November produced a lovely, relaxed month for us—with a focus on family and enjoying Virginia as fall turned to winter. With that, the return of one of our favorite spending categories—”nothing”! Check out the update below to see how great free things in our area—and probably yours, too!—can be.

For our monthly donation, our theme is hapiness. You can read more about them and vote for your favorite in the poll below!

We track our income, spending, and savings each month to stay on our FIRE path and share it with you. Please keep reading to see our monthly updates, tips, and charity reviews.

Budget Update

In the Sankey diagram below, the income on the left matches our expenses on the right.

We’ll run through the income and expense sources for the month and remark on any interesting items.

Income Summary

Aside from our usual monthly income, here are some interesting anecdotes:

Cashback

We use various online referral platforms, bonuses, etc. to earn cashback on purchases on certain activities. Some of our favorites are Rakuten and Swagbucks. Payouts often represent several months of earnings.

- Chris earned about $94 from Bank of America credit card rewards.

- Jenni earned about $37 through Ibotta.

We earned $131 in cashback.

Local Sales

We’re still finding occasional success upgrading our old gear or selling off promos via our local Facebook Marketplace/Craigslist. Related purchases appear in their expense sections below, too [for more details].

- [$410] We sold the two iPhone 12s we bought recently that were locked to the carrier, Metro—originally we’d intended to use these for trade-ins but earned good local sales.

- [$105] Chris sold a set of AirPods 4 that he bought on sale from Best Buy with the gift card he earned recently with a Pixel 9 trade-in.

- [$30] We sold our old Nighthawk WiFi router after getting an upgraded unit last month with WiFi 6.

We earned $545 from local sales.

Expense Summary

From our $5,246 monthly budget, we saved and invested $811! We did put more money into 401(k), but a large chunk came from our checking.

After subtracting our credits and savings—we spent about $2,776 on living expenses.

That’s 58% of our FIRE budget from 2022 ($4,787/month).

Our income would have been enough to cover our expenses had we not saved/invested, so we were net positive for the month. But, that’s mostly because of our low spending. Let’s break down some of the more exciting details.

Food & Dining

Our food expenses dropped by nearly 50% since last month!

Groceries

At $484, most of our food-related costs came in as groceries. As we weren’t traveling in November, our dining out costs dropped like a rock and our grocery expenses stabilized. Some of this cost is offset by Jenni’s Ibotta cash back that she was awarded this month (about $37).

Restaurants, Fast food, Alcohol & bars

We still took advantage of a few deals our credit cards provide, local food places were offering, etc. So, we spent about $26 on dining out for little bites here and there throughout the month.

We spent $510 on food & dining this month.

Expense Conclusion

While that covers the big stuff, we still had a few random things small purchases to mention that might be of interest.

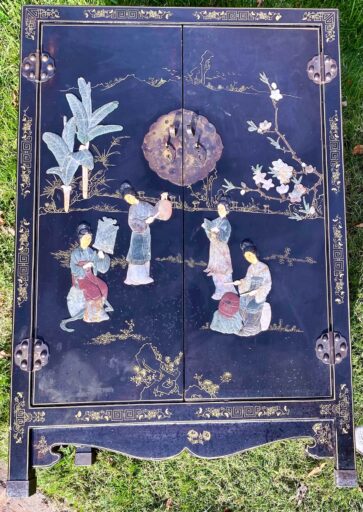

Furnishings

We learned about “GovDeals”—a regional auction site for Virginia government-related institutions. Chris resisted buying a lot of 25 laptops—and instead—we got a very lovely black cabinet with Asian influence. The beautiful inlay and stone accents attracted both of us. It was just over $62 after auction fees and we picked it up only a handful of miles away.

Utilities

Hot tip—

We’ve been prepaying our electric and local utility bills this year via credit card. Both incur a fee (of about 3%). But, we’ve been using a credit card that earns 5x points (worth about 7.5% to us) to buy Visa or Mastercard gift cards locally which we then pay the utilities with. We buy those cards when they have no fee (frequently at Staples or Office Max/Depot).

Below is a quick table of our annual (estimated) utility expenses and how we use them to earn travel reimbursements.

| Description | Expense ($) | CC Fee ($) | Points Earned |

|---|---|---|---|

| Utility: City Water/Gas | 276 | 7 | 1,380 |

| Utility: Electric | 871 | 26 | 4,335 |

| Total | 1,147 | 33 | 5,715 |

For $33 in fees, we earned 5,715 in points. With the Chase Sapphire Reserve card, those are worth at least $85 to us. The bonus points easily offset the payment fee and we earn a bunch of points for future travel. Just one of the small ways we strategically spend. Fun!

Hotel

Our one travel-related expense this month, $95, was actually for the annual fee on Chris’s Chase Sapphire Preferred card. As we use the earned points most for travel—frequently hotels—we’ve designed the fee in the “hotel” category. Because of certain Chase offers and future travel strategies, Chris is retaining the card for another year rather than downgrading to avoid this fee.

Nothing

The return of one of our favorite spending categories—

Nothing. We spent nothing, as we routinely do, on some of the most fun we had all month! Everything below; not a penny in additional costs:

While there are of course some incidental costs to doing things—like food for gatherings or gas to get places—they’re pretty minimal and hey, we’ve got to eat anyway! Entertaining, enjoyable, and fulfilling ways to fill your time don’t have to cost a bunch of money.

ⓘ Curious about some of the other expenses that we didn’t address? We’ve written about every expense in this month’s diagram either in this post or in the past. Check out our previous budget updates for more detail or ask in the comments below!

How Much We Work

We like to keep track of how much time we spend doing work that is paid.

Let’s add this month to the list…

Design Note: A reader suggested we should collapse the hours worked and net worth history history tables below. They’ve started to get quite long after a handful of years! Let us know if this works well for you in the comments.

History of Monthly “Hours Worked”

| Month | Chris (Hours Worked) | Jenni (Hours Worked) |

|---|---|---|

| May 2020 | 41 | 108 |

| Jun 2020 | 38 | 96 |

| Jul 2020 | 36 | 120 |

| Aug 2020 | 39 | 48 |

| Sep 2020 | 27 | 76 |

| Oct 2020 | 26 | 104 |

| Nov 2020 | 27 | 57 |

| Dec 2020 | 28 | 57 |

| Jan 2021 | 25 | 102 |

| Feb 2021 | 24 | 104 |

| Mar 2021 | 24 | 106 |

| Apr 2021 | 23 | 85 |

| May 2021 | 17 | 29.75 |

| Jun 2021 | 19 | 66 |

| Jul 2021 | 21 | 30.25 |

| Aug 2021 | 23 | 16.5 |

| Sep 2021 | 26 | 28 |

| Oct 2021 | 22 | 49 |

| Nov 2021 | 21 | 51 |

| Dec 2021 | 64 | 27 |

| Jan 2022 | 32 | 80 |

| Feb 2022 | 29 | 63 |

| Mar 2022 | 14 | 70 |

| Apr 2022 | 15 | 21 |

| May 2022 | 14 | 36 |

| Jun 2022 | 6 | 12 |

| Jul 2022 | 13 | 45.5 |

| Aug 2022 | 15 | 96 |

| Sep 2022 | 12 | 54 |

| Oct 2022 | 14 | 34.5 |

| Nov 2022 | 12 | 72 |

| Dec 2022 | 11 | 16.5 |

| Jan 2023 | 10 | 88 |

| Feb 2023 | 11 | 81.5 |

| Mar 2023 | 12 | 47.5 |

| Apr 2023 | 8 | 1 |

| May 2023 | 16 | 100 |

| Jun 2023 | 10 | 109 |

| Jul 2023 | 12 | 48 |

| Aug 2023 | 16 | 54.5 |

| Sep 2023 | 9 | 20 |

| Oct 2023 | 14 | 22 |

| Nov 2023 | 15 | 22 |

| Dec 2023 | 16 | 12 |

| Jan 2024 | 12 | 61.25 |

| Feb 2024 | 14 | 28.5 |

| Mar 2024 | 16 | 61.5 |

| Apr 2024 | 12 | 22 |

| May 2024 | 8 | 19.5 |

| Jun 2024 | 18 | 19.5 |

| Jul 2024 | 14 | 44 |

| Aug 2024 | 18 | 81 |

| Sep 2024 | 15 | 20 |

| Oct 2024 | 51 | 18 |

| Nov 2024 | 5 | 15 |

Our time spent working continues as a mild background task. Jenni’s earnings went into 401(k) contributions.

Net Worth Update

Net worth is not our primary measurement and can understand it can be discouraging if you’re working yourself out of debt. We also understand it’s difficult to be transparent with our readers without divulging this information so we continue to do so.

Account breakdown

The market keeps chugging along and so do our investments. From a high level, our assets and liabilities are shown in the data table below as of November 30, 2024.

| Description | Value (USD, $) |

|---|---|

| 401(k) | 1,072,220 |

| Brokerage | 950,857 |

| Roth IRA | 199,428 |

| Traditional IRA | 25,900 |

| HSA | 65,159 |

| Real Estate | 443,600.00 |

| Mortgage | (134,859) |

| Miscellaneous Assets | 25,000 |

| Checking & Savings | 38,309 |

| Net Worth | 2,685,615 |

- Miscellaneous assets include specific investments we’ve made in physical assets (think collectibles) and treasury bonds

- Amounts do not reflect the value of the businesses Chris owns or their assets, which should appear as income to us over future years

- Jenni’s Prius is omitted

The S&P 500 was way up at about 5.7% for the month.

We were up about 4.2%. That’s great! But, it’s a bit behind the market. We tend to lag big swings, so that’s not too surprising.

Overall, our net worth increased by around $108K this month.

Net Worth History

| Date | Amount | % Change |

|---|---|---|

| July 2020 | $1,555,289 | – |

| August 2020 | $1,597,334 | 2.7% |

| September 2020 | $1,566,393 | (2.0%) |

| October 2020 | $1,568,182 | 0.01% |

| November 2020 | $1,720,113 | 9.6% |

| December 2020 | $1,810,864 | 5.3% |

| January 2021 | $1,860,996 | 2.8% |

| February 2021 | $1,878,154 | 0.9% |

| March 2021 | $1,918,269 | 2.1% |

| April 2021 | $2,010,849 | 4.8% |

| May 2021 | $2,049,213 | 1.9% |

| June 2021 | $2,093,896 | 2.2% |

| July 2021 | $2,092,153 | (0.1%) |

| August 2021 | $2,130,761 | 1.8% |

| September 2021 | $2,070,730 | (2.8%) |

| October 2021 | $2,151,272 | 3.9% |

| November 2021 | $2,095,273 | (2.6%) |

| December 2021 | $2,160,235 | 3.1% |

| January 2022 | $2,055,292 | (4.9%) |

| February 2022 | $2,058,001 | 0.01% |

| March 2022 | $2,134,428 | 3.7% |

| April 2022 | $1,968,069 | (7.8%) |

| May 2022 | $1,975,569 | 0.04% |

| June 2022 | $1,868,397 | (5.4%) |

| July 2022 | $1,975,608 | 5.7% |

| August 2022 | $1,878,352 | (5.2%) |

| September 2022 | $1,735,997 | (7.6%) |

| October 2022 | $1,820,287 | 4.9% |

| November 2022 | $1,920,635 | 5.5% |

| December 2022 | $1,866,513 | (2.8%) |

| January 2023 | $1,953,691 | 4.7% |

| February 2023 | $1,882,656 | (3.6%) |

| March 2023 | $1,969,566 | 4.6% |

| April 2023 | $1,981,934 | 0.6% |

| May 2023 | $1,995,247 | 0.7% |

| June 2023 | $2,092,479 | 4.9% |

| July 2023 | $2,189,821 | 4.7% |

| August 2023 | $2,140,296 | (2.2%) |

| September 2023 | $2,042,865 | (4.6%) |

| October 2023 | $2,015,648 | (1.3%) |

| November 2023 | $2,157,404 | 7.0% |

| December 2023 | $2,261,458 | 4.8% |

| January 2024 | $2,296,269 | 1.5% |

| February 2024 | $2,365,110 | 3.0% |

| March 2024 | $2,434,250 | 2.9% |

| April 2024 | $2,371,284 | (2.6%) |

| May 2024 | $2,423,205 | 2.2% |

| June 2024 | $2,472,353 | 2.0% |

| July 2024 | $2,513,877 | 1.7% |

| August 2024 | $2,560,215 | 1.8% |

| September 2024 | $2,592,558 | 1.3% |

| October 2024 | $2,576,903 | (0.6%) |

| November 2024 | $2,685,615 | 4.2% |

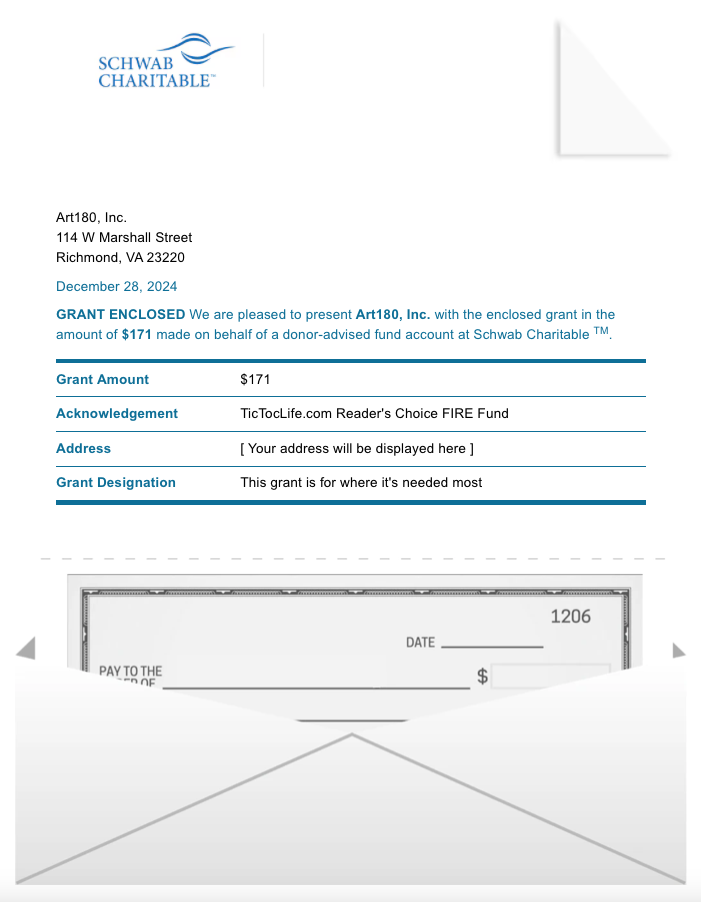

Previous Donation Winner

Pursuing the dream of being an artist takes a lot of courage. Having the support from your community, alongside a talented mentorship program, may increase the chances of being discovered. Our winner this month, Art 180, Inc., has allowed young artists to showcase and sell their work at the Atlas Holiday Market this winter. These programs allow youth to channel their energy and focus on their skills.

Our Reader’s Fund seeks to leverage the principles of FIRE to build a lifetime of giving.

Thank you for your participation in our polls over the last 4 years. We’ve given over $6,800 to deserving charities with your help in deciding which organizations to donate to.

Polls are now open for our next round of candidates: Kindness Charities.

Charity Round-Up

Simple acts of kindness can make a big difference in a person’s life. Let’s face it, we all could use a little more happiness in our lives. It doesn’t take much to make someone smile. Happiness can come from something as simple as a handmade card. It can come from someone reaching out to help you or it can come from giving back to others in need.

Each of these organizations has happiness at the top of their wish list this year. They have excellent charity ratings. We invite you to learn more about great work around the world and join us in donating to one of them by casting your vote.

Summaries below include the impact metrics and a link to their Guidestar profile which details the nonprofit’s operations and transparency.

1) Little Saint Nick Foundation Inc.

Why? They help kids who want to bring hope and help other kids in need.

Where? Canada, California, Florida, Georgia, Texas, Pennsylvania, New Jersey, and New York.

What? Little Saint Nick Foundation Inc. is a nonprofit organization bringing compassion and a little distraction to kids in crisis. The idea came from a child who experienced a short hospitalization in 2004. Feeling fortunate that he was going to be ok, he wanted to give back to the kids that were left in the hospital. At age six, he founded this foundation which brings sick children simple anti-anxiety gift bags and handmade get-well cards made by local children. Kids learn about volunteering to help others while kids in crisis receive a little love and a welcomed distraction.

2) Bikes for Tykes Inc.

Why? Every kid needs a bike. They promote independence, self-esteem, and the foundation for a healthy lifestyle.

Where? Florida

What? Bikes for Tykes Inc. is a nonprofit organization giving away refurbished and new bikes to children and adults. Each recipient receives bicycle safety training, helmets, reflectors, and locks. They’ve expanded their program to include bike maintenance and repair training for individuals and organizations.

3) Starlight Children’s Foundation

Why? Positivity, comfort, and happiness can be exactly what a child and family need when faced with a long-term hospitalization.

Where? The United States

Our Notes: Starlight Children’s Foundation is a nonprofit organization bringing happiness to children in hospitals in various ways catered specifically to each patient. Special colorful gowns are designed for kids that fit better and have fun interactive games via QR codes. Gaming equipment boosts spirits and reduces stress. They can play in their rooms or playrooms if able. Hero wagons allow children to go for a ride outside their rooms to reduce isolation and loneliness. Virtual Reality programs act as a distraction and engage multiple senses during long or painful treatments. They also deliver books, toys, and arts and crafts directly to seriously ill children.

Nonprofit poll

After reviewing the list above, please take a moment to vote for which nonprofit you think will put funds to use in the best way.

(Have trouble using or seeing the poll above? Some reader tools or apps may not display it. View this page in a browser or use this link to our Reader Fund page which has a copy of the poll!)

Thank you for taking the time to vote!

One of our primary goals with TicTocLife is building a stream of giving within the FIRE community and that starts with knowledge.

Want to hear about the results? Sign up for our free FIRE Insider newsletter! We send it out every few weeks and include the monthly poll results and donation winners. You can see an archive of the FIRE Insider and sign up here!

What’s Next

Our monthly update is coming a little late, so we know our next month—December—will be filled with a lovely trip to Antigua and plenty of family time around the holidays. We’ll have a breakdown of that trip—including one of our best point redemptions yet!—next month.

Chris continues to work on a variety of posts he’s fallen behind on. Hopefully, he’ll manage to publish one in January!

And, our year is drawing to a close. We’ll be working to maximize our different subscriptions, annual fees, and so on which are ending with the year. We’ll be making last-minute tweaks to our income and deductions for the close of the tax year. And, we’re planning a fun trip to Portugal to kick the year off right in late January.

How’s 2025 looking for you?

Any hot tax tips before the year ends?

Let us know in the comments or on Threads and X (Twitter)!