún with friends followed by a 40th birthday celebration in Nashville. And, the market had a huge run-up that helped ameliorate inflation’s effects on our FIRE spending.

Besides preparing for fall, we continued our donation tradition to one of three nonprofits, this time helping medical support services. You can read more about them and vote for your favorite in the poll below!

Each month, we track our income, spending, and savings to stay on our FIRE path and share it with you. Please keep reading to see our monthly updates, tips, and charity reviews.

Budget Update

If you’d like a more detailed description of our typical monthly cash flow (like our jobs or housing situation), check out our previous budget updates.

In the Sankey diagram below, the income on the left matches our expenses on the right.

We’ll run through the income and expense sources for the month and remark on any interesting items.

Income Summary

We didn’t wind up short in November quite like we did last month (where we were short about $4K!). But, we’re still drawing against checking and savings to balance our budget by about $800. Still, we’re doing just fine in FIRE terms.

Tax Refund

Virginia passed a one-time tax refund to filers. Jenni earned $200 from this.

We earned $200 in tax refunds.

Credits

Several of our credit cards offer statement credits for purchasing with certain companies. Chase cardholders are eligible for statement credits with Gopuff ($10/month). Between the two of us, we can get back about $100 from Gopuff credits. That’s pretty great considering most of our Chase cards have no annual fee.

Chris’s AMEX gold earned $10 back for dining.

We received $110 in statement credits.

Cashback

Laurel Road no-fee checking accounts earn a $10 monthly bonus for making direct deposits of at least $2,500/month.

We earned $10 in cash back.

Expense Summary

From our $4,277 monthly budget, we saved and invested about $106.

After subtracting our credits and savings, we spent about $4,170 on living expenses.

That’s 97% of our FIRE budget from 2021 ($4,281/month).

Let’s break down some of the more exciting details.

Food & Dining

Our food expenses tend to vary a lot while we travel. Let’s see how we did with two short trips this month: Cancún and Nashville.

Groceries

Our grocery spending came to about $463. We stocked up on an amazing Amazon Fresh deal where we got a combined $100 off just over $200 in spending!

It’s worth noting that about $110 of our grocery costs was covered by credits from AMEX/Chase for Grubhub, and Gopuff.

Restaurants, Fast food, Alcohol & bars

Our dining-out expenses remained similar to last month—even with less travel this month. Restaurants rang in at about $165, alcohol & bars at $63, and fast food at $25.

Our trip to Cancún with friends to experience their first “all-inclusive” was a culinary tour! Despite the inclusive nature, we still spent about $70 on tips between restaurants, cafes, and bars.

We met a group of friends to celebrate one of Chris’ best friend’s 40th birthday. Naturally, that meant several bar and restaurant stops that added to our tabs.

…But those visits and tabs naturally included entertainment! All the live music made the higher costs in Nashville seem reasonable. We never had to wander far to find more glitz and glamor.

We spent $717 on food & dining this month.

Travel

This month, we spent four nights in Cancún and three more in Nashville. The trips were short blasts of fun seeing friends. We love being able to do this sort of thing with highly flexible schedules that come with minimal work schedules!

We managed to drastically cut the cost of these trips through hotel certificates and points. Let’s have a look at the details.

Hotel

Below are our hotel stay details for our two November trips:

| When | Where | Description | Nts. | Cost ($, USD) | Reward Pts/Miles |

|---|---|---|---|---|---|

| 11/05/23 | Cancún, MX | Seadust Cancún | 3 | 639.12 | |

| 11/08/23 | Cancún, MX | Hilton All-Inclusive Cancún | 1 | 0.00 | Hilton Certificate |

| 11/16/23 | Nashville, TN | Hyatt House Nashville Airport | 1 | 8,000 | Hyatt Pts (Chase UR) |

| 11/17/23 | Nashville, TN | Hyatt House Vanderbilt | 2 | 24,000 | Hyatt Pts (Chase UR) |

And, here are some photos in order of where we stayed—

Seadust Cancún (All-Inclusive, Balcony):

Hilton Cancún (All-Inclusive, Balcony):

Our two Hyatt stays in Nashville were very nice, though also very standard. We didn’t bother to snap photos of the two rooms.

Had we not used Hyatt Points (converted from our Chase Ultimate Rewards) for our three nights in Nashville, the cost would have been about $700. Not a bad use of 32,000 points. We even earned 3,000 with a Hyatt bonus!

That said, our friends celebrating a 40th birthday, sure went all out. Check out what about $1,500/night will get you right on Broadway:

Notably, they did split the cost up among five couples.

Rental Car & Taxi

In both Nashville and Cancún, we had no rental car or useful public transit. Instead, we relied on Uber for airport-to-destination transfers and back.

That totaled about $161 which was nearly evenly split between the two destinations.

Air Travel

Our flights to Cancún involved a connection through Atlanta which meant we were flying Delta. Chris’ American Expresses Business Platinum offered up a good tool to cover the cost through Membership Rewards points with a bonus to boot.

$200 of the flight cost was covered by an annual credit the card offers. Another $121 was paid out of pocket. The remaining cost was covered by 31,867 MR points.

These flights would have otherwise come to about $799 roundtrip for us.

Our flights to Nashville were more straightforward (and direct!). They were $238 roundtrip for the pair of us. Not a bad deal at all when you can pack small enough to qualify as a “personal item” only.

We spent $1,171 on travel this month.

Expense Conclusion

While that covers the big stuff, we still had a few random things small purchases to mention that might be of interest.

Electronics & software

Chris was lured in by Apple’s new Watch OS update that promised new running metrics: power generation, vertical oscillation, and more. Of course, his Series 5 watch was just shy of being able to deliver the hardware to support this new data gathering. He found a good deal on a reconditioned Series 8 for just $192 and jumped on it. He immediately sold the old one for $150 (more than the $130 he paid more than a year ago), bringing the net upgrade cost to $42. We picked up some new batteries for Jenni’s car remote for about $6, too — bringing our total to $48 in this category.

Parking

Occasionally, you might see a fairly high parking fee appear in our budget. While sometimes it’s for several individual parking periods during a trip, it’s often for long-term parking fees at our airport. We use a third-party parking service (not the official airport one) that charges much lower rates and shuttles us about five minutes to the airport. It’s often difficult to decide between roundtrip Uber versus parking for relatively short trips. This month, that came in at about $55.

License Renewal

Jenni may not work all that much, but she still renews her Pharmacy license in our state each year. It’s an out-of-pocket expense, this time, $120.

Amusement

Right at the end of the month, we visited both our local botanical gardens and science museum. The real draw for the museum was the annual model railroad show! We spent about $50 on amusements this month.

Having reviewed all our more interesting expenses, let’s have a look at how much we worked this month.

How Much We Work

We like to keep track of how much time we spend doing work that is paid.

Let’s add this month to the list…

| Month | Chris (Hours Worked) | Jenni (Hours Worked) |

|---|---|---|

| May 2020 | 41 | 108 |

| Jun 2020 | 38 | 96 |

| Jul 2020 | 36 | 120 |

| Aug 2020 | 39 | 48 |

| Sep 2020 | 27 | 76 |

| Oct 2020 | 26 | 104 |

| Nov 2020 | 27 | 57 |

| Dec 2020 | 28 | 57 |

| Jan 2021 | 25 | 102 |

| Feb 2021 | 24 | 104 |

| Mar 2021 | 24 | 106 |

| Apr 2021 | 23 | 85 |

| May 2021 | 17 | 29.75 |

| Jun 2021 | 19 | 66 |

| Jul 2021 | 21 | 30.25 |

| Aug 2021 | 23 | 16.5 |

| Sep 2021 | 26 | 28 |

| Oct 2021 | 22 | 49 |

| Nov 2021 | 21 | 51 |

| Dec 2021 | 64 | 27 |

| Jan 2022 | 32 | 80 |

| Feb 2022 | 29 | 63 |

| Mar 2022 | 14 | 70 |

| Apr 2022 | 15 | 21 |

| May 2022 | 14 | 36 |

| Jun 2022 | 6 | 12 |

| Jul 2022 | 13 | 45.5 |

| Aug 2022 | 15 | 96 |

| Sep 2022 | 12 | 54 |

| Oct 2022 | 14 | 34.5 |

| Nov 2022 | 12 | 72 |

| Dec 2022 | 11 | 16.5 |

| Jan 2023 | 10 | 88 |

| Feb 2023 | 11 | 81.5 |

| Mar 2023 | 12 | 47.5 |

| Apr 2023 | 8 | 1 |

| May 2023 | 16 | 100 |

| Jun 2023 | 10 | 109 |

| Jul 2023 | 12 | 48 |

| Aug 2023 | 16 | 54.5 |

| Sep 2023 | 9 | 20 |

| Oct 2023 | 14 | 22 |

| Nov 2023 | 15 | 22 |

Our work schedules came in about as we expected considering we were traveling.

Net Worth Update

Net worth is not our primary measurement and can understand it can be discouraging if you’re working yourself out of debt. We also understand it’s difficult to be transparent with our readers without divulging this information so we continue to do so.

Account breakdown

The market keeps chugging along and so do our investments. From a high level, our assets and liabilities are shown in the data table below as of November 30, 2023.

| Description | Value (USD, $) |

|---|---|

| 401(k) | 801,992 |

| Brokerage | 771,099 |

| Roth IRA | 155,855 |

| Traditional IRA | 14,061 |

| HSA | 57,188 |

| Real Estate | 413,500 |

| Mortgage | (139,503) |

| Miscellaneous Assets | 51,642 |

| Checking & Savings | 31,572 |

| Net Worth | 2,157,404 |

- Miscellaneous assets include specific investments we’ve made in physical assets (think collectibles) and treasury bonds

- Amounts do not reflect the value of the businesses Chris owns or their assets, which should appear as income to us over future years

- Jenni’s Prius is omitted

The S&P 500 was up about 8.9% for the month. That’s huge! Nearly an entire year of typical returns.

While we had a huge sunup, we didn’t quite match the market. We came in with a 7.0% gain.

Overall, our net worth increased by around $142K.

Net Worth History

| Date | Amount | % Change |

|---|---|---|

| July 2020 | $1,555,289 | – |

| August 2020 | $1,597,334 | 2.7% |

| September 2020 | $1,566,393 | (2.0%) |

| October 2020 | $1,568,182 | 0.01% |

| November 2020 | $1,720,113 | 9.6% |

| December 2020 | $1,810,864 | 5.3% |

| January 2021 | $1,860,996 | 2.8% |

| February 2021 | $1,878,154 | 0.9% |

| March 2021 | $1,918,269 | 2.1% |

| April 2021 | $2,010,849 | 4.8% |

| May 2021 | $2,049,213 | 1.9% |

| June 2021 | $2,093,896 | 2.2% |

| July 2021 | $2,092,153 | (0.1%) |

| August 2021 | $2,130,761 | 1.8% |

| September 2021 | $2,070,730 | (2.8%) |

| October 2021 | $2,151,272 | 3.9% |

| November 2021 | $2,095,273 | (2.6%) |

| December 2021 | $2,160,235 | 3.1% |

| January 2022 | $2,055,292 | (4.9%) |

| February 2022 | $2,058,001 | 0.01% |

| March 2022 | $2,134,428 | 3.7% |

| April 2022 | $1,968,069 | (7.8%) |

| May 2022 | $1,975,569 | 0.04% |

| June 2022 | $1,868,397 | (5.4%) |

| July 2022 | $1,975,608 | 5.7% |

| August 2022 | $1,878,352 | (5.2%) |

| September 2022 | $1,735,997 | (7.6%) |

| October 2022 | $1,820,287 | 4.9% |

| November 2022 | $1,920,635 | 5.5% |

| December 2022 | $1,866,513 | (2.8%) |

| January 2023 | $1,953,691 | 4.7% |

| February 2023 | $1,882,656 | (3.6%) |

| March 2023 | $1,969,566 | 4.6% |

| April 2023 | $1,981,934 | 0.6% |

| May 2023 | $1,995,247 | 0.7% |

| June 2023 | $2,092,479 | 4.9% |

| July 2023 | $2,189,821 | 4.7% |

| August 2023 | $2,140,296 | (2.2%) |

| September 2023 | $2,042,865 | (4.6%) |

| October 2023 | $2,015,648 | (1.3%) |

| November 2023 | $2,157,404 | 7.0% |

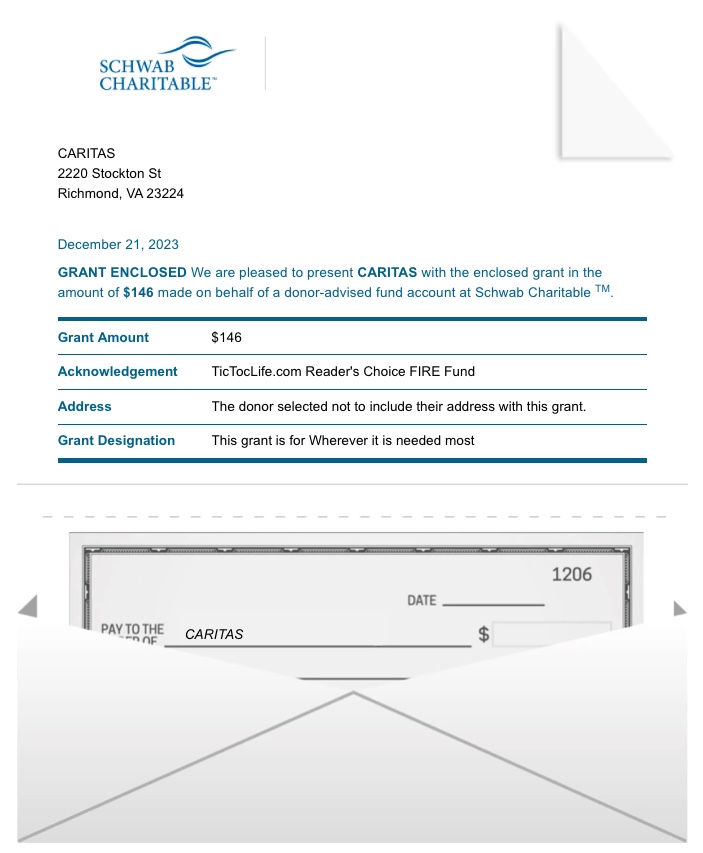

Previous Donation Winner

Just in time for the holidays, our donation winner is CARITAS with seven votes. CARITAS hosts Holiday Shops, filled with locally donated items, provides more than 300 participants with necessities and festive cheer bags containing a new pair of PJs, socks, and a pair of underwear. They also set up holiday crafts and decor in their emergency shelters for those who find themselves homeless or in recovery this season.

Our Reader’s Fund seeks to leverage the principles of FIRE to build a lifetime of giving.

Thank you for your participation in our polls over the last 40 months. We’ve given over $4,900 to deserving charities with your help in deciding which organizations to donate to.

Polls are now open for our next round of candidates: medical support service charities.

Charity Round-Up

When a loved one is sick, you just want access to the best possible care. This can be challenging. Traveling or finding lodging near the hospital for an unknown length of time is stressful. Learning the cost for treatment can be shocking. These huge barriers can limit the treatment for some.

These three organizations help to remove some of the barriers of accessing quality healthcare. Each one has excellent charity ratings to ensure our donation will have the most significant impact. We invite you to learn more about them and join us in donating to one of them by casting your vote.

Summaries below include the impact metrics and a link to their Guidestar profile which details the nonprofit’s operations and transparency.

1) HealthWell Foundation

Why? Healthcare in The United States is expensive. Somewhat affordable health insurance is usually tied to one’s job. But, having a chronic illness can make holding a full-time job difficult. This leads to many patients without healthcare simply because they cannot afford it.

Where? The United States.

What? HealthWell Foundation is a non-profit organization that eases the burden of healthcare costs for those with chronic or life-altering diseases. Their programs help make it possible to afford costly medications, medical treatments, health insurance premiums, copays and other out-of-pocket costs. Their vision is that no patient goes without essential medical treatments because they cannot afford them.

2) The Doorways

Why? Patients undergoing complex medical procedures need the love and support of their loved ones. Often, patients and families need places to sleep close the doctors—which shouldn’t include the hospital floor. The Doorways provide a home away from home that’s close to several hospitals and medical facilities. Beyond the rooms and meals, guests are welcomed into a supportive community of those going through similar situations.

Where? Richmond, Virginia.

Our Notes: The Doorways was founded as a non-profit 28-bed Hospital Hospitality House, providing lodging and support for patients and their loved ones in 1983. Since then, they have grown to a 117-bed hotel complete with a shared kitchen and living space or private apartments for those needing isolation. They are located in the hub of Richmond’s healthcare facilities making it easy to be close to care. They are open 365 days a year and operate mostly on donations. Guests are asked for $15 per night but are not turned away if they cannot afford it. And, often group meals are prepared by local volunteers.

3) Ronald McDonald House Charities of Greater Washington, D.C. INC.

Why? Parents of very sick children need to be close to their child. They shouldn’t have to worry about where they are going to stay while their little one is getting the best treatment, often, at very distant locations.

Where? Washington, DC, Virginia, Maryland, West Virginia.

Our Notes: Ronald McDonald House Charities of Greater Washington, D.C. INC. is a non-profit organization that provides temporary housing for families of seriously ill children being taken care of at local hospitals. They also have a mobile unit, the Ronald McDonald Care Mobile program, that offer free healthcare, fitness and nutrition education to under-served children in the DC area.

Nonprofit poll

After reviewing the list above, please take a moment to vote for which nonprofit you think will put funds to use in the best way.

(Have trouble using or seeing the poll above? Some reader tools or apps may not display it. View this page in a browser or use this link to our Reader Fund page which has a copy of the poll!)

Thank you for taking the time to vote!

One of our primary goals with TicTocLife is building a stream of giving within the FIRE community and that starts with knowledge.

Want to hear about the results? Sign up for our free FIRE Insider newsletter! We send it out every few weeks and include the monthly poll results and donation winners. You can see an archive of the FIRE Insider and sign up here!

What’s Next

While we have one last trip for the year to Phoenix in December, it feels like the end of the year is coming quickly. The holiday season is closing in with Thanksgiving now in the rearview mirror.

We’re planning to make a stop off to check out Culdesac Tempe with some friends while we’re in Phoenix and seeing family. These sorts of community environments have always interested us (in fact, we live in a historic cooperative). Hopefully, we’ll have the opportunity to share some thoughts after our visit!

And of course, Christmas. We’re planning to have a low-key friends and family-oriented December with lots of local events and social gatherings. That’s just the right sort of thing for us, and being able to say “yes” to so many invitations is such an exciting and wonderful experience that comes with the freedom that FIRE brings.

How are your holidays shaping up this season?

Let us know in the comments or on Threads and X (Twitter)!

2 replies on “Fall in Cancún & Nashville (Nov. 2023 Update)”

Any update on your health insurance situation? Are you still on ACA? If so, any changes in the premium?

TK,

Good question! Yes, we’re both still on ACA. We’ve been making adjustments within the program as our income changes and/or life changes permit. As our income goes down—from working less—the credit tends to go up.

We’ll see how things shake out for 2023 as a whole. It seems that Jenni could have been slightly underpaying (and will pay back some of her credit through her tax return) while I should have been on target or at least close to it.

Our 2024 numbers are looking similar.

We’ll both add that coverage levels are quite good for ACA silver tier plans. Cost-sharing comes in to help take the bite out of high deductibles, too, with low incomes like ours are trending towards.

I’d be surprised if we end up paying more than $150/month on average, for both of us, after accounting for any additional underestimate fees we pay. Dental insurance is another $50/month/person.