With tax season upon us and a friend willing to act as a case study for a specific tax strategy, today we’re going to work through beating the standard deduction and itemizing your taxes through strategic giving.

I’m writing to you for the first time since we started TicTocLife from, well, not home. Jenni and I plan to continue to be able to write to you our reader whether we’re off globetrotting or relaxing at home in Virginia.

I’m considering this trip to the beaches of North Carolina a bit of a trial run! We’re getting our feet wet—yes, in the chilly Carolina ocean—but also back to traveling. With vaccinations growing at a rapid pace throughout the United States, we thought it might be time to blow the rust off our travel wheels.

We’re back on the road.

Relatedly, with close friends also vaccinated, we’re able to have a small gathering on these frigid shores. Brian—one of my best and oldest friends—is joining us along with his family. Just a few weeks ago he sent me a screenshot that acts as the impetus for this post.

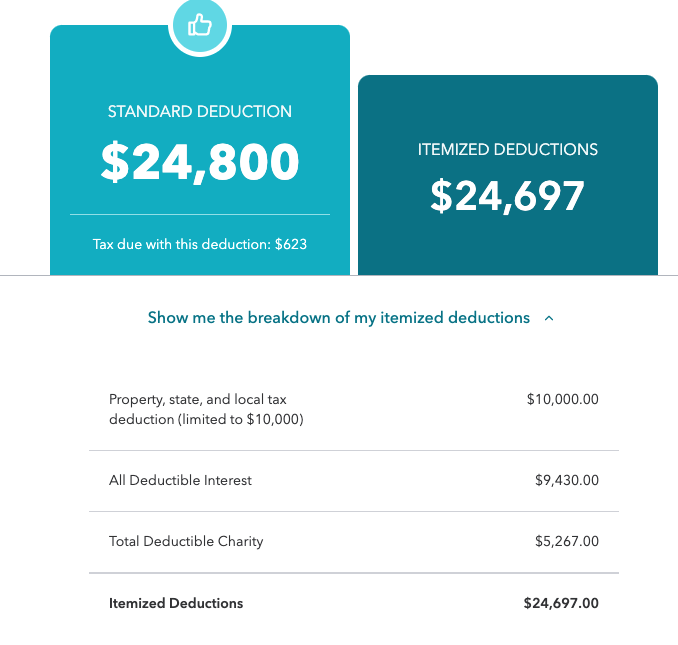

He was lamenting the loss of the value of his family’s various deductions since they didn’t surpass the standard deduction when combined.

Beating the Standard Deduction

As a family with mostly W2 employment income, they had no significant deductions to add aside from mortgage interest, property taxes, and charitable deductions.

As a comparison point, because of my business income over the last several years, I’ve itemized my taxes each year. My business deductions easily surpass the standard deduction. And so, I get the full tax deduction value from our mortgage, property taxes, and charitable deductions.

Not so for Brian’s family.

SALT deduction limit

Much of this is because of the $10K SALT (state and local tax) deduction limit imposed by 2017’s Tax Cut and Jobs Act.

While the House of Representatives has recently passed bills in 2019 and 2020 to raise this limit to $20K, it’s not made it through the Senate. It’s reasonable to expect this limit will remain for the foreseeable future.

Q: Is there room to optimize the SALT deduction?

A: No. Unfortunately, the current SALT deduction limit is $10K and they have already maxed this out.

Mortgage interest deduction

The family’s other big deduction is the interest on their home mortgage. Combined with the SALT deduction of $10K, they nearly reach $20K in deductions.

For most people, including Brian’s family, you’ll be able to fully deduct your mortgage interest.

There are some exceptions, with the most notable changing a bit in 2017 as part of the Tax Cuts and Jobs Act. For mortgages prior to about midway through 2017, you can deduct interest on the first $1M of the mortgage.

For contracts written after the 2017 changes to the law, the amount is reduced to $750K.

That means if you have a mortgage written in 2019 for $825K that you paid $30K of interest on throughout the year, you can probably deduct around $27K worth of interest.

These figures are for married-filing jointly folks.

Q: Is it possible to increase the mortgage interest deduction?

A: Only by increasing the mortgage that the interest is derived from or accepting a higher interest rate. Other than moving, it’s possible to do this through a refinance—something you should keep in mind when evaluating debt changes. Make sure you understand that through a cash-out refinance (which likely will raise your total annual mortgage interest, and therefore deduction), you can only deduct the additional mortgage interest if the funds are used for capital improvements to your home. This isn’t something I understood until writing this article!

Charitable giving deduction

The last remaining deduction piece is their charitable contributions. In 2020, that was a bit over $5K. And this is where I suggested they might be able to make some changes to put a dent in their total taxes owed.

As we saw from their tax estimate screenshot, they were just $103 in deductions short of being able to take itemized deductions.

To be clear: had they another $113 in deductions, and they chose to itemize their taxes, the only effect would be an additional $10 in income deductions. The net outcome would lower their total federal taxes by around $2.40 (if we assume they’re in a 24% federal income tax bracket).

Breaching the standard deduction threshold to qualify for itemized tax deductions doesn’t suddenly mean your tax burden will be dramatically lower. It just means that you’ll be able to take a deduction on additional deductible costs which might lower your total tax burden.

This often confuses people as some understand it to mean that suddenly they’ll be able to take all their itemized deductions at full value. Really, you’re just trading the standard deduction for your itemized deductions.

Let’s proceed with what I see as an opportunity for my buddy’s family.

The simple version

The easy way to take advantage of their situation is to simply “group” their charitable deductions every other year. Allow me to explain.

They donated about $5K to charitable organizations in 2020. They consistently do this annually.

Moving forward, they could donate two years’ worth of giving in 2021–$10K. In this scenario, during 2022, they would make no additional donations.

Between the two years, they would still donate the same total amount—$10K—as they have historically year-to-year.

How does this benefit them?

If we assume their other itemized deductions remain consistent and no tax law changes occur, their 2021 income taxes would show an additional $5K worth of deductions over 2020. They’d donate $10K instead of $5K.

In this scenario, they’d have about $30K worth of itemized deductions in 2021. If the standard deduction remains about the same, they’d itemize $5K worth of deductions over the standard deduction in this case.

Without considering the state tax implications (which likely provide additional benefit), at a 24% federal income tax rate, they’d reduce their tax burden by $1,200 in 2021.

In 2022, where they make no donations, their total itemized deductions would be about $20K. They’d take the $25K standard deduction (again, assuming no tax law changes). Like in 2020, their donations would have no impact on their tax burden since the standard deduction is more.

Overall, they’d still donate the same amount of money over the two-year period but have an extra $1,200 in their pockets.

If they continued to group their charitable giving like this every two years and the variables (tax law) remained consistent, they’d save themselves $600 per year by making this fairly simple strategic tax change!

Tax deduction grouping to the max

What’s more, they could take this strategy further by grouping their giving over even longer periods. If they knew their giving would remain consistent over decades, they could, for example, make a large contribution every five years.

In this scenario, they’d take the standard deduction annually for four years and then donate five years’ worth of giving on the fifth year. That’d mean a $25K donation!

In that fifth year, they’d have $20K worth of itemized deductions over the standard deduction. With the same 24% federal income tax bracket, that’s $4,800 in tax savings!

By grouping every five years instead of every other year, they bump average annual savings from $600 to $960! That’s more than a 50% increase!

Maintain consistent giving by investing

One issue with spacing out giving by years and making large lump sum donations is that it might break the giving routine you currently have.

You could avoid this problem and keep up a healthy routine while also increasing your giving by combining it with investing.

Using our every-five-years donation scenario, the family would be setting aside $5K annually and donating $25K every fifth year.

But what if they invest the intended donation amount while they wait for that fifth year to hit?

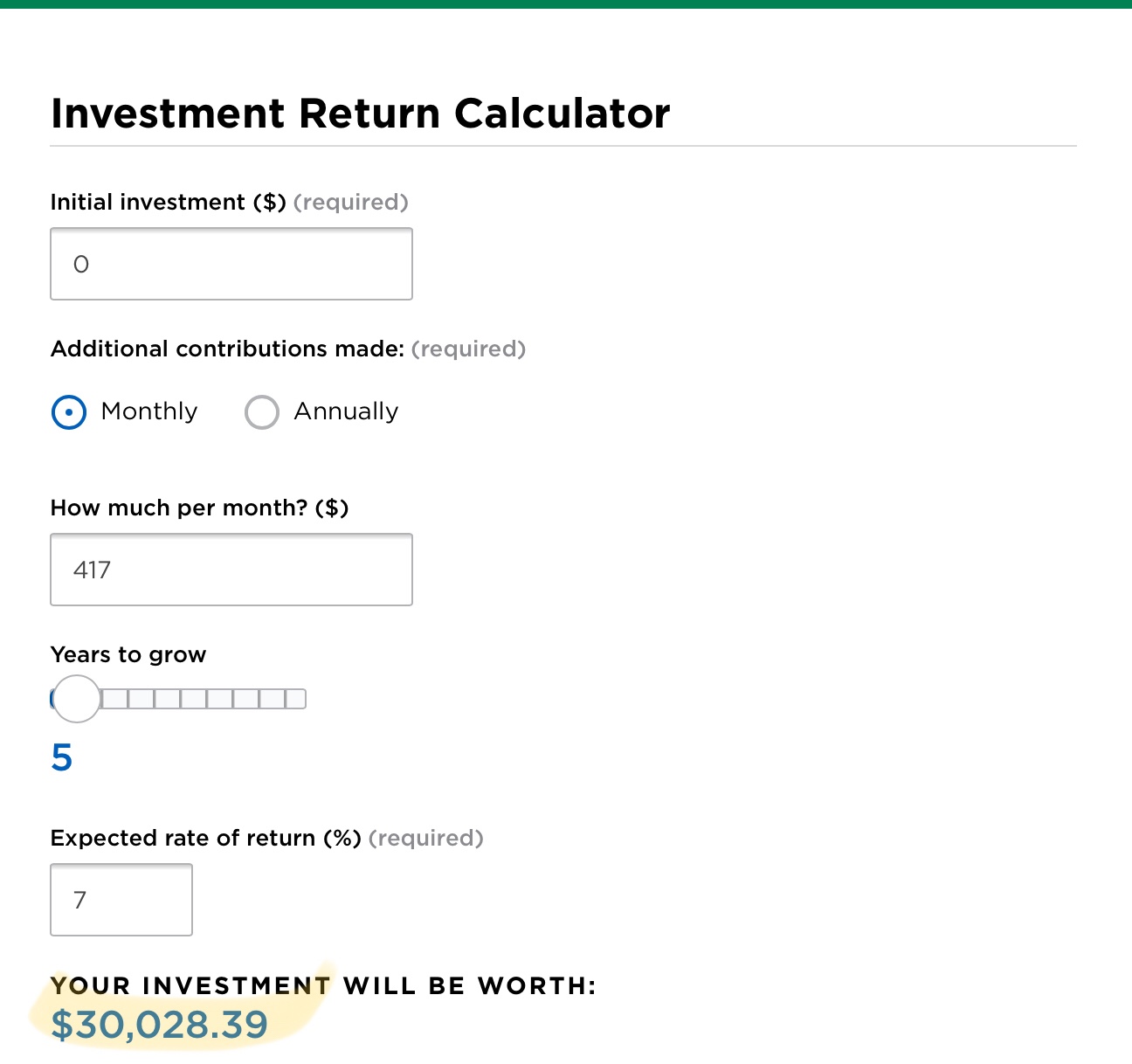

Let’s assume they make a monthly “donation” investment of $417 in order to hit just a bit over $5K/year.

Because they have a fairly short time horizon for the use of this investment, we’ll also assume they invest it somewhat conservatively. Perhaps 80% in a well-diversified index fund like VTSAX or VTI and the remaining 20% in a broad bond index like VBTLX.

Historically, that portfolio might net them about 7% nominal returns per year.

Here’s what that looks like:

They’ll likely need to set aside about 15% of their $5K in profit ($750) for capital gains taxes.

Despite this, they’ll wind up with around $4,300 more! That’s $860/year!

By creating a separate investment account for this money, they’ll also be able to segment the money for giving and maintain their monthly routine.

Maximizing itemized donation deductions (for the experts)

In the previous section, we talked about relatively simple ways to maximize your charitable giving deductions for tax benefits. In this section, we’ll combine some of these tips and incorporate a more complicated option: donor-advised funds.

Minimize capital gains with a DAF

In our investment example from the previous section, Brian and his family would owe about $750 in capital gains taxes every five years—or about $150/year on average.

One way to eliminate this expense is to leverage a Donor-Advised Fund (DAF) to house the invested capital while it’s appreciating during each five-year period.

DAFs are an account type at a bank that is treated favorably for tax purposes when making donations. We’ll get into the details, but for now, just think of them as another investment account option you can transfer your funds to which has specific tax advantages—like a 401(k) or IRA might.

One key difference is that assets transferred to a DAF are not reversible. You can’t just pay a fee to get the money back like with a 401(k). The assets in a DAF can only be used to make charitable contributions to verifiable nonprofit organizations.

With these limitations, you earn one of the great benefits of a DAF—as soon as money is sent to your DAF account, you can realize the tax deduction. So, you can group your donations (as discussed previously) in a single year to your DAF and earn the tax deduction. However, the money need not actually flow through to your preferred nonprofit in that year.

One reason this might be valuable to you is if you desire to give consistently in order to help create predictable cash flow for the organization. For smaller organizations, it might be harder for them to plan and budget when they receive $25K suddenly every five years versus a consistent $417 per month.

Automate giving

Talking with Brian and his wife, their charitable giving has revolved around their community church historically. That’ll be important for the next valuable use of a DAF, but for now, it serves to reinforce the point that giving is commonly for smaller organizations that might benefit from consistent giving.

Most DAFs managed by larger banks (for example, we use Schwab and Vanguard for our DAFs—one of which is our Reader Fund) offer online tools to automate donations on a fixed schedule.

By using tools provided by DAFs, you can automate your giving which might help reduce the friction you experience in your giving. The DAF process is consistent whether you donate to your local church or an international organization. There are no varying forms or applications you have to fill out—the DAF handles that for you.

Personally, I greatly appreciate the reduced friction in our giving that DAFs have brought to us.

Donate appreciated assets

As I alluded to earlier, DAFs have another big advantage over direct giving that is especially applicable for smaller organizations. They can make it significantly easier to donate appreciated assets to charitable organizations.

While many large nonprofits can accept and manage appreciated assets, most smaller organizations—like churches—aren’t equipped to handle donations of appreciated assets.

So what do I mean by “donating appreciated assets”?

In the context of financial independence, for most people, this will likely be appreciated stock shares. DAFs can also assist in donating property, private businesses, and other appreciated assets—but the most common use case is for stock donations.

Your initial response to this might be—“this doesn’t apply to me, I just donate cash!”

And that’s precisely where this last opportunity lies.

Remember, money is fungible. One dollar—the cash you donate—is interchangeable with the dollars you have invested.

In other words, while you may not currently donate appreciated assets, if you have money invested in the stock market and make cash donations those dollars could have been from your investments.

In fact, if you need to currently—or later—sell your appreciated assets to fund your life (and perhaps continue those donations), you’ll have to pay capital gains on the profits before you can then donate the balance to a nonprofit.

DAFs, which again limit their funds to be used for donations, don’t incur capital gains taxes for the assets within them as they appreciate or when they’re initially donated.

Let’s use an example.

Perhaps you want to donate $25K this year to a nonprofit that’s dear to you. You might decide to sell some of your stocks to fund this donation. Perhaps you decide to sell some stock you purchased ten years ago which has nearly doubled since your purchase.

You decide to sell $27K worth of the stock to fund your donation which had a cost basis of $14K. You earn a $13K long-term capital gains profit.

You set aside 15% of the profit to pay your capital gains taxes ($1,950), and proceed with your $25K donation as planned.

It’s cost you nearly $27K to donate $25K, or about 7% of the total!

If you’d transferred your appreciated stock from your portfolio to your DAF first, you could have made the $25K donation without having to pay capital gains taxes. The DAF handles selling the stock for you and sending a payment to your preferred nonprofit.

Use Strategic Giving to Beat the Standard Deduction

Throughout this article, we’ve addressed the fact that my friend’s family had nearly $25K worth of tax deductions in 2020 but that ended up being just shy of the standard deduction. We’ve looked out how we could maximize the value of their deductions.

While we addressed ways they might be able to modify their mortgage interest deduction, that’s likely inflexible for most people. Without tax law changes, the $10K SALT deduction limit will continue to be a problem for them—and undoubtedly, many similar middle-upper-income families.

The primary way they could improve their tax burden is by being strategic with their giving of about $5K/year.

Here are the three changes we discussed they—or you!—could make:

- Group donations—changing from $5K/year to $25K every 5 years could create a $960/year reduction in tax burden

- Conservatively invest the money monthly to maintain a giving routine and potentially earn a profit during your 5-year cycle, which could be worth $860/year

- Open a DAF to house your invested donation money and reduce your capital gains taxes while making it easier to donate appreciated assets like stocks, which saved about $400/year in this scenario

By combining all of these strategies, Brian’s family could continue to donate the same $25,000 every five years as they have while simultaneously putting $11,100 in their pockets during the same period.

That’s $2,220/year that’s been left on the table!

There are issues with DAFs beyond the scope of this article, but I’ll highlight some of the key ones:

- DAFs act as another third party within your finances: security risks, bankruptcy risk, and just plain corruption—stick with well-regarded, long-lived institutions

- Fees on assets under management vary for DAFs but are typically about 0.6%—which isn’t insignificant but is easily made up for by the ease of giving management and tax advantages

- Overall, DAF managers (i.e. investment banks) end up earning a profit through your charitable giving, which may not match with your giving ethics

With tax season hitting its apex, I hope these strategic giving tips help you set up a plan to reduce your tax burden moving forward.

While you may choose to retain these tax savings for yourself—and perhaps help reach financial independence sooner—they could also be used to increase your giving! Your extra effort to enact these changes could significantly increase your giving without any additional cost out of your pocket. That means greater impact and better outcomes for others in need.

8 replies on “Beating the Standard Deduction with Strategic Giving”

Many people fail to take advantage of the mileage deduction for charity. In the above example let’s say that the couple helps out the church by teaching a Sunday school class or helping out in the nursery. They can deduct the miles driven to and from church. Volunteering at a local food bank? The same applies. The mileage rate is reduced, it’s not the 50 plus cents per mile and more like seven cents per mile but over a year it adds up. In order to qualify for the deduction you can’t simply attend a meeting you have to do something extra. Summer camps and vacation bible school are coming up so if you drive a group to scout camp you can deduct those miles too. We are very active in our local church and have been using this deduction for 30 plus years. I thought there was also talk about allowing some charitable deductions in addition to the standard deduction. Thanks!

Great point, Tim! That’s not actually a deduction I was aware of—travel costs related to charitable giving. Neat!

The special charitable deduction you’re thinking of is probably the $300 above-the-line deduction that was part of the CARES act. For my friend subject of this post, his family should be able to take advantage. Here’s some details:

https://www.irs.gov/newsroom/special-300-tax-deduction-helps-most-people-give-to-charity-this-year-even-if-they-dont-itemize

My wife loves to travel but we have not been able to travel as much as we would like due to the high cost. For example, a no frills week at the beach over spring break cost us 1,500. I would love to see more articles and advice from people who are able to travel for less. Just how were you able to travel so much while still making progress to retiring early?

Tim, I think as the pandemic passes and the world recovers, we’ll be back to traveling much more. We fully intend to write articles related to high value travel along with fulfilling our internal goals with that travel. For example, Jenni will likely repeat some of her medical aide trips to Central America and Australia. We’ll have cost breakdowns for all these trips and related trip reports that hopefully reveal how we manage to do it inexpensively.

We’ve actually got a draft article mostly written months ago that breaks down our big trips in 2019 (which are briefly mentioned in our FIRE budget from 2019 article), it explains how we use points, rewards, coupons, and short term deals to make travel affordable.

Relatedly, we’re staying in a nearly new 2 bedroom, 2 bath condo right now that I can see the ocean from. We have access to loads of amenities not to mention the beautiful beach. We paid about $490 total for 5 nights, which I think is a great deal. It was just a matter of researching options, calling this place since ownership is changing (so their online information was lacking), then conducting the booking through Travelocity’s app to cut another 15% off. After making the booking, Jenni called in to speak with the same staff member again who was kind enough to move our reservation to a particular unit closest to the beach and in the renovated building.

I’m sure we’ll have a lot more to tell about travel. Thanks for joining us on the journey, Tim!

Fantastic strategy for charitable donations. I would have never thought to skip years to double up on donations to maximize deductions. I appreciate these tax posts very much. There’s just so many little things that can be done to dull the tax sting.

That’s cool you guys are getting back out on the road. I know over here in the Bay Area so many people I know are either vaccinated or in between shots. We’re planning some small trips for the next few months as our state opens back up.

Yea, it’s surprising what can be done with a little creativity and forethought.

Of course, my secret goal for posts like this is to encourage more giving. ?

Yea, at least around us in VA, we seem to be doing really well with vaccinations.

Hypothetically, we were thinking about taking our first flight in April if things were progressing well and this trip supported the idea. But frankly, we might slow things down a little and aim for May. NC is pretty lax and we were looking at FL for that flight.

Ah, good point. By bunching up and grouping their contributions to one year over spreading it out, they save more on taxes which they could choose to donate more for more deductions if they choose to and create this infinite loop of tax deductions.

Well, I guess it does have to end sometime but still, haha.

Yep, you’ve got it David!

I’d love to think folks would treat it that way (tax reduction means more money to donate more which means a larger tax deduction, etc.)—but I think lots of folks will pocket the savings. Either way, perhaps just the act of reevaluating will help encourage charitable giving to continue.