December pushed us further into winter—and we pushed back by running off to Antigua in the Caribbean! Check out the travel section below to see how we cut a massive 92% off the $12,527 cash rate for that trip! FIRE certainly offers up extra time to do the research and take advantage of such opportunities that we otherwise might not have the energy to find—nor the flexibility to match. Plus, we break down our huge $32K budget for this month—powered mostly by big year end dividends.

For our monthly donation, our theme is emergency housing. You can read more about the three charities we’re considering and vote for your favorite in the poll below!

We track our income, spending, and savings each month to stay on our FIRE path and share it with you. Keep reading to see our monthly updates, tips, and charity reviews.

Budget Update

In the Sankey diagram below, the income on the left matches our expenses on the right.

We’ll run through the income and expense sources for the month and remark on any interesting items.

Income Summary

Aside from our usual monthly income, here are some interesting anecdotes:

Dividends

Our 2024 dividend Christmas has arrived! Every December, we anticipate significant dividend payments from our various stock holdings—most of it from Vanguard funds like VTSAX. This represents an increase of about 13% over 2023’s December dividends. More than a third of our distributions were automatically reinvested.

We earned $23,226 in total distributions.

Accountable Plan

If you’re interested in the details of how an accountable plan for businesses works, check out this original post.

Chris’s business reimbursed him for the use of our house, utilities, health insurance, and other expenses. This reimbursement covers expenses for the fourth quarter of 2024.

Chris was reimbursed $1,232.

Credits

Several of our credit cards offer statement credits for purchasing with certain companies. This month we used:

- Chris’s AMEX Gold offers a $10 dining credit which he uses on grocery pick up.

- Chris’s pair of AMEX cards offered a $20 credit when buying a $300 AMEX gift card. He purchased two with no fees and used the resulting $600 balance to pay down various bills—effectively a $40 discount on our existing expenses.

We received $50 in statement credits.

Expense Summary

From our huge $32,4478 monthly budget, we saved and invested $28,040! Our big dividend month supplied the earnings for huge 401(k) contributions, Dividend Reinvestment Program (DRIP) funding, and refilling our checking coffers.

After subtracting our credits and savings, and netting our gifts—we spent about $4,158 on living expenses.

That’s 87% of our FIRE budget from 2022 ($4,787/month).

We’ve spent most of 2024 below our 2022 FIRE budget. We’re behind on our annual breakdowns, but it’ll be interesting to see if our spending is actually trending downward.

Let’s break down some of the more exciting details this month.

Food & Dining

Our food expenses jumped as we spent a bit of time outside the US this month.

Groceries

At $556, most of our food-related costs came in as groceries. That’s less than $10/day for each of us in a month where we mostly ate at home. Pretty great! In fact, our most expensive food purchases occurred while we were in Antigua. If you think eggs are expensive in the USA…phew!

Restaurants, Fast food, Alcohol & bars

Our big restaurant expense—$163—mostly came from our dining costs while in Antigua. The Inn we stayed with included both breakfast and dinner. But, we tipped about $10 on each meal which we included as part of our dining expenses. This was partially offset by a $50 quarterly credit offered by Chris’s AMEX Hilton card. In addition, we had once very nice meal out at a high end Mexican restaurant in Virginia—about $67—that was mostly offset by another AMEX credit of $50 at Resy restaurants. And of course, we had a few lighter bites out while in Antigua and in Virginia during the course of the month ($37 in “fast food”).

We spent $756 on food & dining this month.

Expense Conclusion

While that covers the big stuff, we still had a few random things small purchases to mention that might be of interest.

Sporting Goods

In something like a Christmas gift, Jenni picked up a Stand Up Paddle-board from Woot that was on deep discount. She’s been eyeing one now for several months—watching for just the right deal. We’ve used SUPs many times from friends or places we’ve stayed; on lakes, rivers, and the ocean. And as we have the James River not far from home, we’re hoping to put the $95 SUP to good use!

License Renewal

Jenni continues to maintain her pharmacy license which means continuing education classes and an annual license fee. At $120, it’s a significant expense, but also easily worth it to maintain her ability to earn income if desired!

Amusement

In two of our favorite seasonal events, we spent about $89. We picked up tickets to a local performance of Charlie and the Chocolate Factory as well as tickets for a regional model railroad show. Jenni loves musicals, Chris loves trains. We’re still kids at heart!

Antigua Travel Summary

We took an 9-day trip to the Caribbean’s Antigua from December 8 to December 16. This trip was intended as an escape from Virginia’s winter. We centered it around utilizing a valuable Hilton hotel certificate and Hilton points to stay at a very nice inn.

Let’s break down our trip budget.

We’ll include all expenses we incurred for the trip—even groceries, restaurants, and amusement. But we’ll skip expenses that we incurred during the trip that were not part of the trip (for example, our utility bill back home in Virginia).

Trip cost table

Let’s take a look at our total trip cost. In the table below, you’ll find four columns:

- Description: a summary of what the expense was for. We’ve included some basic geographical information for things like flights or hotels.

- Cost: our incurred expense in US dollars for the described line item. In some cases, this appears as zero. If a travel currency like hotel points, airline miles, or a credit card reward certificate covers the total expense, we record a zero here. Sometimes, there’s a minor fee in addition to using points/miles for surcharges or taxes.

- Rewards Points/Miles: we maximize our credit card rewards and frequent traveler currencies to cover the costs of our travel wherever possible. You’ll see a short description of the type of certificate or currency that we used.

- Estimated Value: when using a reward from the previous column to cover an expense, we record what we would have otherwise paid for the line item. This gives us a sense of our savings.

The table is generally in chronological order.

We still incurred expenses at home (mortgage, utilities, etc.)—but these do not appear as part of our trip costs.

| Description | Cost (USD, $) | Rewards Pts/Miles | Est. Value (USD, $) |

|---|---|---|---|

| Flight—RIC→CLT→ANU (2x, Economy) | 218.22 | 40,000 AA Miles | 1,394.00 |

| Hotel: Airbnb Cottage—2 nights | 365.18 | ||

| Hotel: The Inn at English Harbour (Hilton)—6 nights | Free Night Certificate + 420,000 Hilton Pts | 10,140.00 | |

| Rental car: 9 days | 18,666 Chase UR | 280.00 | |

| Gas & fuel (rental car) | 10.47 | ||

| Dining: restaurants, fast food | 156.20 | ||

| Groceries | 77.04 | ||

| Amusement—tickets | 15.00 | ||

| Gifts & souvenirs | 20.00 | ||

| Airport parking: 8 nights | 54.00 | ||

| Phone eSIM (2x) | 14.80 | ||

| Total | 930.91 | 478,666 Pts | 11,814.00 |

Trip cost discussion

We spent about $931 on a 9 day trip for two people. That’s just $103/day (or about $52/person). And this was a luxurious trip. We stayed in one of the nicest environments we ever have with top tier service. In fact, our calculated value of this trip was a whopping $12,527! That’s $1,392/day! Had we not used a mix of credit card points and miles to cover the larger expenses, we’d have spent more than 13x more paying cash rates for the exact same experience!

The outlier expense here was our hotel stay. The Inn at English Harbour bills itself as a “secluded beachfront luxury boutique resort” and we think that’s a fair description. This hotel recently joined Hilton’s portfolio when they acquired “Small Luxury Hotels of the World” (SLH). Booking rates for a standard room are routinely $1,350/night plus taxes. And it’s very well rated.

When we spotted this hotel while looking at Hilton’s portfolio of warm weather places to escape to, it seemed to offer an outsize value for one of Chris’s free night certificates—which expire each year. In fact, its point redemption rate was just 105,000 Hilton points with pretty good availability. That’s a lot of Hilton points, yes. But, they’re normally valued at around half a cent per point—so around $525 for 105K.

Getting somewhere around $1,400-1,500 in value out of 105K points would be crazy good (about 1.5c/point). In addition, Hilton offers the 5th night free with points. So, we combined our free night certificate as one booking and followed it with five points nights (105K/night with the 5th free equates to 420K points cost). Now that’s a monster redemption! And the resort was pretty fantastic!

Here’s a little sampling of our stay if you’re curious about it—

We spent the first two nights on Antigua in a small Airbnb to begin our break from the cold.

We explored a bit nearby, enjoyed the amazing view off the porch, and started soaking in the sun. Not bad for less than $170/night.

As usual, we flew using miles to cover the majority of the flight cost for both of us. American Airlines frequently offers good miles value traveling from the east coast to the Caribbean, which turned out to be the case for Antigua too! At just 20,000 miles plus taxes/fees per person, we managed to again cut our out-of-pocket expenses greatly. Cash rates were just under $700/person otherwise!

Jenni used her Chase Sapphire Reserve card for our car rental. This allowed us to pool our Chase Ultimate Rewards (UR) points and redeem those for a value of 1.5 cents per point (instead of the typical 1:1). Chase had a booking rate on their portal similar to what we could find with Priceline so we were happy to use about 19K points instead of $280.

Summary—

We cut a whopping 92% off of the cost of this trip by using points/miles instead of cash for our various expenses. That’s wild! Now, granted, if we were paying cash, we wouldn’t have stayed at the resort we did. We’d have looked for Airbnbs like the one we stayed at the first few days of the trip. Somewhere around $200/night. But, it would have been a very different experience. Our resort was directly on the water with a bunch of amenities—live music, activities, water sports, water taxi, garden tours, and more. Not to mention a high-end breakfast, afternoon tea, and three course dinner every evening.

Some of those extras:

Oh, and someone met us at the airport on arrival with a sign and guided us through customs and out the airport. So that was…extra pretentious cool.

ⓘ Curious about some of the other expenses that we didn’t address? We’ve written about every expense in this month’s diagram either in this post or in the past. Check out our previous budget updates for more detail or ask in the comments below!

How Much We Work

We like to keep track of how much time we spend doing work that is paid.

Let’s add this month to the list…

Design Note: A reader suggested we should collapse the hours worked and net worth history history tables below. They’ve started to get quite long after a handful of years! Let us know if this works well for you in the comments.

History of Monthly “Hours Worked”

| Month | Chris (Hours Worked) | Jenni (Hours Worked) |

|---|---|---|

| May 2020 | 41 | 108 |

| Jun 2020 | 38 | 96 |

| Jul 2020 | 36 | 120 |

| Aug 2020 | 39 | 48 |

| Sep 2020 | 27 | 76 |

| Oct 2020 | 26 | 104 |

| Nov 2020 | 27 | 57 |

| Dec 2020 | 28 | 57 |

| Jan 2021 | 25 | 102 |

| Feb 2021 | 24 | 104 |

| Mar 2021 | 24 | 106 |

| Apr 2021 | 23 | 85 |

| May 2021 | 17 | 29.75 |

| Jun 2021 | 19 | 66 |

| Jul 2021 | 21 | 30.25 |

| Aug 2021 | 23 | 16.5 |

| Sep 2021 | 26 | 28 |

| Oct 2021 | 22 | 49 |

| Nov 2021 | 21 | 51 |

| Dec 2021 | 64 | 27 |

| Jan 2022 | 32 | 80 |

| Feb 2022 | 29 | 63 |

| Mar 2022 | 14 | 70 |

| Apr 2022 | 15 | 21 |

| May 2022 | 14 | 36 |

| Jun 2022 | 6 | 12 |

| Jul 2022 | 13 | 45.5 |

| Aug 2022 | 15 | 96 |

| Sep 2022 | 12 | 54 |

| Oct 2022 | 14 | 34.5 |

| Nov 2022 | 12 | 72 |

| Dec 2022 | 11 | 16.5 |

| Jan 2023 | 10 | 88 |

| Feb 2023 | 11 | 81.5 |

| Mar 2023 | 12 | 47.5 |

| Apr 2023 | 8 | 1 |

| May 2023 | 16 | 100 |

| Jun 2023 | 10 | 109 |

| Jul 2023 | 12 | 48 |

| Aug 2023 | 16 | 54.5 |

| Sep 2023 | 9 | 20 |

| Oct 2023 | 14 | 22 |

| Nov 2023 | 15 | 22 |

| Dec 2023 | 16 | 12 |

| Jan 2024 | 12 | 61.25 |

| Feb 2024 | 14 | 28.5 |

| Mar 2024 | 16 | 61.5 |

| Apr 2024 | 12 | 22 |

| May 2024 | 8 | 19.5 |

| Jun 2024 | 18 | 19.5 |

| Jul 2024 | 14 | 44 |

| Aug 2024 | 18 | 81 |

| Sep 2024 | 15 | 20 |

| Oct 2024 | 51 | 18 |

| Nov 2024 | 5 | 15 |

| Dec 2024 | 19 | 12 |

Most of our [limited] labor income this month went into 401(k) contributions.

Net Worth Update

Net worth is not our primary measurement and can understand it can be discouraging if you’re working yourself out of debt. We also understand it’s difficult to be transparent with our readers without divulging this information so we continue to do so.

Account breakdown

The market keeps chugging along and so do our investments. From a high level, our assets and liabilities are shown in the data table below as of December 31, 2024.

| Description | Value (USD, $) |

|---|---|

| 401(k) | 1,035,272 |

| Brokerage | 919,619 |

| Roth IRA | 188,219 |

| Traditional IRA | 25,080 |

| HSA | 63,447 |

| Real Estate | 449,700 |

| Mortgage | (134,429) |

| Miscellaneous Assets | 25,000 |

| Checking & Savings | 49,825 |

| Net Worth | 2,621,732 |

- Miscellaneous assets include specific investments we’ve made in physical assets (think collectibles) and treasury bonds

- Amounts do not reflect the value of the businesses Chris owns or their assets, which should appear as income to us over future years

- Jenni’s Prius is omitted

The S&P 500 was down about 2.5% for the month.

We were down about 2.4%. So, we slightly outperformed the S&P on a down month—which is generally expected for our slightly more defensive positions.

Overall, our net worth decreased by around $64K this month.

Year-over-year, our net worth is up about 16% since December 2023.

Net Worth History

| Date | Amount | % Change |

|---|---|---|

| July 2020 | $1,555,289 | – |

| August 2020 | $1,597,334 | 2.7% |

| September 2020 | $1,566,393 | (2.0%) |

| October 2020 | $1,568,182 | 0.01% |

| November 2020 | $1,720,113 | 9.6% |

| December 2020 | $1,810,864 | 5.3% |

| January 2021 | $1,860,996 | 2.8% |

| February 2021 | $1,878,154 | 0.9% |

| March 2021 | $1,918,269 | 2.1% |

| April 2021 | $2,010,849 | 4.8% |

| May 2021 | $2,049,213 | 1.9% |

| June 2021 | $2,093,896 | 2.2% |

| July 2021 | $2,092,153 | (0.1%) |

| August 2021 | $2,130,761 | 1.8% |

| September 2021 | $2,070,730 | (2.8%) |

| October 2021 | $2,151,272 | 3.9% |

| November 2021 | $2,095,273 | (2.6%) |

| December 2021 | $2,160,235 | 3.1% |

| January 2022 | $2,055,292 | (4.9%) |

| February 2022 | $2,058,001 | 0.01% |

| March 2022 | $2,134,428 | 3.7% |

| April 2022 | $1,968,069 | (7.8%) |

| May 2022 | $1,975,569 | 0.04% |

| June 2022 | $1,868,397 | (5.4%) |

| July 2022 | $1,975,608 | 5.7% |

| August 2022 | $1,878,352 | (5.2%) |

| September 2022 | $1,735,997 | (7.6%) |

| October 2022 | $1,820,287 | 4.9% |

| November 2022 | $1,920,635 | 5.5% |

| December 2022 | $1,866,513 | (2.8%) |

| January 2023 | $1,953,691 | 4.7% |

| February 2023 | $1,882,656 | (3.6%) |

| March 2023 | $1,969,566 | 4.6% |

| April 2023 | $1,981,934 | 0.6% |

| May 2023 | $1,995,247 | 0.7% |

| June 2023 | $2,092,479 | 4.9% |

| July 2023 | $2,189,821 | 4.7% |

| August 2023 | $2,140,296 | (2.2%) |

| September 2023 | $2,042,865 | (4.6%) |

| October 2023 | $2,015,648 | (1.3%) |

| November 2023 | $2,157,404 | 7.0% |

| December 2023 | $2,261,458 | 4.8% |

| January 2024 | $2,296,269 | 1.5% |

| February 2024 | $2,365,110 | 3.0% |

| March 2024 | $2,434,250 | 2.9% |

| April 2024 | $2,371,284 | (2.6%) |

| May 2024 | $2,423,205 | 2.2% |

| June 2024 | $2,472,353 | 2.0% |

| July 2024 | $2,513,877 | 1.7% |

| August 2024 | $2,560,215 | 1.8% |

| September 2024 | $2,592,558 | 1.3% |

| October 2024 | $2,576,903 | (0.6%) |

| November 2024 | $2,685,615 | 4.2% |

| December 2024 | $2,621,732 | (2.4%) |

Previous Donation Winner

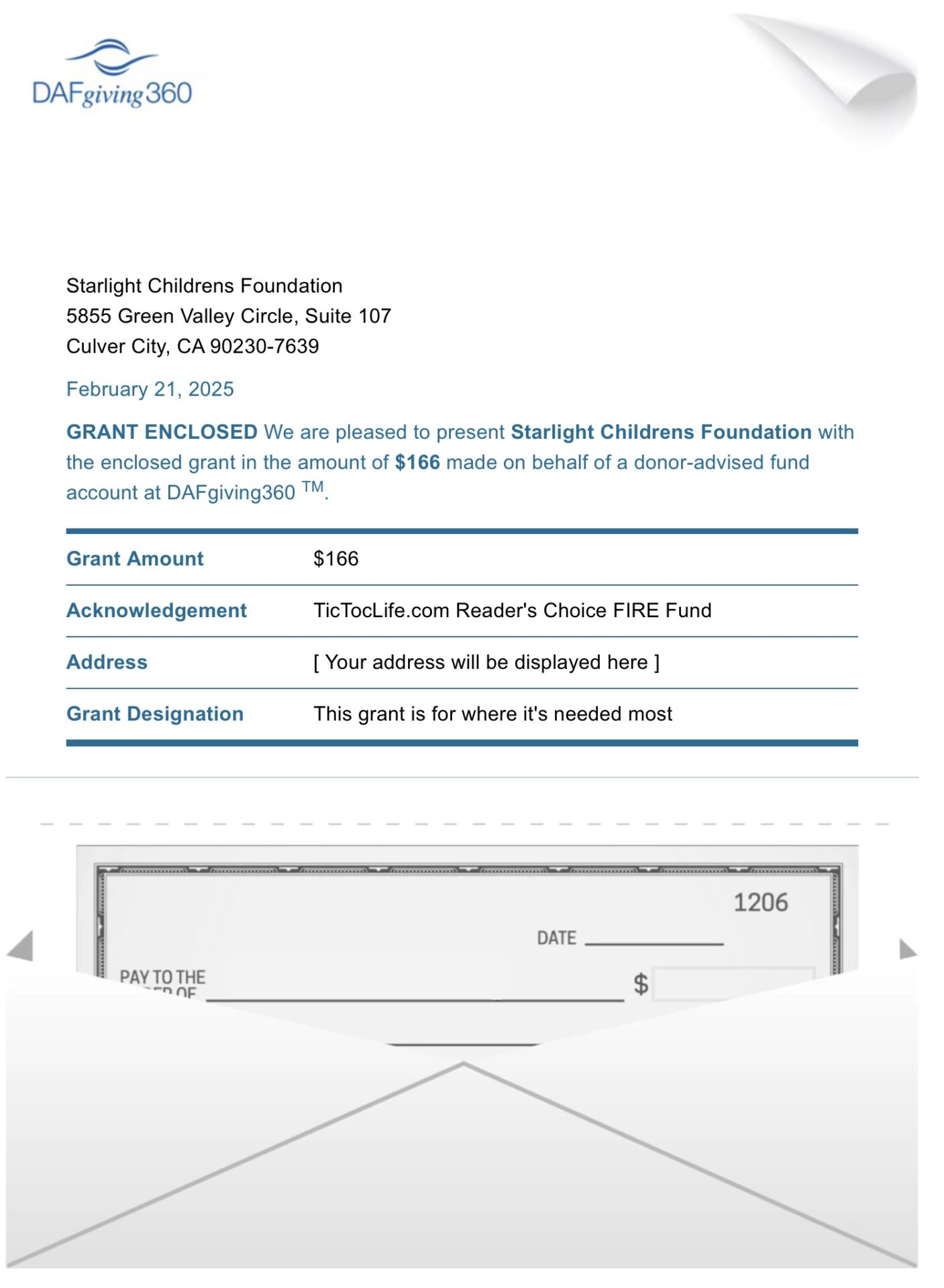

November’s “kindness” charity poll winner brings happiness to hospitalized children. Fun gowns, games and other distractions allow kids to have a little break from the difficulty they are facing. Congratulations to Starlight Children’s Foundation.

Our Reader’s Fund seeks to leverage the principles of FIRE to build a lifetime of giving.

Thank you for your participation in our polls over the last 4 years. We’ve given over $6,800 to deserving charities with your help in deciding which organizations to donate to.

Polls are now open for our next round of candidates: Emergency Housing.

Charity Round-Up

Look up! That roof over your head is providing way more than just shelter and warmth this winter. It provides a sense of security and safety. Unfortunately, many people may look up and only see the cold dark sky above. Losing one’s home can come about in a variety of ways. Whether it be a from financial reasons, a natural disaster, or from a horrendous war, being unhoused leaves people in a crisis. Without emergency shelters and the proper support, people of all ages could be left out on the street with only the sky to look upon.

Each of these organizations are helping keep roofs over peoples heads in times of desperate need. They have excellent charity ratings. We invite you to learn more about great work around the world and join us in donating to one of them by casting your vote.

Summaries below include the impact metrics and a link to their Guidestar profile which details the nonprofit’s operations and transparency.

1) Los Angeles Mission, Inc.

Why? L.A. is known for having the one of the biggest unhoused populations in The United States and not enough shelters to support this population. This was before one of the worst wildfires destroyed over 12,000 structures, forcing 100,000 people to flee their homes. With so many working class homes destroyed, emergency shelters may see a large influx of people seeking emergency shelters this winter.

Where? Los Angeles County, California

What? Los Angeles Mission, Inc. is a nonprofit faith-based organization that started out as a small rescue mission but has grown to be one of the nation’s largest provider to the unhoused. With hot meals, safe shelters, clothing, and personal care, they help people of all ages and all types of backgrounds free of charge.

2) CARITAS

Why? Freezing temperatures are blanketing The United States this winter and no one should have to sleep outside. Having access to shelter and recovery services 24/7 lets participants find a place to stay with tools to develop a path to get back on their feet.

Where? Richmond, Virginia

What? CARITAS is a nonprofit organization providing a safe place for people to heal and have time to rebuild. They are part of a coordinated system of emergency shelters, financial housing supports, and case management. Their hotline places people in shelters, showers, laundry, hot dinner and breakfast, plus lunch for the next day. During their stay, case managers help clients move from shelters to permanent housing. Additional support programs include the furniture bank, a 5 week job readiness program, a recovery program, as well as apartments in a sober living community.

3) ShelterBox USA

Why? When a disaster hits, the only thing you want to feel is safe and secure. Even it’s temporary, having a place for you and your family to live is essential.

Where? Ukraine, Gaza, Bangladesh, Caribbean, Morocco, Malawi, Somalia, Turkey, Syria, Pakistan, Mozambique, Cameroon, Burkina Faso, Yemen, Ethiopia, The Philippines, and The United States.

Our Notes: ShelterBox USA is a non-profit organization responding to natural and man made disasters all over the world. Their volunteers provide appropriate shelter or materials for the unique situation at hand. A family might need a tent, blankets, water filters, and cooking set while others need building and repair supplies, or just cash. They provide all of the above to let families start to rebuild after a devastation.

Nonprofit poll

After reviewing the list above, please take a moment to vote for which nonprofit you think will put funds to use in the best way.

(Have trouble using or seeing the poll above? Some reader tools or apps may not display it. View this page in a browser or use this link to our Reader Fund page which has a copy of the poll!)

Thank you for taking the time to vote!

One of our primary goals with TicTocLife is building a stream of giving within the FIRE community and that starts with knowledge.

Want to hear about the results? Sign up for our free FIRE Insider newsletter! We send it out every few weeks and include the monthly poll results and donation winners. You can see an archive of the FIRE Insider and sign up here!

What’s Next

The last few days of December was spent trying to maximize our various methods of being tax efficient. Tax-loss harvesting, tax-advantaged account contributions, and lots of moving money around. Naturally, January will include a bit more of that and then making sure we actually did it all correctly! This will be our first year filing as married with a joint return. We’ll share what we’ve found with this change and how it impacts some of our strategy.

January also begins another trip for us just as the month closes. We’ll be heading to Portugal for a few weeks to enjoy one of our favorite parts of Europe, explore a bit with family, and avoid a bit more of this cold weather in Virginia!

How’s your new year looking?

2025 plans? Hot tips for joint marriage tax returns?

Let us know in the comments or on Threads and X (Twitter)!

2 replies on “A $12K Island Escape on $1K (Dec 2024 Update)”

That looks like an amazing trip, especially given you were able to find the hotel on sale!

I wonder why it was discounted so much even during peak tourism season.

How did you accumulate so many Hilton points in the first place?

Hey TK!

That English Harbour Inn wasn’t discounted — we just received a great deal on paying for it with Hilton points. That’s the “normal” price, at least at the moment. I suspect it’ll be adjusted though in the near future.

We earned our Hilton points by signing up for 2x AMEX “Surpass” cards (about 150k/per) and 2x regular AMEX Hilton cards (about 70k/per) — plus normal spending on them, mostly in bonus categories. This was over the last several years. It adds up!